يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

International Bancshares (IBOC) Valuation Check After Recent Outperformance Versus BancFirst

International Bancshares Corporation IBOC | 71.54 | -0.28% |

International Bancshares (IBOC) is back in focus after a comparative review showed it outperforming BancFirst on most profitability and earnings measures, while also trading on a lower P/E multiple and carrying stronger analyst sentiment.

The recent comparative spotlight comes after a softer patch for the shares, with a 30 day share price return of 5.67% and a 1 day slip to $68.39. Yet longer term total shareholder returns of 6.72% over one year and 84.33% over five years suggest momentum has been built over time rather than in the latest month.

If you are looking beyond regional banks, it could be a good moment to broaden your watchlist and check out fast growing stocks with high insider ownership for other stocks catching investor interest.

So with International Bancshares posting solid multi year total returns, trading below some valuation estimates, and sitting at a discount to its analyst price target, is this a genuine opportunity or is the market already pricing in future growth?

Price-to-Earnings of 10.1x: Is it justified?

International Bancshares closed at $68.39 and is currently on a P/E of 10.1x, which screens as inexpensive compared with peers that trade on higher earnings multiples.

The P/E ratio tells you how much you are paying for each dollar of current earnings and is a common way to compare banks that already generate steady profits. For International Bancshares, earnings have grown by 17.9% per year over the past 5 years and net profit margins of 51.2% sit slightly above last year. As a result, the market is assigning this 10.1x multiple to a business with high quality, profitable operations.

Against that, the company is flagged as trading at good value versus several benchmarks. Its 10.1x P/E is below the US Banks industry average of 11.9x and below the peer average of 47.1x. It is also under an estimated fair P/E of 11.1x that our fair ratio work suggests the market could move towards if pricing were to align more closely with earnings characteristics.

Result: Price-to-Earnings of 10.1x (UNDERVALUED)

However, you still need to weigh up risks such as a weaker share price patch and the possibility that analyst expectations embedded in the $85 target prove too optimistic.

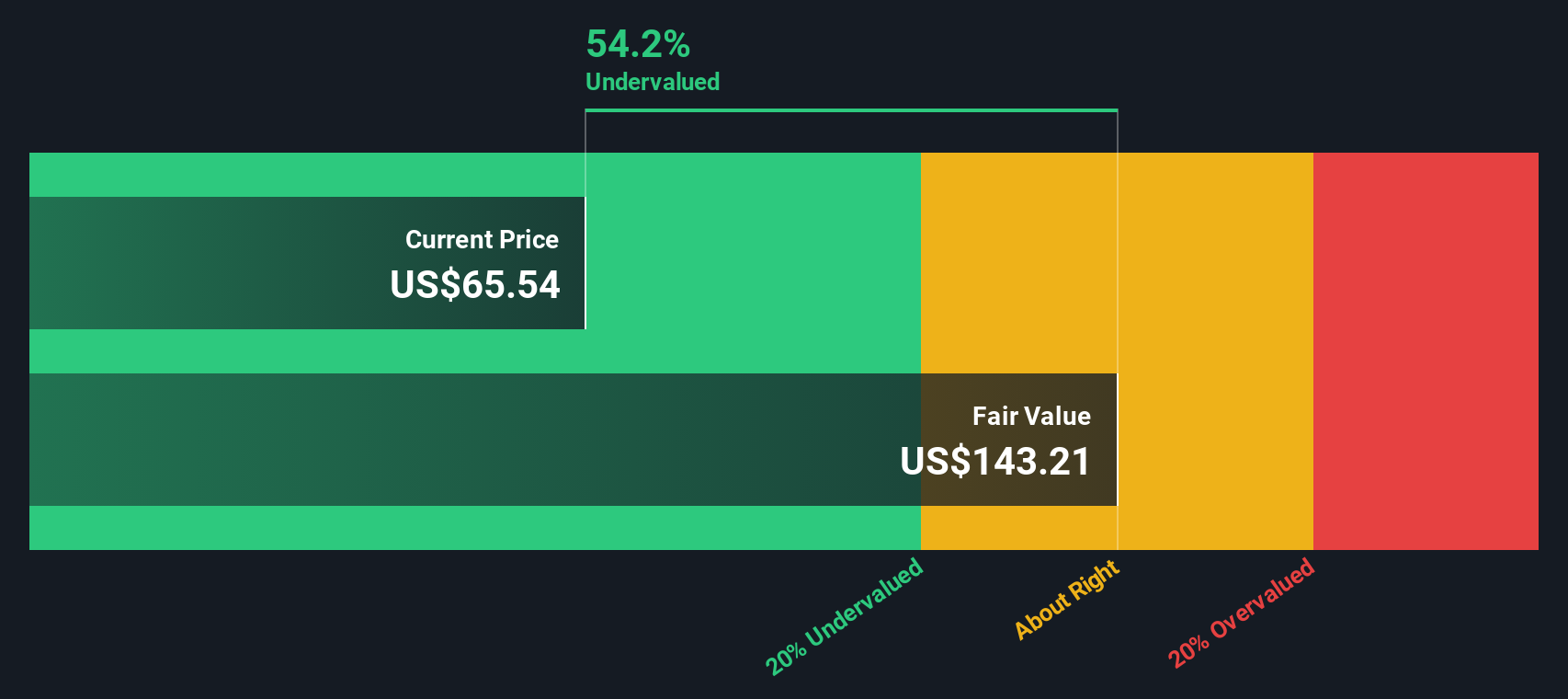

Another View: What Our DCF Model Suggests

The P/E work presents International Bancshares as inexpensive, and our DCF model indicates something stronger. With the shares at $68.39 and our fair value estimate at $142.08, the stock appears to be trading at a 51.9% discount. A gap of that size may reflect caution around future earnings or a market that has not fully repriced a solid, profitable bank. Which side of that argument do you lean toward?

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out International Bancshares for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 880 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own International Bancshares Narrative

If you look at this and feel differently, or just prefer to test the numbers yourself, you can build a fresh narrative in a few minutes, starting with Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding International Bancshares.

Want more investment ideas on your radar?

If this kind of structured, numbers first thinking appeals to you, do not stop at one bank. Use the Simply Wall St Screener to uncover more focused opportunities.

- Target potential mispricings by running through these 880 undervalued stocks based on cash flows, where you can quickly spot companies that screen cheaply against their cash flow profiles.

- Ride major tech shifts earlier by scanning these 26 AI penny stocks. This highlights companies linked to artificial intelligence themes that many investors are watching closely.

- Lock in consistent cash flow ideas by filtering for these 12 dividend stocks with yields > 3%, which highlights companies offering dividend yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.