يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

Is LPL Financial’s (LPLA) Acquisition-Driven Growth Transforming Its Retirement Strategy Edge?

LPL Financial Holdings Inc. LPLA | 385.14 | +3.44% |

- In recent news, LPL Financial Holdings reported its total advisory and brokerage assets reached US$2.26 trillion by August 2025, fueled by the acquisition of Commonwealth Financial Network, and BMO Capital initiated coverage with an Outperform rating highlighting the company's growth profile. LPL Financial also announced an expanded partnership with Prudential Financial to develop retirement lifetime income strategies targeting financial advisors.

- This combination of rising assets, new analyst coverage, and partnership expansion underscores LPL's momentum in integrating acquisitions to broaden its retirement solutions footprint in a consolidating wealth management sector.

- We'll examine how LPL's asset growth following the Commonwealth acquisition shapes the evolving investment narrative and future opportunities.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

LPL Financial Holdings Investment Narrative Recap

To believe in LPL Financial Holdings as a shareholder, you need to have confidence in the company's ability to grow its base of independent financial advisors and assets, while integrating large acquisitions in a consolidating market. The recent report that total assets reached US$2.26 trillion following the Commonwealth acquisition is significant for the company’s growth narrative, but does not materially change the biggest short-term catalyst: the successful integration of recent acquisitions and retention of assets. The most acute risk remains ongoing margin pressure tied to interest-rate sensitive revenues and possible execution challenges from rapid expansion. Among the recent announcements, the acquisition of Commonwealth Financial Network stands out as most relevant. With this deal, LPL meaningfully accelerates its asset base growth and strengthens its foothold with independent advisors, directly addressing the catalyst of expanding market share via scale. Still, with any substantial acquisition, investors remain mindful of integration and retention risks, especially as the wealth management sector faces fee compression and heavier regulatory demands. Yet, while assets are growing and new partnerships are forming, investors should also consider what could happen if interest rates shift and...

LPL Financial Holdings' narrative projects $23.0 billion revenue and $1.9 billion earnings by 2028. This requires 18.7% yearly revenue growth and a $0.8 billion earnings increase from $1.1 billion today.

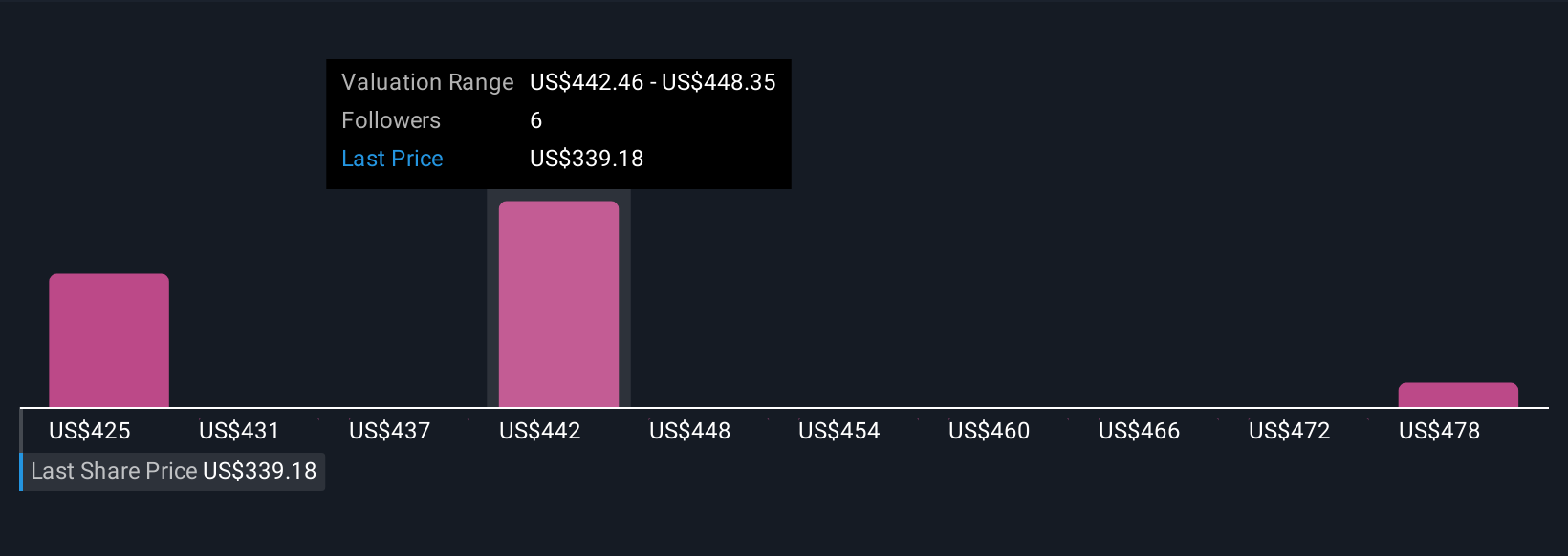

Uncover how LPL Financial Holdings' forecasts yield a $442.38 fair value, a 42% upside to its current price.

Exploring Other Perspectives

Three members of the Simply Wall St Community have valued LPL shares between US$440.70 and US$483.69, a considerable spread above the recent market price. With ongoing fee compression challenging revenue per client, these diverse perspectives remind you to weigh several viewpoints before making decisions.

Explore 3 other fair value estimates on LPL Financial Holdings - why the stock might be worth just $440.70!

Build Your Own LPL Financial Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your LPL Financial Holdings research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free LPL Financial Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate LPL Financial Holdings' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our top stock finds are flying under the radar-for now. Get in early:

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.