يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

Is Spotify's Freemium Success and Ad Revenue Growth Reshaping the Investment Thesis for SPOT?

Spotify SPOT | 597.80 597.80 | -0.18% 0.00% Pre |

- Recently, Spotify's freemium model and advanced personalization features have driven strong user growth and very low churn, highlighting the effectiveness of its global platform in bundling music, podcasts, and audiobooks.

- An interesting takeaway is that increasing advertising revenues, particularly from the podcast segment, are seen as key contributors to Spotify’s potential for expanded margins and sustained long-term profitability.

- We'll explore how Spotify's unique approach to platform differentiation and rising ad revenue is shaping its broader investment outlook.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 28 best rare earth metal stocks of the very few that mine this essential strategic resource.

Spotify Technology Investment Narrative Recap

To be a Spotify shareholder, you need to believe in management’s ability to turn a commanding user base and rising ad revenues, driven by the platform’s freemium model and personalization, into sustainable profitability and margin expansion. The recent news reinforces Spotify’s low churn and differentiated content, supporting longer-term ad monetization goals, but it does not materially change the short-term risk, which remains the challenge of scaling podcasts and audiobooks profitably against ongoing high licensing costs.

Among Spotify’s latest announcements, its freshly renewed multi-year agreement with Warner Music Group stands out as most relevant. This deal secures critical music licensing and may help contain content costs, directly impacting gross margins, one of the most important variables in the company’s path to consistent profitability amid growing ad-driven segments.

Yet, despite growing ad revenues and platform strength, a crucial risk investors should keep front of mind is the persistent pressure from major record labels, as their ongoing control over music licensing continues to...

Spotify Technology's narrative projects €23.8 billion in revenue and €3.4 billion in earnings by 2028. This requires 12.8% yearly revenue growth and a €2.6 billion earnings increase from the current €806.0 million.

Uncover how Spotify Technology's forecasts yield a $756.18 fair value, a 7% upside to its current price.

Exploring Other Perspectives

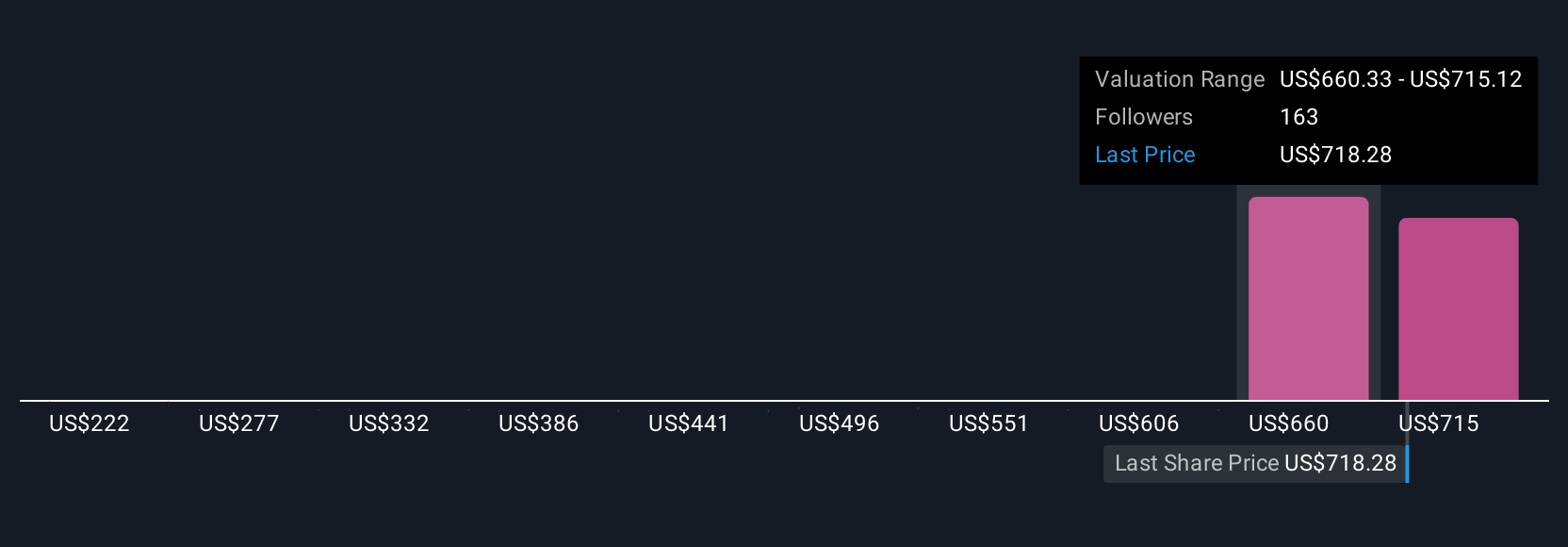

Fair value estimates from 24 Simply Wall St Community members range from €222 to €769.91, reflecting sharply different outlooks on Spotify. While the company’s strong user retention stands out, scaling new verticals remains an open question that could shape outcomes for years to come.

Explore 24 other fair value estimates on Spotify Technology - why the stock might be worth less than half the current price!

Build Your Own Spotify Technology Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Spotify Technology research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Spotify Technology research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Spotify Technology's overall financial health at a glance.

Searching For A Fresh Perspective?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.