يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

Jefferies Financial Group (JEF): Exploring Valuation with Shares Trading Sideways

Jefferies Financial Group Inc. JEF | 62.00 | -1.96% |

Jefferies Financial Group (JEF) shares recently moved in line with the broader market, reflecting a period without major catalysts or headlines. Investors may be weighing the company’s sustained growth as well as evolving sentiment in the financial sector.

Jefferies Financial Group’s share price has traded largely sideways in recent weeks, even as the company continues to post steady growth figures. Looking at the bigger picture, its subdued one-year share price return contrasts with a more robust total shareholder return over the past several years. This hints at underlying confidence among longer-term investors despite short-term market hesitations.

If you're curious to see what other opportunities might be out there, it's a great moment to explore fast growing stocks with high insider ownership.

With shares holding steady and financials showing consistent growth, the question for investors becomes clear: is Jefferies Financial Group currently undervalued and primed for upside, or has the market already factored in all the good news?

Price-to-Earnings of 20.3: Is it justified?

Jefferies Financial Group is currently valued at a price-to-earnings (P/E) ratio of 20.3, which is lower than its peer and industry averages. This suggests that investors might be underappreciating its recent growth momentum.

The price-to-earnings ratio measures how much investors are willing to pay per dollar of a company's earnings. It is a widely used metric for comparing valuation levels between companies in the same sector and gives insight into market expectations around future profitability and risk.

For Jefferies, the current P/E of 20.3 stands out. It is well below the US Capital Markets industry average of 26.3 and lower than the peer average of 23.1. This could indicate that the market is not fully recognizing the company’s recent acceleration in earnings, or it may be pricing in future uncertainties despite the positive growth figures.

While the P/E is below sector norms, the estimated Fair Price-to-Earnings Ratio is 18.1. This means Jefferies’ valuation is above the fair level that the market could potentially move toward based on broader valuation frameworks.

Result: Price-to-Earnings of 20.3 (ABOUT RIGHT)

However, potential risks such as slowing revenue growth or unexpected shifts in market sentiment could challenge Jefferies Financial Group’s current valuation story.

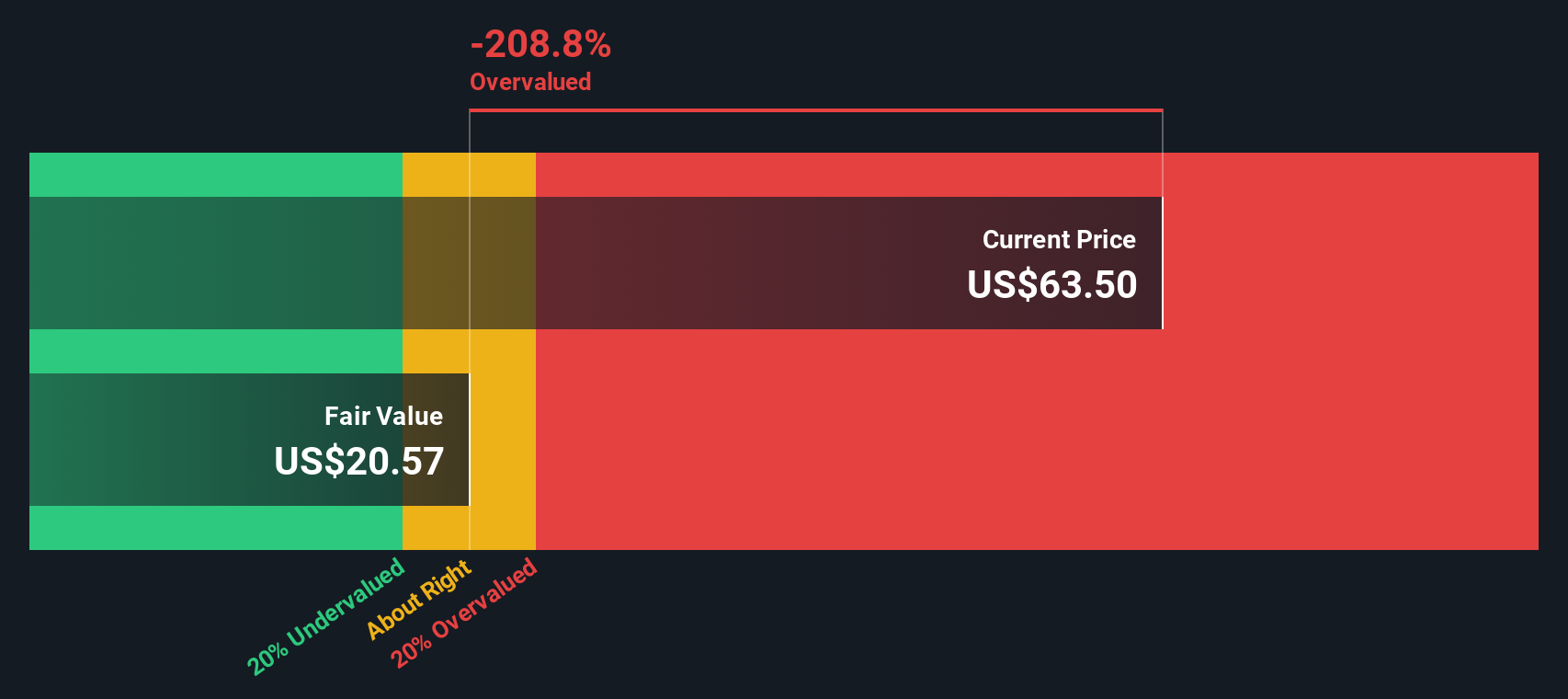

Another View: Discounted Cash Flow Raises Eyebrows

While valuation based on price-to-earnings paints Jefferies Financial Group as reasonably priced against sector peers, our SWS DCF model tells a different story. According to this cash flow analysis, shares are trading well above estimated fair value. Could that mean the recent optimism has gone too far?

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Jefferies Financial Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Jefferies Financial Group Narrative

If you see the story differently or want a hands-on approach to the numbers, you can shape your own view in just a few minutes with Do it your way.

A great starting point for your Jefferies Financial Group research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Plenty of exciting stock opportunities await those who look beyond the obvious. Access expert-curated picks and emerging themes with these powerful tools before others spot them.

- Unlock potential high-yield returns by exploring these 19 dividend stocks with yields > 3%, which highlights companies delivering strong income streams above 3%.

- Ride the wave of technology with these 24 AI penny stocks, and connect with innovative firms shaping the future of artificial intelligence.

- Tap into the evolving world of finance through these 78 cryptocurrency and blockchain stocks, focusing on companies harnessing cryptocurrency and blockchain trends for tomorrow's growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.