يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

Is Allstate’s (ALL) Q2 Earnings Surge Reshaping Its Investment Appeal?

Allstate Corporation ALL | 207.51 | -0.95% |

- On July 30, 2025, The Allstate Corporation reported second quarter net income of US$2.11 billion, a sharp increase over the same period last year, with both basic and diluted earnings per share rising substantially from the prior year’s results.

- This outstanding performance was driven by strong earnings growth, effective cost management, and favorable conditions in its core insurance businesses.

- We’ll explore how Allstate’s significant earnings improvement, fueled by both revenue growth and cost efficiencies, could impact its investment narrative.

These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Allstate Investment Narrative Recap

To be a shareholder in Allstate, you'd need confidence in the company's ability to grow through effective risk management, operational efficiency, and continued leadership in the insurance market. The recent surge in quarterly net income and earnings is a clear positive for near-term sentiment and could reinforce confidence in Allstate’s growth strategy. However, catastrophe losses and ongoing competition in the personal auto insurance segment remain key risks and their potential impact on future results has not been materially altered by this latest performance.

Among recent announcements, the July 30, 2025 earnings release stands out as most relevant, showcasing a marked turnaround in profitability and underscoring Allstate’s progress in balancing cost control and top-line growth. This performance may provide momentum for its transformative growth initiatives, particularly as the company continues to innovate in product offerings and customer retention, catalysts that have underpinned the improved results in this quarter.

But against this backdrop, investors should also keep an eye on the unpredictable nature of catastrophe losses, as...

Allstate's narrative projects $76.9 billion revenue and $5.0 billion earnings by 2028. This requires 5.6% yearly revenue growth and a $1.1 billion earnings increase from $3.9 billion today.

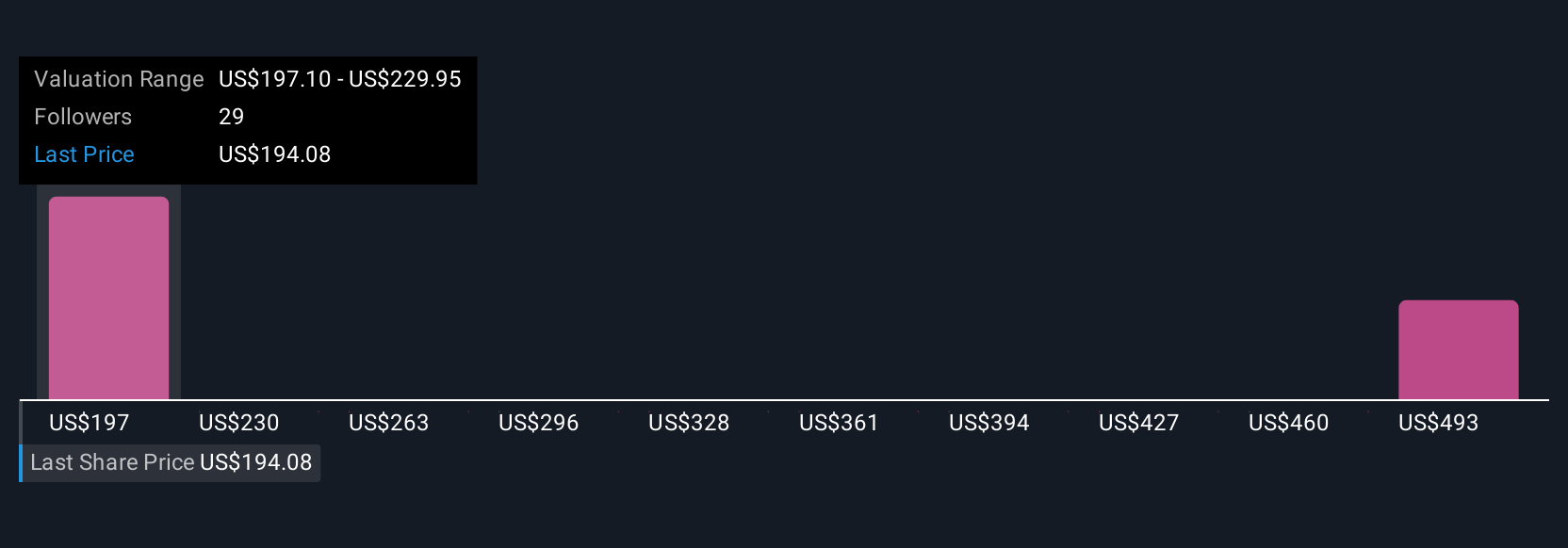

Uncover how Allstate's forecasts yield a $228.59 fair value, a 12% upside to its current price.

Exploring Other Perspectives

Five fair value estimates from the Simply Wall St Community range from US$170.63 to US$588.41, reflecting wide differences in growth outlooks. As catastrophe risks and competitive pressures continue to shape Allstate’s future, you can explore several alternative viewpoints on the company’s value and direction.

Explore 5 other fair value estimates on Allstate - why the stock might be worth 16% less than the current price!

Build Your Own Allstate Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Allstate research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Allstate research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Allstate's overall financial health at a glance.

Contemplating Other Strategies?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Outshine the giants: these 20 early-stage AI stocks could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.