يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

Is Multi‑Year EPS Growth Altering The Investment Case For Moelis (MC)?

Moelis & Co. Class A MC | 63.18 | +0.72% |

- In recent years, Moelis & Company, an independent investment bank, has reported strong multi-year revenue expansion and a very large increase in earnings per share, underlining improved profitability.

- This performance suggests Moelis may be capturing additional market share in advisory mandates, reinforcing its position in the global investment banking landscape.

- Next, we’ll examine how Moelis’s strong multi-year earnings growth shapes its investment narrative for investors assessing the firm’s competitive position.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is Moelis' Investment Narrative?

To own Moelis, you really have to believe that its recent acceleration in revenue and earnings is more than just a cyclical upswing and that the firm can keep converting advisory momentum into sustainably higher profitability. The latest two-year numbers, with strong top-line growth and a very large step-up in earnings per share, strengthen the near-term catalyst around the upcoming Q4 2025 results on February 4, where the market will look for confirmation that this trend is holding. At the same time, the stock already trades on a richer earnings multiple than many direct peers, so the bar for positive surprises is higher, and any slowdown in deal activity or compression in margins could matter more than before. In that sense, the recent news both enhances the opportunity and sharpens the execution risk.

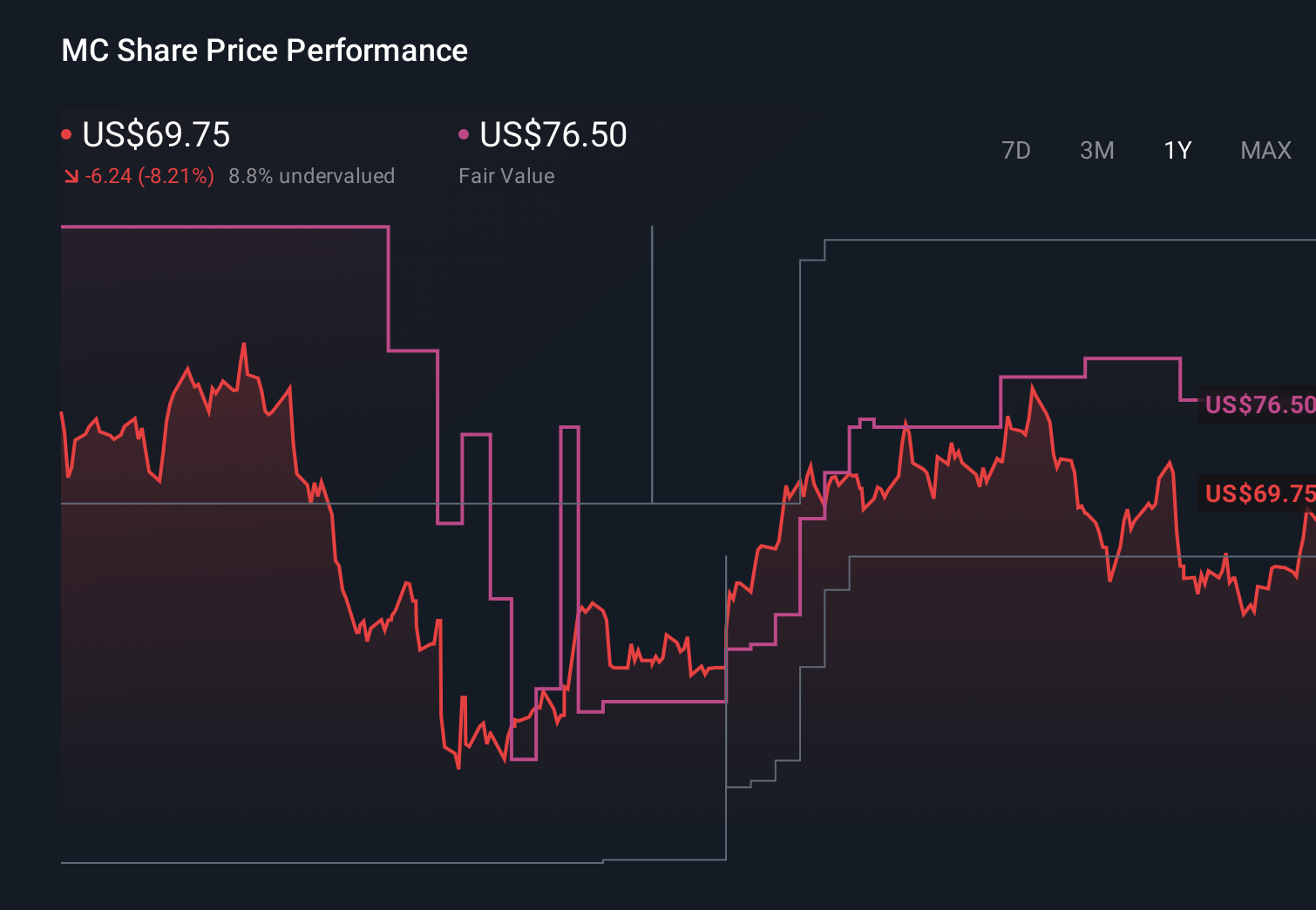

However, there is one risk in particular that shareholders should not overlook. Moelis' share price has been on the slide but might be up to 9% below fair value. Find out if it's a bargain.Exploring Other Perspectives

Explore 2 other fair value estimates on Moelis - why the stock might be worth as much as $76.50!

Build Your Own Moelis Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Moelis research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Moelis research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Moelis' overall financial health at a glance.

Ready For A Different Approach?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Explore 23 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 32 companies in the world exploring or producing it. Find the list for free.

- AI is about to change healthcare. These 109 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.