يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

Is It Too Late to Consider Preferred Bank After Strong Multi Year Share Price Gains?

Preferred Bank PFBC | 100.09 | +2.31% |

- If you are wondering whether Preferred Bank at around $97 a share is still a smart consideration or if most of the upside is already reflected in the price, this breakdown is for you.

- The stock has climbed 2.0% over the last week, 5.2% over the past month, and is up 13.5% year to date, building on gains of 54.3% over 3 years and 145.3% over 5 years.

- Those returns have come as investors have grown more comfortable with regional banks that show disciplined lending and resilient credit quality. Preferred Bank has often been cited as one of the more conservatively run names in the space. In addition, coverage has highlighted its focus on niche commercial clients and tight cost control, both of which shape how the market is recalibrating the risk and reward trade off.

- Right now, Preferred Bank scores a 5/6 on our valuation checks, suggesting the market may still be undervaluing parts of the story. Next, we will unpack those methods, plus a way to think about valuation that ties everything together by the end of the article.

Approach 1: Preferred Bank Excess Returns Analysis

The Excess Returns model looks at how much profit Preferred Bank can generate above the minimum return that shareholders demand, and then capitalizes those surplus profits into an intrinsic value per share.

For Preferred Bank, the analysis starts with a Book Value of $62.81 per share and a Stable EPS of $11.37 per share, based on weighted future Return on Equity estimates from 5 analysts. That implies an Average Return on Equity of 15.96%, well above the modeled Cost of Equity of $4.95 per share.

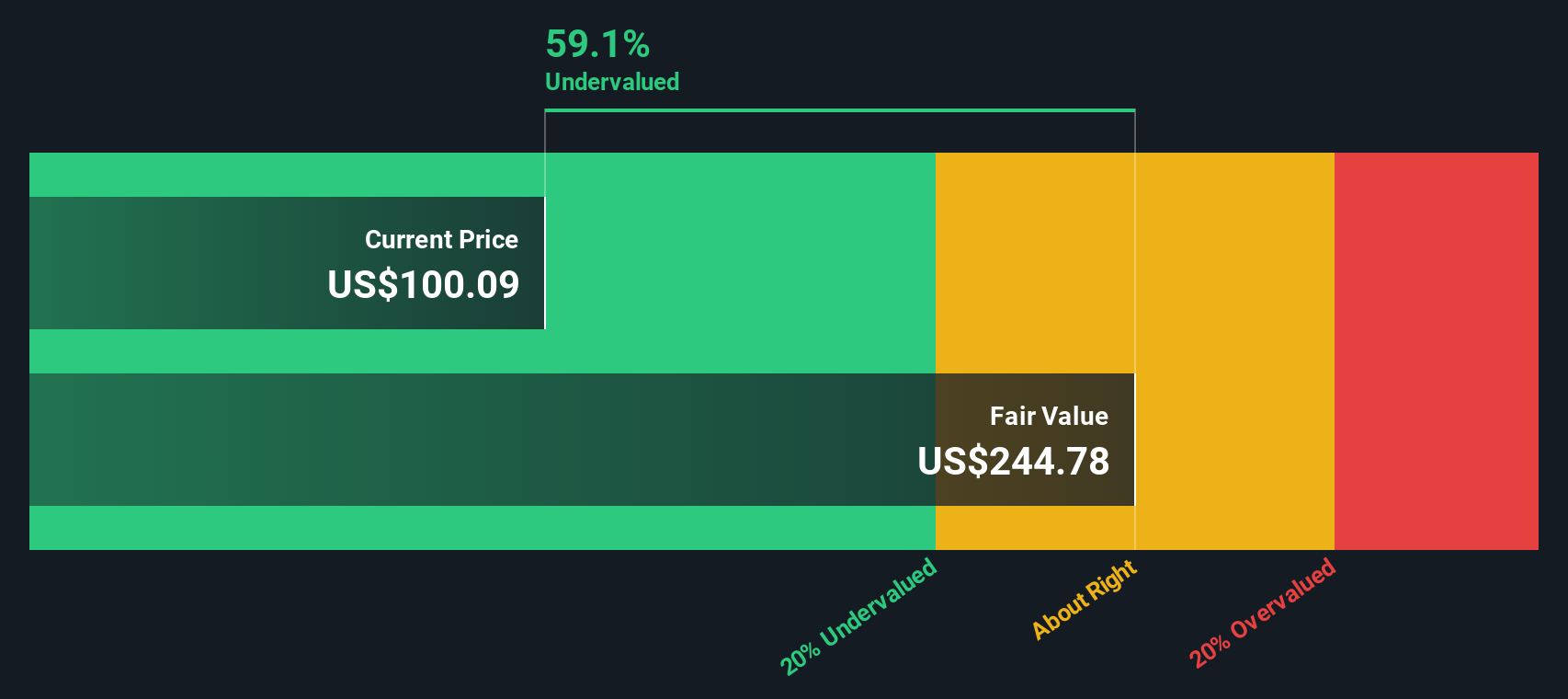

The gap between what shareholders require and what the bank is expected to earn shows up as an Excess Return of $6.41 per share, supported by a Stable Book Value forecast of $71.22 per share from 4 analysts. These sustained excess returns are then projected forward and discounted to arrive at an intrinsic value estimate of about $244.78 per share.

With the shares trading around $97, the Excess Returns model indicates the stock is approximately 60.3% below this intrinsic value estimate, suggesting notable potential upside if these profitability levels hold.

Result: UNDERVALUED

Our Excess Returns analysis suggests Preferred Bank is undervalued by 60.3%. Track this in your watchlist or portfolio, or discover 906 more undervalued stocks based on cash flows.

Approach 2: Preferred Bank Price vs Earnings

For a profitable bank like Preferred Bank, the price to earnings ratio is a useful yardstick because it links what investors are paying directly to the earnings the business is currently generating. In broad terms, faster growth and lower perceived risk tend to justify a higher PE multiple, while slower growth or higher risk usually mean the stock should trade on a lower multiple.

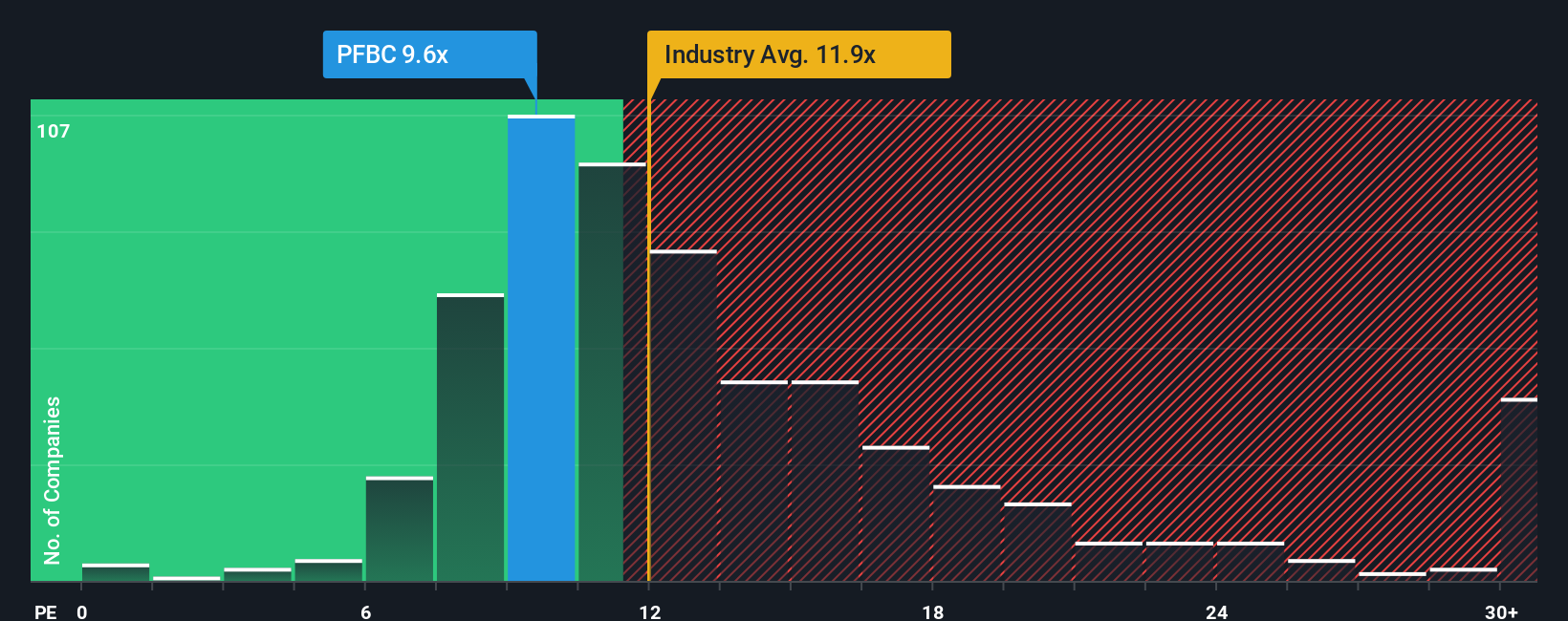

Preferred Bank currently trades on a PE of about 9.29x, which is below both the broader Banks industry average of roughly 11.90x and the peer group average of around 13.59x. On the surface, that discount hints at some value, but simple comparisons can be misleading because they ignore differences in growth outlook, margins, size and risk.

That is where Simply Wall St’s Fair Ratio comes in. It estimates what PE multiple would be reasonable for Preferred Bank after accounting for its earnings growth profile, profitability, risk characteristics, industry positioning and market cap. The Fair Ratio for Preferred Bank is 9.99x, modestly above the current 9.29x. This suggests the shares trade at a meaningful discount to what would be expected given the fundamentals.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1448 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Preferred Bank Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple framework that lets you attach a clear story to your assumptions about a company’s fair value, and its future revenue, earnings and margins.

A Narrative is your view of how a business will actually evolve, translated into a financial forecast, and then into a fair value that you can compare against the current share price to decide whether to buy, hold or sell.

On Simply Wall St’s Community page, used by millions of investors, Narratives make this process accessible by guiding you through the key drivers and updating your fair value automatically as new information like earnings or news flows in. This helps ensure your story and your numbers always stay in sync.

For Preferred Bank, one investor might build an optimistic Narrative around successful expansion into Manhattan and Silicon Valley with resilient margins and steady buybacks that supports a fair value above today’s price. Another investor could focus on concentrated California exposure, competitive funding pressures and slower digital adoption to arrive at a much lower fair value. Narratives help you clearly see which perspective you most agree with and how that translates into action.

Do you think there's more to the story for Preferred Bank? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.