يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

Is Marzetti's (MZTI) Steady High ROCE and Increased Reinvestment Shaping Its Investment Story?

The Marzetti Co. Ordinary Shares MZTI | 0.00 |

- Earlier this week, Marzetti reported a sustained return on capital employed of about 21%, well above the industry average, and revealed it has increased capital deployment in its operations by 26% over the past five years.

- This signals a pattern of effective earnings reinvestment and operational discipline, setting Marzetti apart from its sector peers despite relatively modest shareholder returns in recent years.

- We'll now explore how Marzetti's strong ROCE and disciplined capital reinvestment influence its broader investment narrative and growth outlook.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Marzetti Investment Narrative Recap

To be a Marzetti shareholder, you need to believe in the company's ability to consistently reinvest profits at high returns on capital, outpacing the wider industry and reinforcing its standing in a mature segment. While the recent news confirms Marzetti's operational strength, it does not significantly impact the primary short term catalyst, new product launches, or offset the main risk of consumer trends moving away from processed foods.

Among recent announcements, the July product partnership with Buffalo Wild Wings ties directly into Marzetti's growth catalysts, as expanding branded and licensed offerings could help drive volume and diversify revenue streams amid evolving retail and consumer pressures.

By contrast, one risk investors should be aware of is the accelerating shift toward fresh and clean-label foods, which could ultimately challenge Marzetti’s long-term demand and profitability if...

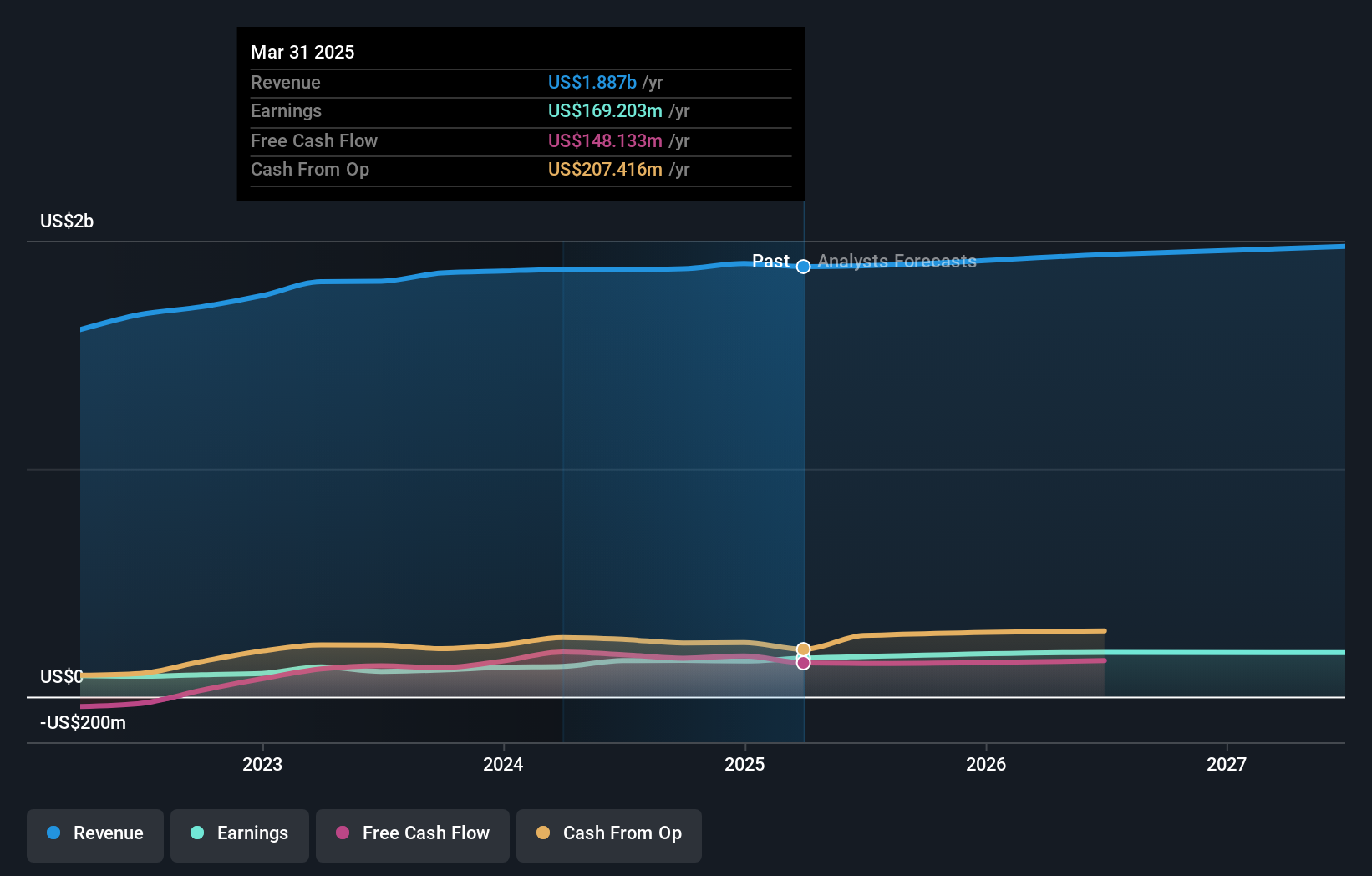

Marzetti's outlook anticipates $2.0 billion in revenue and $201.0 million in earnings by 2028. This is based on a 1.7% annual revenue growth rate and a $34.1 million increase in earnings from the current $166.9 million.

Uncover how Marzetti's forecasts yield a $199.00 fair value, a 17% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members submitted three fair value estimates for Marzetti ranging from US$133.45 to US$199 per share. These diverse opinions appear even as the company's recent strong reinvestment leaves room for debate about its ability to maintain growth leadership over shifting consumer preferences.

Explore 3 other fair value estimates on Marzetti - why the stock might be worth as much as 17% more than the current price!

Build Your Own Marzetti Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Marzetti research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Marzetti research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Marzetti's overall financial health at a glance.

Ready For A Different Approach?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.