يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

Is Encore Capital Group’s Record Revenue Growth and Estimate Beats Reshaping the Case for ECPG?

Encore Capital Group, Inc. ECPG | 58.31 | +0.97% |

- Encore Capital Group recently reported a strong second quarter, with revenues growing 24.4% year on year and surpassing analyst expectations by 15.3%, while its earnings per share and EBITDA also exceeded forecasts.

- This outperformance makes Encore Capital Group the fastest-growing company among its specialty finance peers for the quarter, capturing attention for its operational execution and sector leadership.

- We’ll examine how Encore’s record revenue growth and estimate beats shape its evolving investment narrative and long-term prospects.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Encore Capital Group Investment Narrative Recap

To be a shareholder in Encore Capital Group, you need to believe in the ongoing supply of non-performing loans in the U.S. and Encore’s ability to convert those purchases into rising collections and earnings. The recent quarterly revenue and earnings beats reinforce management’s track record and may boost confidence regarding the company’s near-term portfolio growth, but do not materially change the fact that Encore’s greatest short-term catalyst remains the supply of charged-off debt, while its biggest risk continues to be sensitivity to shifts in U.S. consumer credit performance and regulatory oversight.

One recent announcement with direct relevance is Encore’s Q2 earnings report, where revenues surged by 24.4% year on year and earnings per share more than doubled compared to the previous year. This result, powered by record collections and successful portfolio deployment, reflects strong execution on key business catalysts, but it does not resolve the central risk of increased competition, or potential regulatory changes, that could constrain margin expansion or limit further growth.

On the other hand, investors should keep in mind the company’s reliance on a steady supply of U.S. non-performing loans, especially if…

Encore Capital Group's outlook anticipates $2.1 billion in revenue and $838.0 million in earnings by 2028. This is based on an assumed annual revenue growth rate of 11.8% and a dramatic earnings increase of $927.1 million from the current loss of $-89.1 million.

Uncover how Encore Capital Group's forecasts yield a $57.25 fair value, a 26% upside to its current price.

Exploring Other Perspectives

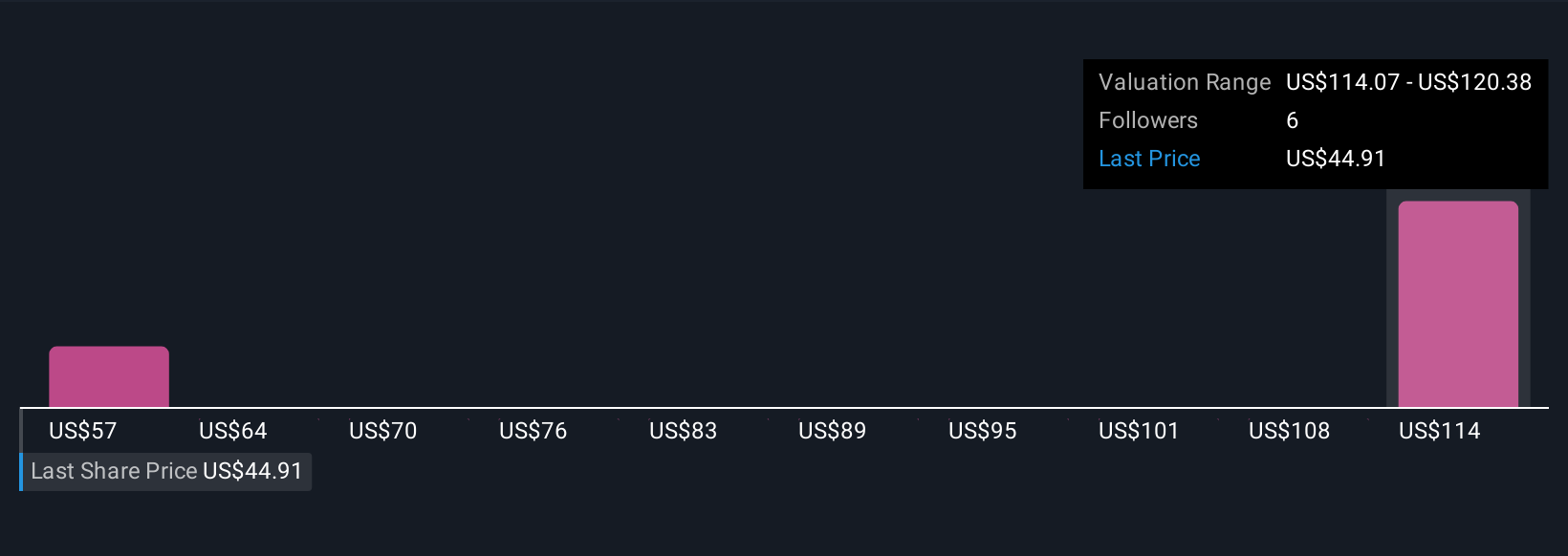

Fair value estimates from the Simply Wall St Community range from US$57.25 to US$120.38, based on two independent analyses. While recent revenue records may encourage optimism, reliance on a favorable environment for charged-off debt remains a central focus for Encore’s future performance, so consider these diverse perspectives as you review the full story.

Explore 2 other fair value estimates on Encore Capital Group - why the stock might be worth over 2x more than the current price!

Build Your Own Encore Capital Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Encore Capital Group research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Encore Capital Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Encore Capital Group's overall financial health at a glance.

Seeking Other Investments?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.