يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

Investors Appear Satisfied With Adeia Inc.'s (NASDAQ:ADEA) Prospects

Xperi Holding Corp ADEA | 12.94 | -1.22% |

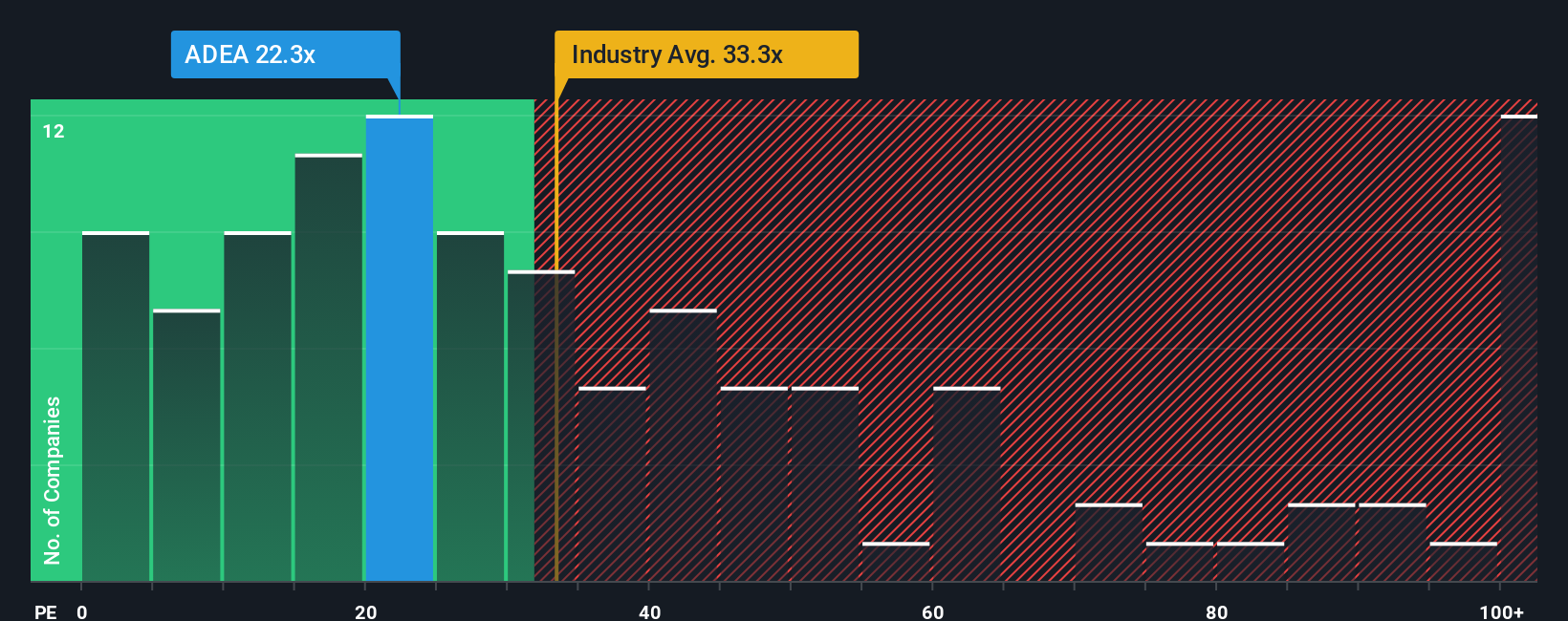

With a price-to-earnings (or "P/E") ratio of 22.3x Adeia Inc. (NASDAQ:ADEA) may be sending bearish signals at the moment, given that almost half of all companies in the United States have P/E ratios under 18x and even P/E's lower than 11x are not unusual. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

Adeia certainly has been doing a good job lately as it's been growing earnings more than most other companies. The P/E is probably high because investors think this strong earnings performance will continue. If not, then existing shareholders might be a little nervous about the viability of the share price.

How Is Adeia's Growth Trending?

Adeia's P/E ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the market.

If we review the last year of earnings growth, the company posted a terrific increase of 80%. However, this wasn't enough as the latest three year period has seen a very unpleasant 43% drop in EPS in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Shifting to the future, estimates from the three analysts covering the company suggest earnings should grow by 15% per year over the next three years. Meanwhile, the rest of the market is forecast to only expand by 11% per annum, which is noticeably less attractive.

With this information, we can see why Adeia is trading at such a high P/E compared to the market. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What We Can Learn From Adeia's P/E?

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Adeia maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

You might be able to find a better investment than Adeia.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.