يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

Hyatt Luxury Openings Test Valuation And Growth Expectations For Investors

Hyatt Hotels Corporation Class A H | 171.84 | +2.31% |

- Hyatt Hotels, NYSE:H, has expanded its luxury and lifestyle portfolio with the opening of Alila Mayakoba in Mexico.

- The company has also welcomed the historic Seaview Hotel & Golf Club in the Mid Atlantic to the Destination by Hyatt brand.

- These moves extend Hyatt's reach in Latin America and the Caribbean and deepen its presence in a key U.S. coastal market.

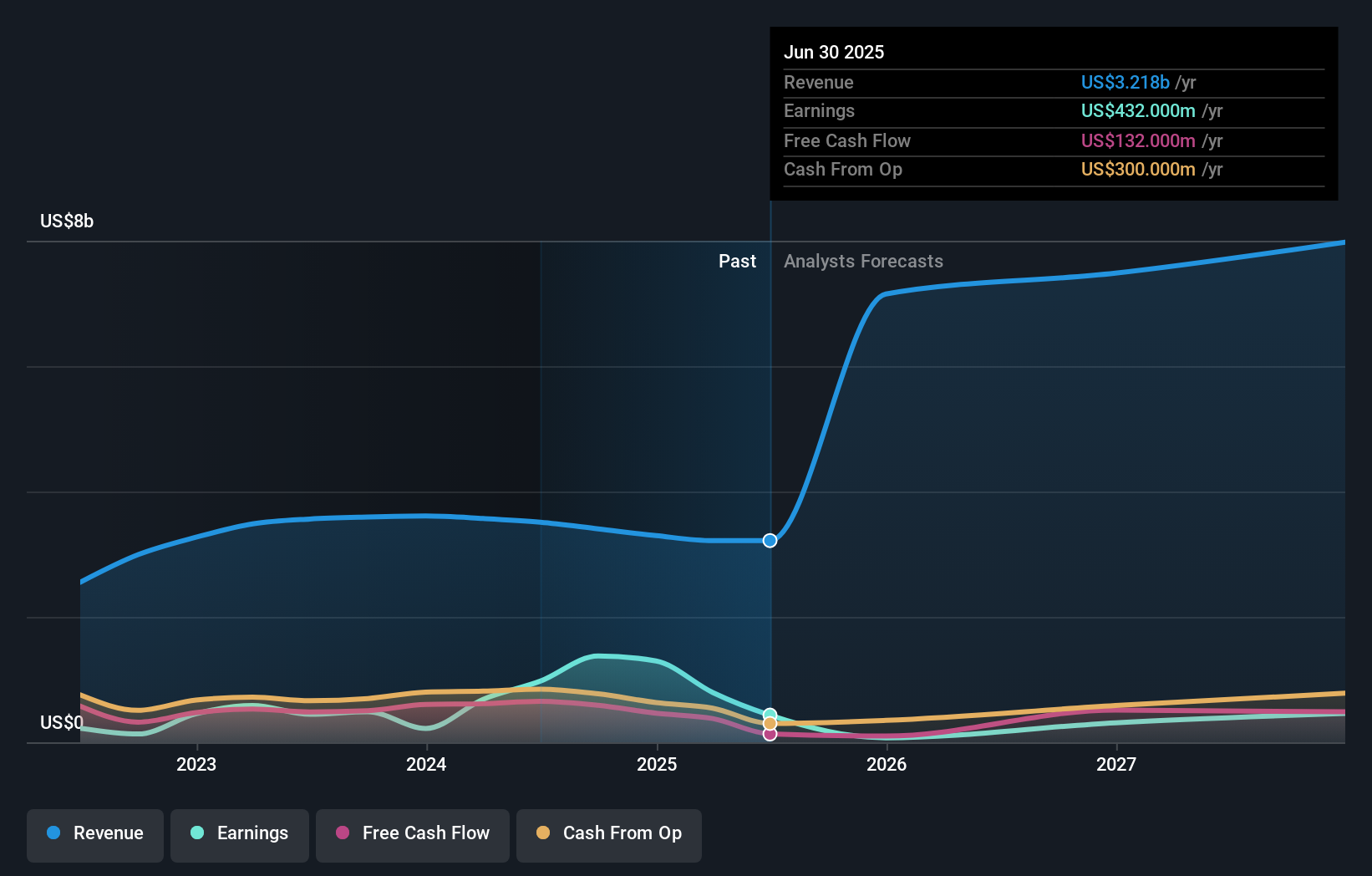

Hyatt Hotels enters this expansion phase with its shares trading at $165.39 and a 1 year return of 16.4%. Over 3 years the stock is up 47.2% and over 5 years it is up 103.5%, which offers context as investors consider how these portfolio additions fit into the broader company story.

The debut of Alila in Latin America and the Caribbean and the integration of Seaview into Destination by Hyatt illustrate how Hyatt is building out its luxury and lifestyle offerings across different types of high interest locations. For investors watching NYSE:H, these openings provide additional reference points for assessing how Hyatt is positioning itself within global hospitality and how its mix of brands may influence future guest demand and pricing power.

Stay updated on the most important news stories for Hyatt Hotels by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on Hyatt Hotels.

Quick Assessment

- ⚖️ Price vs Analyst Target: At US$165.39, Hyatt trades about 7% below the consensus target of US$178.35, which sits comfortably within the 10% fair band.

- ⚖️ Simply Wall St Valuation: Simply Wall St currently views Hyatt as trading close to its estimated fair value.

- ❌ Recent Momentum: The 30 day return of about 1.7% decline shows short term weakness despite the expansion news.

There is only one way to know the right time to buy, sell or hold Hyatt Hotels. Head to Simply Wall St's company report for the latest analysis of Hyatt Hotels's Fair Value.

Key Considerations

- 📊 The additions of Alila Mayakoba and Seaview feed directly into Hyatt's luxury and lifestyle focus, which is an area many investors watch closely for pricing power and brand strength.

- 📊 Keep an eye on occupancy, average daily rate and revenue per available room at these new properties to see how quickly they contribute to revenue and earnings.

- ⚠️ With debt not well covered by operating cash flow, investors may want to watch how any further expansion is financed and whether cash generation keeps pace.

Dig Deeper

For the full picture including more risks and rewards, check out the complete Hyatt Hotels analysis. Alternatively, you can check out the community page for Hyatt Hotels to see how other investors believe this latest news will impact the company's narrative.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.