يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

Is AutoNation (AN) Still Attractive After Recent Share Price Pullbacks?

AutoNation, Inc. AN | 201.47 | +0.18% |

- If you are wondering whether AutoNation's share price reflects its real worth today, you are not alone. Many investors are asking if the current level offers value or if most of the opportunity is already priced in.

- The stock last closed at US$207.81, with returns of 0.6% year to date and 8.5% over the past year, while the shorter term picture shows a 3.3% decline over 7 days and a 2.4% decline over 30 days.

- Recent headlines have focused on AutoNation's positioning in the US auto retail industry and how investors are thinking about demand for vehicles and related services. This context helps explain why the share price has been relatively steady over the year while also seeing some short term pullbacks.

- On our framework, AutoNation scores a 5 out of 6 valuation check score. Next we will walk through the key valuation approaches that produce that result, along with a final section on an even more complete way to think about what the stock might be worth.

Approach 1: AutoNation Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow, or DCF, model estimates what a company could be worth by projecting its future cash flows and discounting them back to today using a required rate of return.

For AutoNation, the model used is a 2 Stage Free Cash Flow to Equity approach. The latest twelve month free cash flow is a loss of $249.8 million, so the valuation leans heavily on what analysts and the model expect cash flows to look like over time rather than on the most recent year alone.

Analysts and the model project free cash flow climbing into positive territory, with an estimated $1,034.0 million by 2030. Simply Wall St provides explicit estimates out to 2029, then extrapolates additional years to complete the 2 stage projection. These projected cash flows are discounted back to today in $ using the DCF framework.

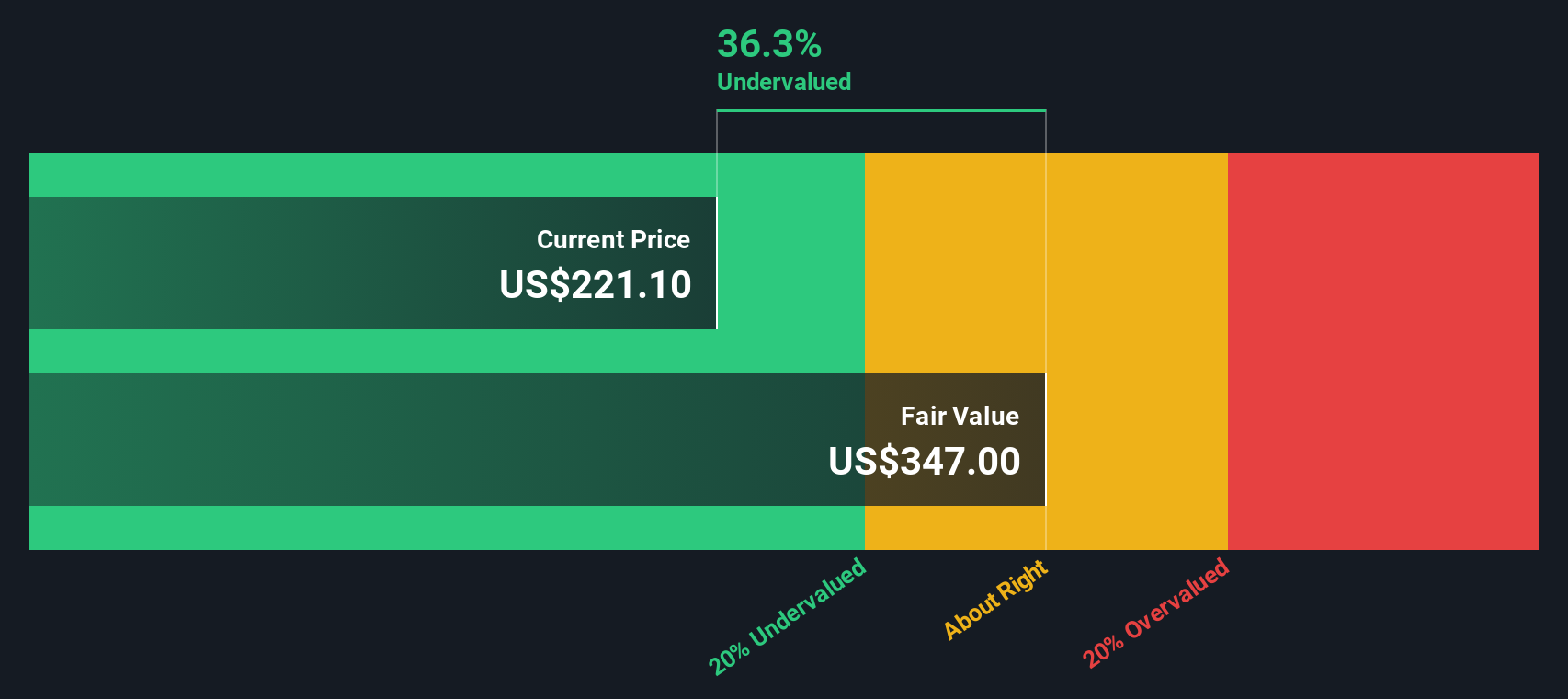

Putting those discounted cash flows together, the model estimates an intrinsic value of about $284.58 per share, compared with the recent share price of $207.81. This implies the shares trade at roughly a 27.0% discount.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests AutoNation is undervalued by 27.0%. Track this in your watchlist or portfolio, or discover 51 more high quality undervalued stocks.

Approach 2: AutoNation Price vs Earnings

For profitable companies, the P/E ratio is a useful way to link what you pay for the stock to the earnings the business is currently generating. It gives you a quick sense of how many dollars of price you are paying for each dollar of earnings.

What counts as a “normal” P/E depends on how the market views a company’s growth prospects and risk. Higher expected growth or lower perceived risk can justify a higher P/E, while slower growth or higher risk typically lines up with a lower P/E.

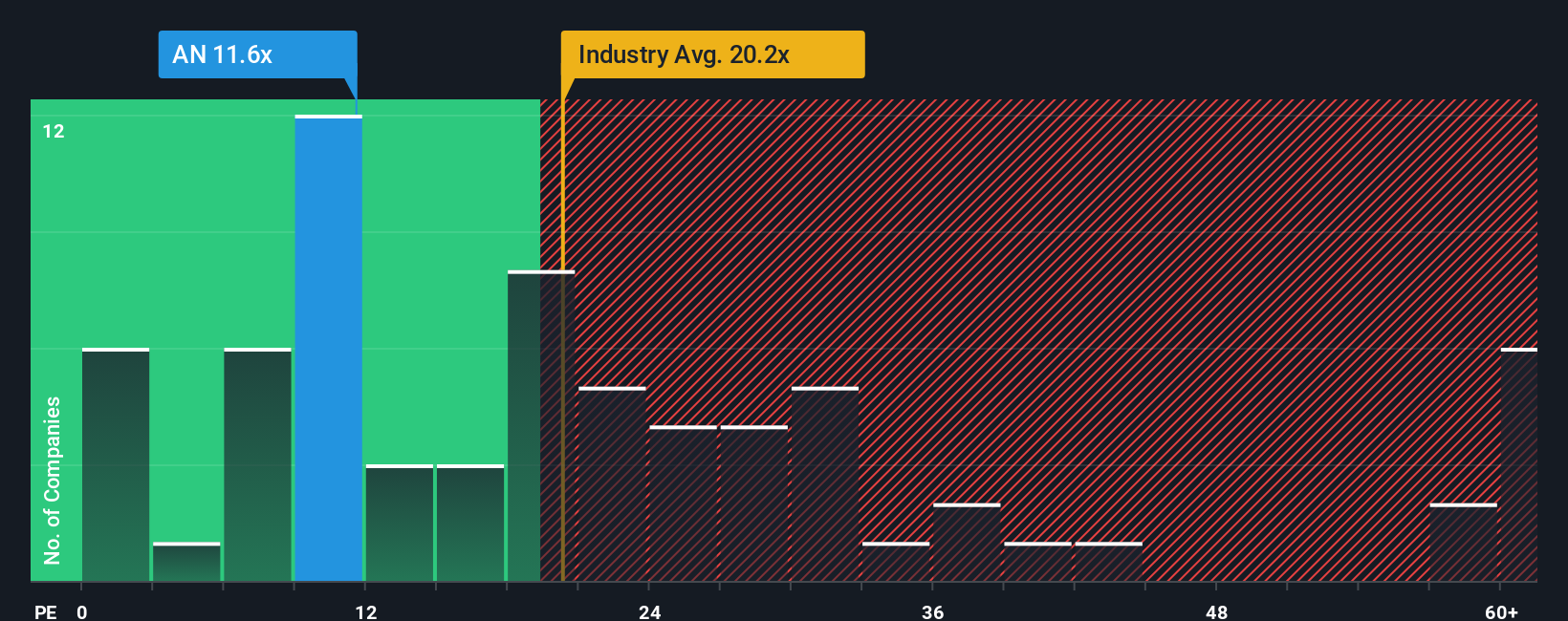

AutoNation currently trades on a P/E of 11.27x. That sits below the Specialty Retail industry average P/E of 20.42x and below the peer group average of 12.48x. Simply Wall St also calculates a proprietary “Fair Ratio” for AutoNation of 16.81x.

The Fair Ratio is designed to be a more tailored benchmark than a simple peer or industry comparison, because it incorporates factors like the company’s earnings growth profile, profit margins, industry, market capitalization and specific risks. In other words, it aims to reflect the P/E that would be reasonable for AutoNation in particular.

Comparing the current P/E of 11.27x with the Fair Ratio of 16.81x, AutoNation’s shares appear inexpensive on this earnings based metric.

Result: UNDERVALUED

P/E ratios tell one story, but what if the real opportunity lies elsewhere? Start investing in legacies, not executives. Discover our 22 top founder-led companies.

Upgrade Your Decision Making: Choose your AutoNation Narrative

Earlier we mentioned that there is an even better way to understand valuation. On Simply Wall St you can use Narratives, which let you attach your own story about AutoNation’s future revenue, earnings and margins to a forecast and fair value. You can then compare that fair value with the current price, see how it stacks up alongside other investors on the Community page, and watch it update automatically when new information arrives, whether you think AutoNation looks closer to the higher fair value view around US$296.79 or the more cautious stance near US$200.00.

For AutoNation, however, we’ll make it really easy for you with previews of two leading AutoNation Narratives:

These are not forecasts you have to accept. They are worked examples that show what different sets of assumptions look like when you tie them to a fair value and compare that with the current share price of US$207.81.

Fair value: about US$296.79 per share

Implied discount to this fair value: roughly 30% compared with the last close

Revenue growth used in this view: about 7.8% a year

- Assumes AutoNation can build on digital car buying, Maryland expansion and broader US presence to support higher long term earnings power.

- Uses analyst expectations for revenue growth, profit margins, discount rate and a future P/E that together point to a higher fair value than the current price.

- Leans on the idea that after sales, financing and Sunbelt exposure can support consistent earnings, with risks tied to dealership heavy operations and changing auto retail models.

Fair value: about US$200.00 per share

Implied premium to this fair value: roughly 4% compared with the last close

Revenue growth used in this view: about 2.3% a year

- Starts from lower revenue growth assumptions and a lower future P/E multiple, which together point to a fair value close to but below the recent share price.

- Highlights risks around credit trends in AN Finance, potential pressure on new and used vehicle gross profit per unit and costs tied to more complex vehicles.

- Allows for upside if after sales strength, finance income, cost control and share repurchases are stronger than this cautious set of expectations implies.

If you want to go beyond these previews and see the full logic that other investors are using, you can compare these with the wider range of views and then set up your own version based on the numbers you are most comfortable with, whether you lean closer to the higher fair value camp or the more conservative stance.

Do you think there's more to the story for AutoNation? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.