يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

Is Fannie Mae’s (FNMA) Liability Management Strategy Shaping a New Direction for Mortgage Finance?

FEDERAL NATIONAL MORTGAGE ASSOC FNMA | 10.99 10.99 | +1.29% 0.00% Pre |

- In late September 2025, Fannie Mae announced the commencement of fixed-price cash tender offers for certain Connecticut Avenue Securities Notes, inviting holders to tender their notes by October 3 with defined payment terms and interest consideration.

- This active management of its liabilities underscores Fannie Mae’s evolving approach to capital structure, reflecting broader shifts within the US mortgage finance sector.

- We’ll explore how Fannie Mae’s targeted approach to liability management influences its overall investment narrative and sector positioning.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

What Is Federal National Mortgage Association's Investment Narrative?

For anyone considering Fannie Mae, the central story remains whether one believes in the long-term value of its central position in U.S. mortgage finance, despite persistent profitability challenges and a government stake still weighing on its independence. The recent cash tender offer for Connecticut Avenue Securities Notes represents another step in proactive capital management, but the move is likely to have only limited immediate effect on the company's fundamental short-term catalysts or risks. Large swings in share price and recent earnings declines of 60% per year continue to signal volatility and uncertainty. However, the government’s proposed stake reduction could eventually reshape the company’s future, impacting both controls and risks. Investors should keep an eye on management actions, board turnover, and how balance sheet moves might interact with broader reforms or market sentiment.

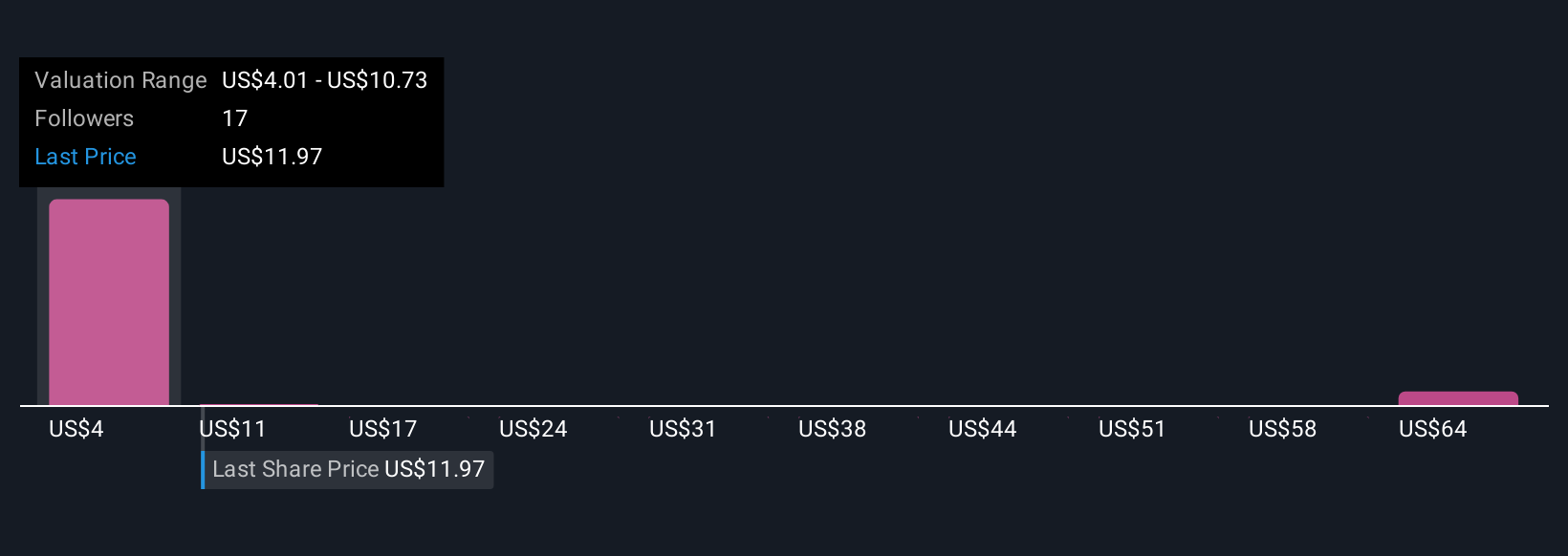

But will improving capital structure offset ongoing pressure from falling earnings and a shifting policy environment? The analysis detailed in our Federal National Mortgage Association valuation report hints at an deflated share price compared to its estimated value.Exploring Other Perspectives

Explore 9 other fair value estimates on Federal National Mortgage Association - why the stock might be worth less than half the current price!

Build Your Own Federal National Mortgage Association Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Federal National Mortgage Association research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Federal National Mortgage Association research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Federal National Mortgage Association's overall financial health at a glance.

Curious About Other Options?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Rare earth metals are the new gold rush. Find out which 32 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.