يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

Johnson Outdoors (NASDAQ:JOUT) Has Affirmed Its Dividend Of $0.33

Johnson Outdoors Inc. Class A JOUT | 50.50 | +3.80% |

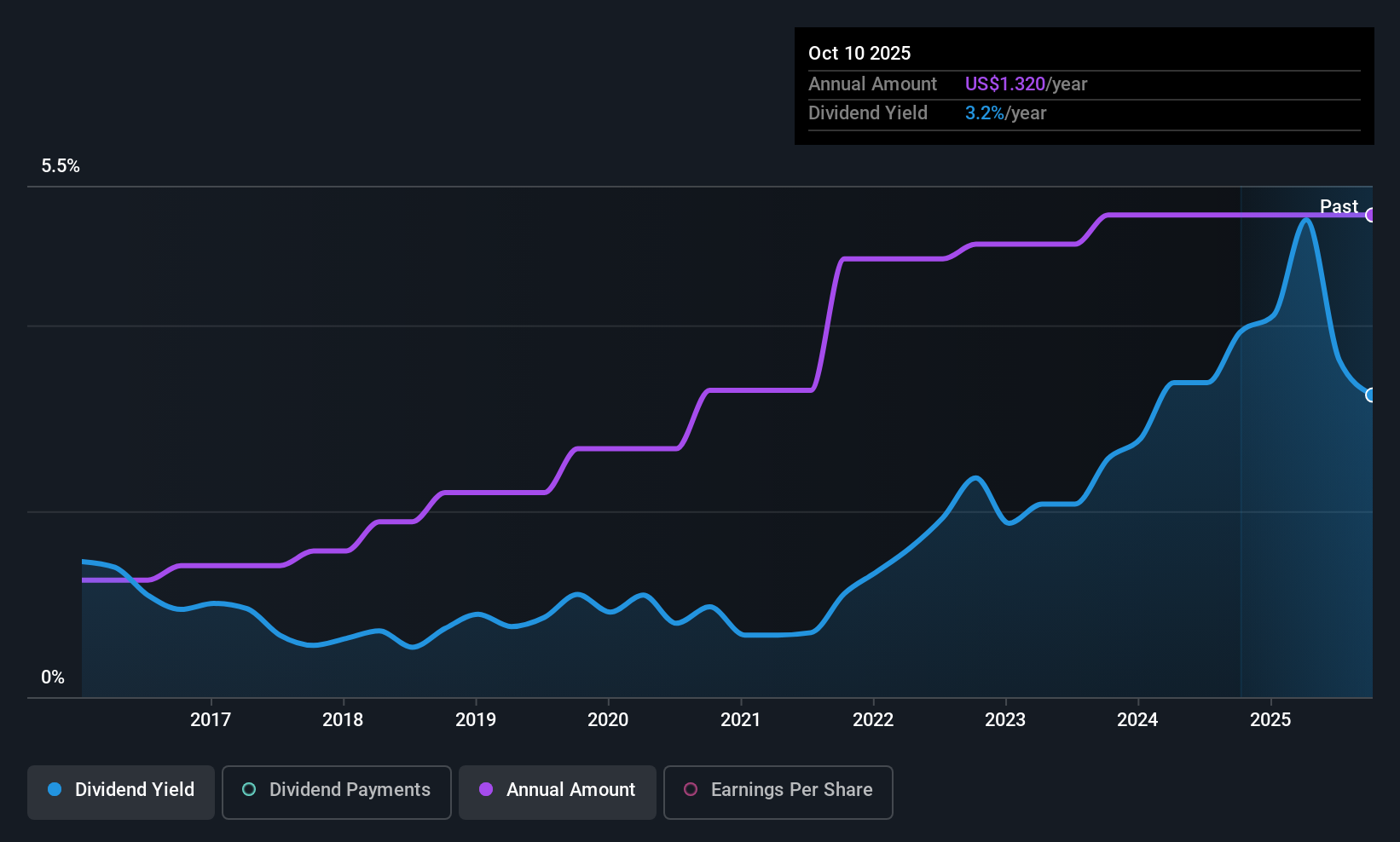

Johnson Outdoors Inc. (NASDAQ:JOUT) has announced that it will pay a dividend of $0.33 per share on the 22nd of January. This means the dividend yield will be fairly typical at 3.2%.

Johnson Outdoors' Projections Indicate Future Payments May Be Unsustainable

Estimates Indicate Johnson Outdoors' Could Struggle to Maintain Dividend Payments In The Future

Johnson Outdoors' Future Dividends May Potentially Be At Risk

We like a dividend to be consistent over the long term, so checking whether it is sustainable is important. Even though Johnson Outdoors isn't generating a profit, it is generating healthy free cash flows that easily cover the dividend. This gives us some comfort about the level of the dividend payments.

Over the next year, EPS is forecast to expand by 117.2%. However, if the dividend continues along recent trends, it could start putting pressure on the balance sheet with the payout ratio getting very high over the next year.

Johnson Outdoors Has A Solid Track Record

The company has a sustained record of paying dividends with very little fluctuation. The annual payment during the last 10 years was $0.30 in 2015, and the most recent fiscal year payment was $1.32. This means that it has been growing its distributions at 16% per annum over that time. We can see that payments have shown some very nice upward momentum without faltering, which provides some reassurance that future payments will also be reliable.

Dividend Growth Potential Is Shaky

Investors could be attracted to the stock based on the quality of its payment history. However, things aren't all that rosy. Over the past five years, it looks as though Johnson Outdoors' EPS has declined at around 53% a year. Dividend payments are likely to come under some pressure unless EPS can pull out of the nosedive it is in. It's not all bad news though, as the earnings are predicted to rise over the next 12 months - we would just be a bit cautious until this becomes a long term trend.

In Summary

Overall, we don't think this company makes a great dividend stock, even though the dividend wasn't cut this year. The company has been bring in plenty of cash to cover the dividend, but we don't necessarily think that makes it a great dividend stock. This company is not in the top tier of income providing stocks.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.