يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

Is Celldex Therapeutics (CLDX) Pricing Reflect Its DCF Upside After Mixed Multi‑Year Returns

Celldex Therapeutics, Inc. CLDX | 23.02 | -2.21% |

- If you are wondering whether Celldex Therapeutics at US$26.23 is priced attractively or asking too much for its potential, you are in the right place.

- The stock has returned 4.3% over the last 7 days, while the 1 year return sits at 6.5%, alongside more mixed figures of a 0.6% decline over 30 days, a 2.9% decline year to date, and a 40.5% decline over 3 years, with a 20.5% gain over 5 years.

- Recent news flow around Celldex has focused on its position within the pharmaceuticals and biotech space and investor interest in how its pipeline and balance sheet support the current share price. These updates help frame why the recent returns have been uneven across different timeframes.

- On our valuation checks, Celldex scores 3 out of 6. This suggests some measures point to value while others call for a closer look, so next we will walk through the usual valuation tools and then finish with a more complete way to think about what the shares could be worth.

Approach 1: Celldex Therapeutics Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow, or DCF, model takes estimates of a company’s future cash flows and discounts them back to today’s value. This aims to show what the business could be worth based on those projected cash flows.

For Celldex Therapeutics, the model used is a 2 Stage Free Cash Flow to Equity approach. The latest twelve month free cash flow sits at a loss of about US$180.3 million. Analyst and extrapolated projections in the model show free cash flow remaining negative for several years, then turning positive, with an estimated US$103.3 million in 2030 and higher figures in the following years, all expressed in US$.

When those projected cash flows are discounted back and added up, the DCF suggests an intrinsic value of about US$84.42 per share. Against the recent share price of US$26.23, this output suggests the shares are priced at a 68.9% discount to that intrinsic estimate, which indicates a material gap between the DCF value and the market price.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Celldex Therapeutics is undervalued by 68.9%. Track this in your watchlist or portfolio, or discover 876 more undervalued stocks based on cash flows.

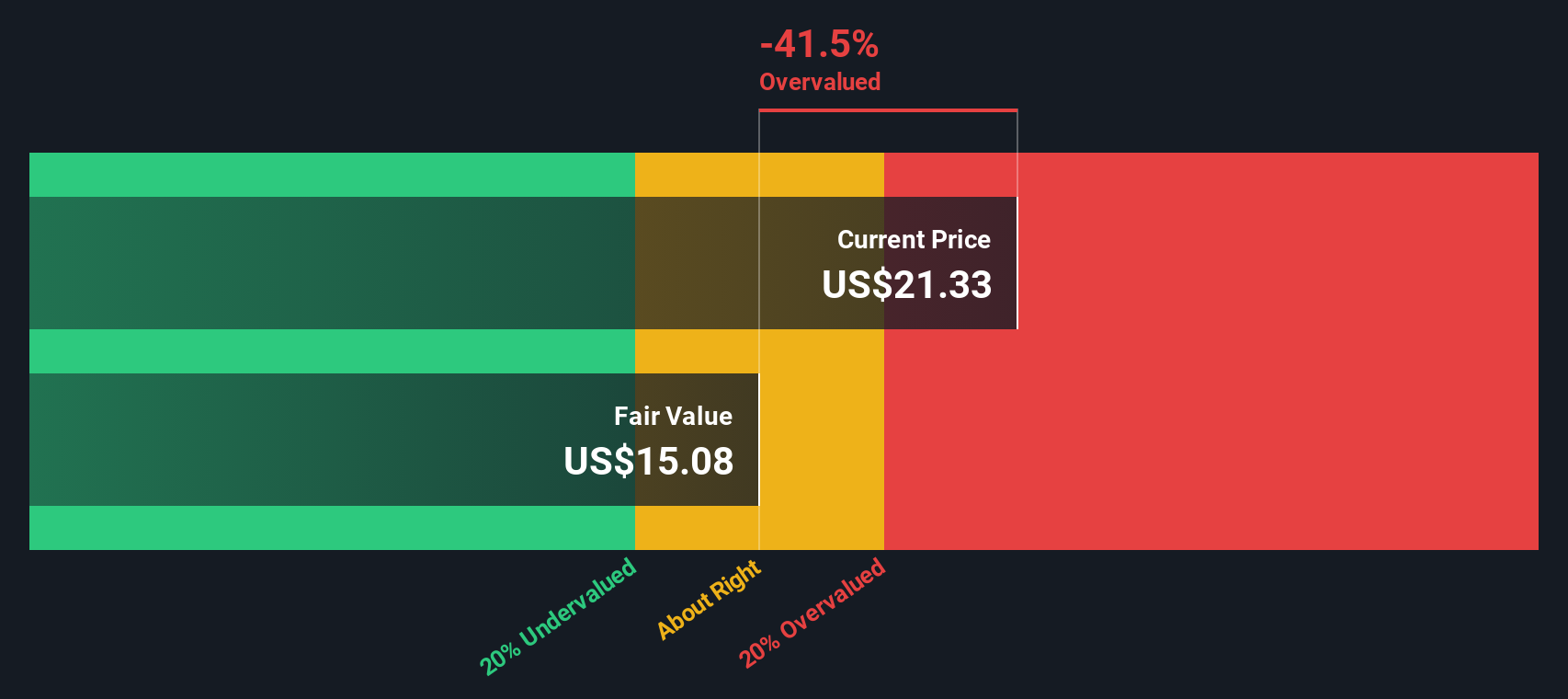

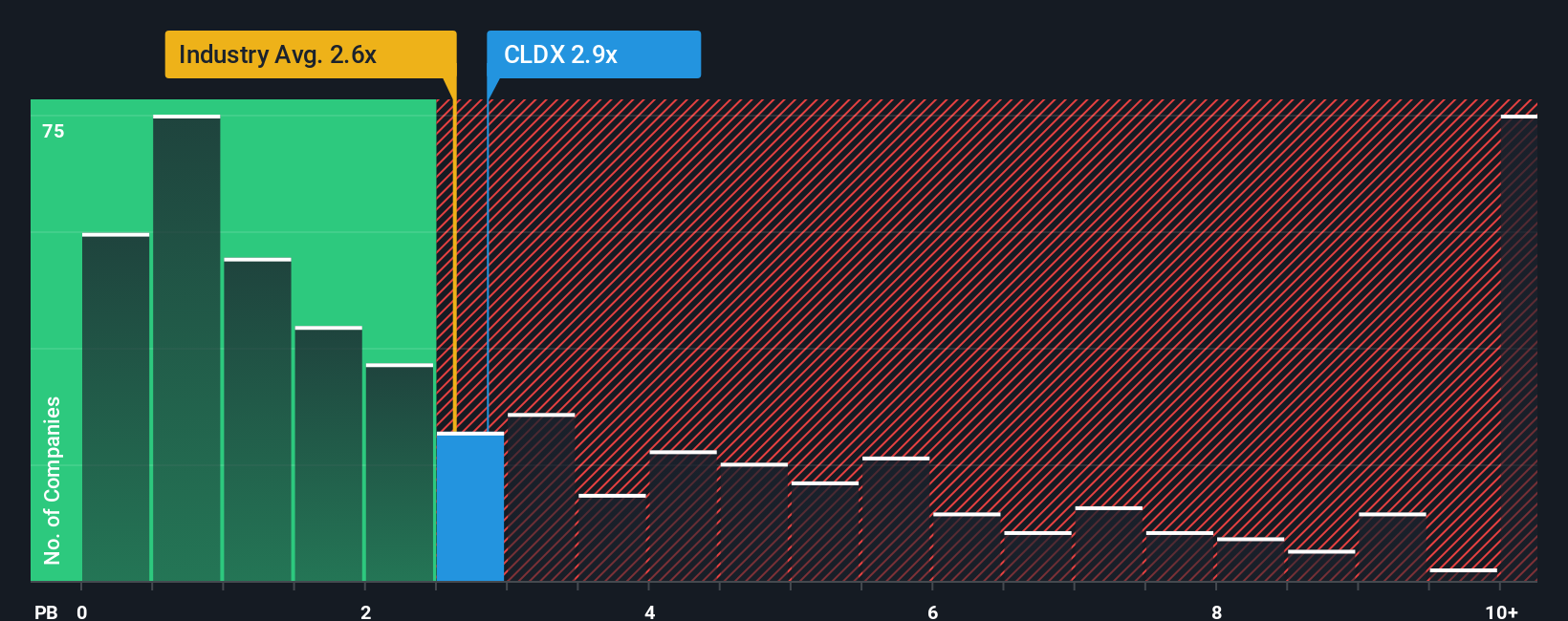

Approach 2: Celldex Therapeutics Price vs Book

For companies that are not yet profitable, or where earnings are volatile, P/B can be a useful way to think about value because it compares the share price with the accounting value of net assets. It is often used for asset heavy sectors and early stage biotechs where earnings do not yet give a stable signal.

What counts as a reasonable P/B multiple depends partly on growth expectations and risk. Higher expected growth or lower perceived risk can justify paying a higher multiple, while more uncertainty or weaker growth expectations usually go with a lower multiple.

Celldex Therapeutics trades on a P/B of 2.91x. That sits close to the Biotechs industry average of 2.69x and below the peer group average of 5.39x. Simply Wall St also uses a “Fair Ratio” for P/B, which is a model driven view of what multiple might make sense after considering factors such as earnings growth, profit margins, industry, market cap and risk profile.

This Fair Ratio can be more tailored than a simple industry or peer comparison, because it adjusts for the specific characteristics of Celldex rather than treating all biotechs as alike. In this case, the Fair Ratio output indicates that Celldex Therapeutics is trading at a level that is consistent with that model driven expectation.

Result: ABOUT RIGHT

P/B ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1422 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Celldex Therapeutics Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, which let you attach a clear story about Celldex Therapeutics to the numbers you already care about, like fair value, future revenue, earnings and margins.

A Narrative is your view of how a company’s story might play out, linked directly to a financial forecast and then to a fair value estimate, so you are not just looking at ratios in isolation but at a joined up picture.

On Simply Wall St, within the Community page used by millions of investors, Narratives are simple to set up, show you how your fair value compares to the current price, and refresh automatically when new information such as news or earnings is added to the platform.

For example, one Celldex Therapeutics Narrative might assume a relatively low fair value and cautious revenue growth, while another assumes a higher fair value with stronger revenue and margin assumptions, giving two very different but clearly explained views on what the shares could be worth.

Do you think there's more to the story for Celldex Therapeutics? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.