يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

How Surging Options Activity and Upbeat Earnings Outlook at MDU (MDU) Has Changed Its Investment Story

MDU Resources Group, Inc. MDU | 19.59 | -0.25% |

- Recently, heightened options activity around the Oct 17, 2025 $10.00 Call for MDU Resources Group, Inc. drew significant market attention due to very high implied volatility, signaling that investors anticipate a major share price move.

- This surge in options interest, coupled with incremental upward revisions in analyst earnings estimates, highlights shifting sentiment and expectations for potential corporate developments impacting the company's prospects.

- We'll explore how elevated options volatility and rising earnings expectations could signal changing risk and opportunity in MDU Resources Group’s investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

MDU Resources Group Investment Narrative Recap

To be a shareholder in MDU Resources Group means believing in the company's evolution toward a focused, regulated energy platform, benefiting from infrastructure growth, regulatory support, and stable utility margins. The recent spike in options activity around the Oct 17, 2025 $10.00 Call reflects heightened short-term uncertainty, but the most important catalyst, demand for U.S. infrastructure and utility expansion, remains unchanged. The biggest risk continues to be rising operating costs outpacing rate recovery, which could limit near-term margin improvement if not managed closely.

One of the more relevant recent announcements is the company's August 2025 follow-on equity offering for US$400 million. This capital raise, while supporting future infrastructure investment, ties directly to concerns about potential shareholder dilution and increasing leverage, a meaningful consideration for investors weighing the risks and rewards of MDU’s planned growth and future returns.

In contrast, one cost trend that could impact future shareholder returns may be hiding in plain sight, and investors should be aware of...

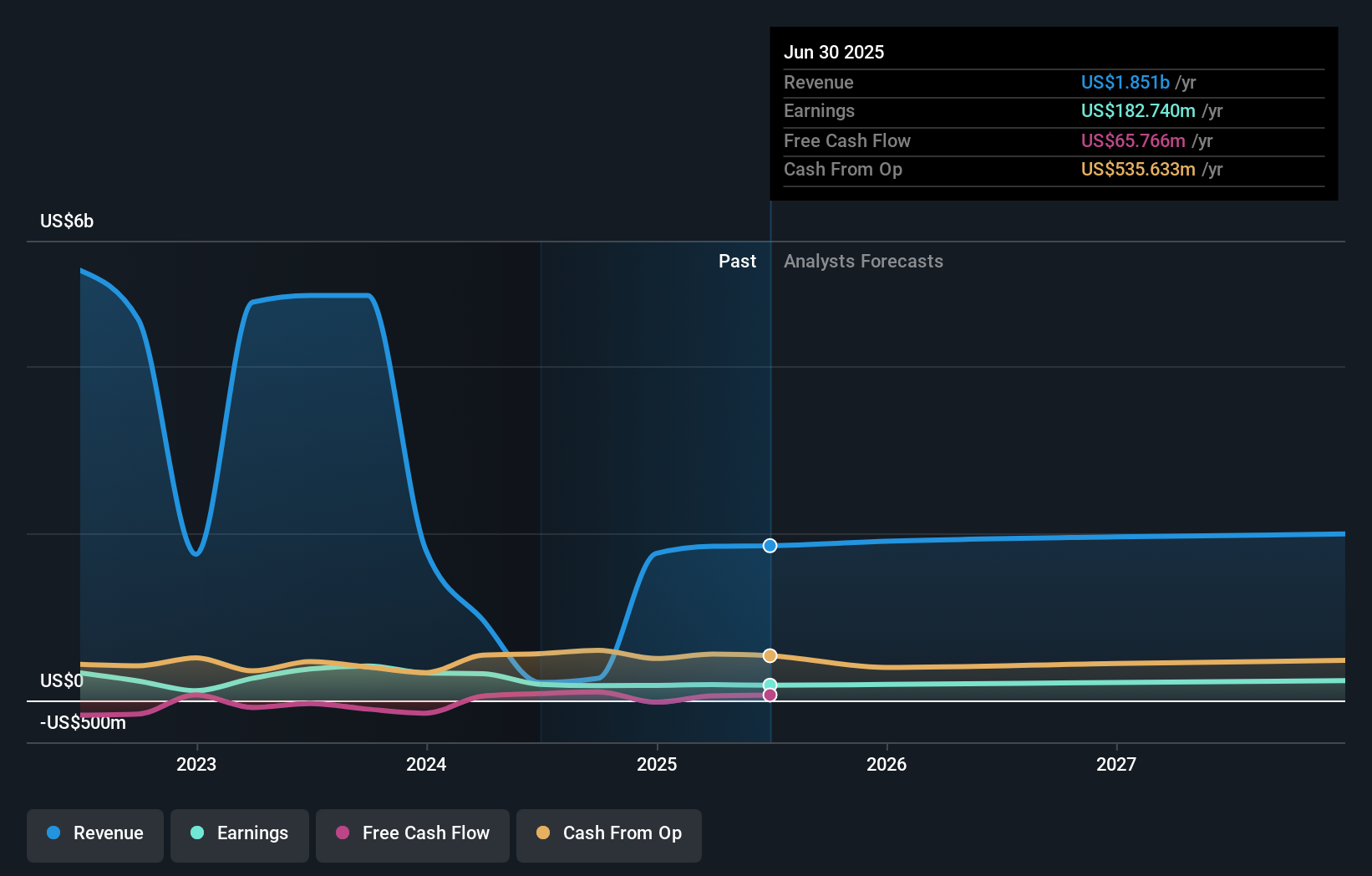

MDU Resources Group's outlook anticipates $2.0 billion in revenue and $233.0 million in earnings by 2028. This is based on a 3.0% annual revenue growth rate and a $50.3 million increase in earnings from the current $182.7 million.

Uncover how MDU Resources Group's forecasts yield a $19.50 fair value, a 19% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members provided two fair value estimates for MDU Resources Group, ranging from as low as US$1.12 to US$19.50 per share. While opinions vary widely, many are watching how required capital investments and dilution risks could shape the company’s performance in coming years, consider seeking out additional viewpoints before making any investment decisions.

Explore 2 other fair value estimates on MDU Resources Group - why the stock might be worth less than half the current price!

Build Your Own MDU Resources Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your MDU Resources Group research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free MDU Resources Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate MDU Resources Group's overall financial health at a glance.

Interested In Other Possibilities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 29 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.