يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

Is Wayfair's (W) Cyber Week Discount Blitz Reframing Its Path to Sustainable Scale?

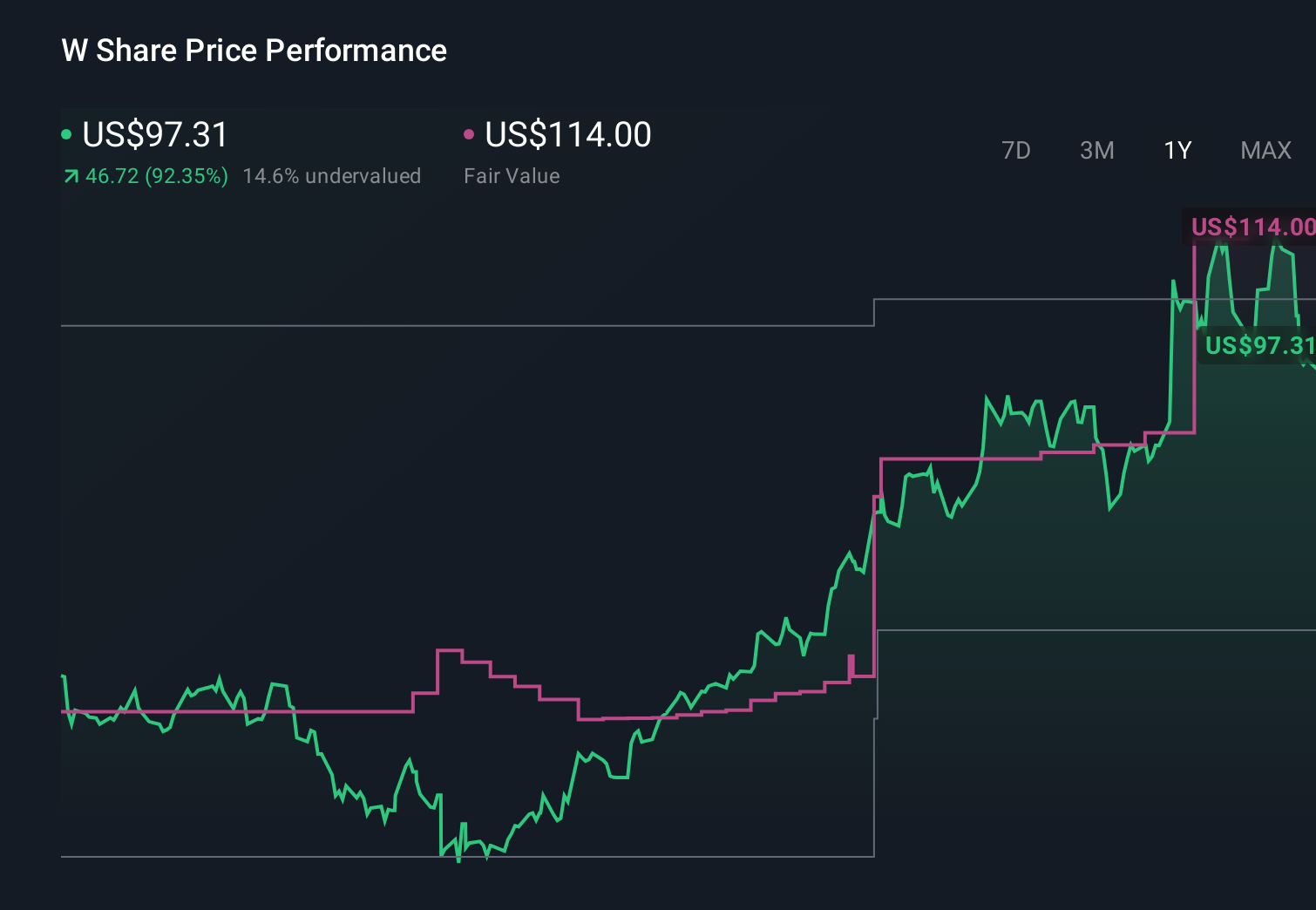

Wayfair, Inc. Class A W | 81.43 | +2.34% |

- Wayfair recently ran a Cyber Week Sale featuring steep discounts across furniture, décor, housewares, and home improvement items, including branded collections like Magnolia Homes by Joanna Gaines, to draw holiday shoppers.

- By concentrating major promotions on big-ticket home goods at the peak of holiday demand, Wayfair is testing how deep discounting can influence customer engagement and order volumes.

- Next, we’ll examine how Wayfair’s aggressive Cyber Week discounting across core home categories may influence its long-term investment narrative.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Wayfair Investment Narrative Recap

To own Wayfair, you need to believe it can turn its large online home goods audience and logistics assets into sustained, profitable growth despite a tough housing and macro backdrop. The Cyber Week Sale may give a short term lift to engagement and order volumes, but on its own it does not materially change the key near term catalyst of improving margins or the major risk that heavy discounting and high advertising spend fail to translate into durable earnings.

The most relevant recent announcement is Wayfair’s Q3 2025 update, which showed continued focus on improving profitability alongside revenue growth. Cyber Week’s aggressive promotions sit against that backdrop, giving investors another data point on whether merchandising and discounting tactics can support conversion without eroding already pressured margins.

But while promotions can help traffic, investors should still watch how heavy discounting interacts with already elevated advertising costs and...

Wayfair’s narrative projects $13.9 billion revenue and $124.7 million earnings by 2028. This requires 4.9% yearly revenue growth and a $424.7 million earnings increase from -$300.0 million today.

Uncover how Wayfair's forecasts yield a $114.00 fair value, a 22% upside to its current price.

Exploring Other Perspectives

Five members of the Simply Wall St Community value Wayfair between US$39.54 and US$179.18, highlighting very different return expectations. Set against this, the key question remains whether initiatives like CastleGate and merchandising tweaks can offset macro and housing headwinds and support a path to sustainable profitability.

Explore 5 other fair value estimates on Wayfair - why the stock might be worth as much as 91% more than the current price!

Build Your Own Wayfair Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Wayfair research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Wayfair research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Wayfair's overall financial health at a glance.

Want Some Alternatives?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.