يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

IPG Photonics (IPGP) Return To Profitability Tests Bullish Growth Narrative After Q3 Earnings

IPG Photonics Corporation IPGP | 133.62 | +2.76% |

IPG Photonics (IPGP) has just posted its FY 2025 third quarter numbers, with revenue of US$250.8 million and basic EPS of US$0.18, as the market weighs what this means for the laser maker’s recent return to profitability. The company has seen quarterly revenue move from US$234.3 million in Q4 2024 to US$227.8 million in Q1 2025 and then to US$250.7 million and US$250.8 million in Q2 and Q3 2025. Basic EPS shifted from US$0.18 to US$0.09, US$0.16 and US$0.18 over the same stretch. That backdrop of stabilizing profits sets the stage for investors to focus on how durable IPG Photonics’ margins really look heading into the next phase of its story.

See our full analysis for IPG Photonics.With the latest figures on the table, the next step is to see how these margins and revenue trends line up with the prevailing narratives around IPG Photonics, and where the numbers might challenge what investors think they know.

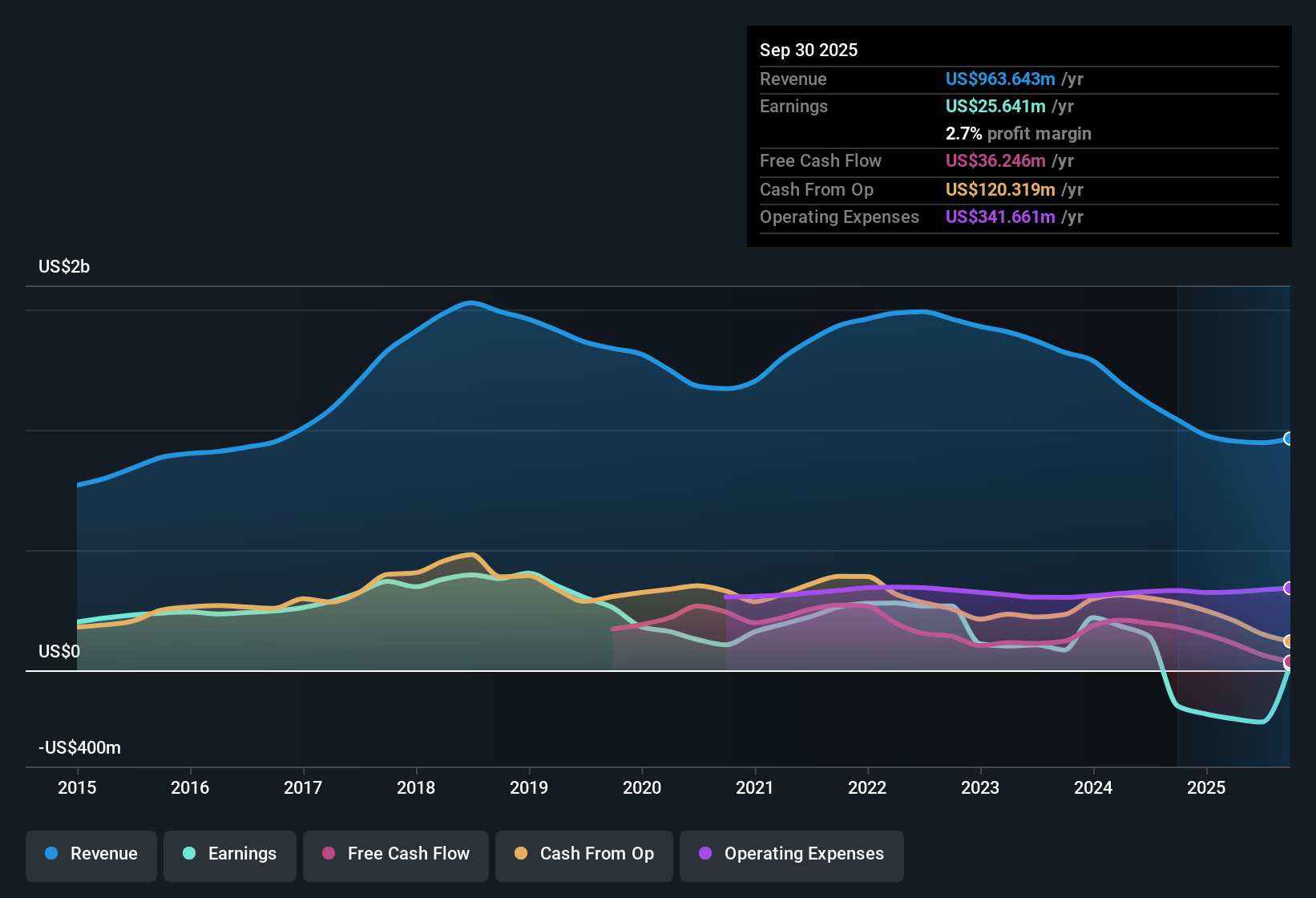

Profit swing on the last twelve months

- On a trailing twelve month basis, IPG Photonics moved from a net loss of US$215.4 million in Q2 2025 to net income of US$25.6 million by Q3 2025, with TTM EPS shifting from a loss of US$5.02 per share to a profit of US$0.60 per share over that span.

- Bulls point to this return to profitability and the expected ~30.5% annual earnings growth as evidence that the worst is behind the company. However, the 5 year annualized earnings decline of 47% and TTM revenue of US$963.6 million, which is lower than the US$1.1b level seen back in Q2 2024, show that the business is still coming off a weaker earnings base than those optimistic forecasts might suggest.

- Supporters of the bullish view often highlight that earnings are now positive again, but the TTM profit of US$25.6 million is small compared to the earlier loss of US$215.4 million that is still in the 5 year history.

- For that bullish growth story to stick, investors will need to watch whether quarters like Q3 2025 net income of US$7.5 million become consistent, rather than a short stretch after a very large loss period.

Bulls argue that this sharp swing back into profit could be the start of a longer earnings rebuild, and they see room for that view to play out over multiple years. 🐂 IPG Photonics Bull Case

Revenue steadies around US$250 million per quarter

- In the last four reported quarters, revenue has sat in a relatively tight band between US$227.8 million and US$257.6 million, with Q3 2025 at US$250.8 million, Q2 2025 at US$250.7 million, Q1 2025 at US$227.8 million and Q4 2024 at US$234.3 million, while TTM revenue is US$963.6 million versus US$1.1b in Q2 2024.

- The consensus narrative talks about diversified growth drivers in areas like automation, electric vehicles and medical. However, the 9.2% TTM revenue growth rate that sits slightly below the cited 10.4% US market growth suggests that so far these newer verticals are not translating into faster top line expansion than the broader market.

- Supporters of that balanced view might point to the near flat quarterly pattern around US$250 million as evidence the business has found a base, but it also means there is not yet clear acceleration beyond the recent high point of US$257.6 million in Q2 2024.

- The claim that new segments could support higher margins over time will be easier to test if future TTM revenue can climb back above the US$1.1b level reached in Q2 2024 while keeping TTM earnings positive.

Rich valuation versus DCF and TTM scale

- With a current share price of US$150.25 and TTM revenue of US$963.6 million, the company is cited as trading on a P/S of 6.6x compared with a peer average of 1.5x and an industry average of 2.9x, and the DCF fair value supplied here is US$17.71.

- Bears focus on this gap between price and fundamentals, arguing that paying 6.6x sales and a large premium to a DCF fair value of US$17.71 leaves little room for error, especially when five year earnings have declined 47% per year and TTM revenue has slipped from US$1.1b in Q2 2024 to US$963.6 million in Q3 2025.

- Critics of the current valuation also point out that the consensus analyst price target allowed here, US$96.92, sits well below the present US$150.25 share price, which suggests that even the more balanced forecasts assume a lower level than where the stock trades now.

- Short term share price volatility flagged over the past three months, combined with the high P/S multiple against peers, means any disappointment relative to the strong earnings growth expectations

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for IPG Photonics on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

See the numbers differently? If this data is pushing you toward a different conclusion, shape that view into your own narrative in just a few minutes: Do it your way

A great starting point for your IPG Photonics research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

IPG Photonics combines a relatively small TTM profit and lower TTM revenue than in Q2 2024 with a high 6.6x P/S multiple and rich DCF gap.

If that mix of modest earnings and a premium price feels like a stretch, shift your attention to 55 high quality undervalued stocks that aim to pair stronger value with sturdier fundamentals right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.