يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

Kearny Financial (KRNY) Net Interest Margin Recovery Tests Bullish Turnaround Narratives

Kearny Financial Corp. KRNY | 8.21 | +1.11% |

Kearny Financial’s latest quarterly results in focus

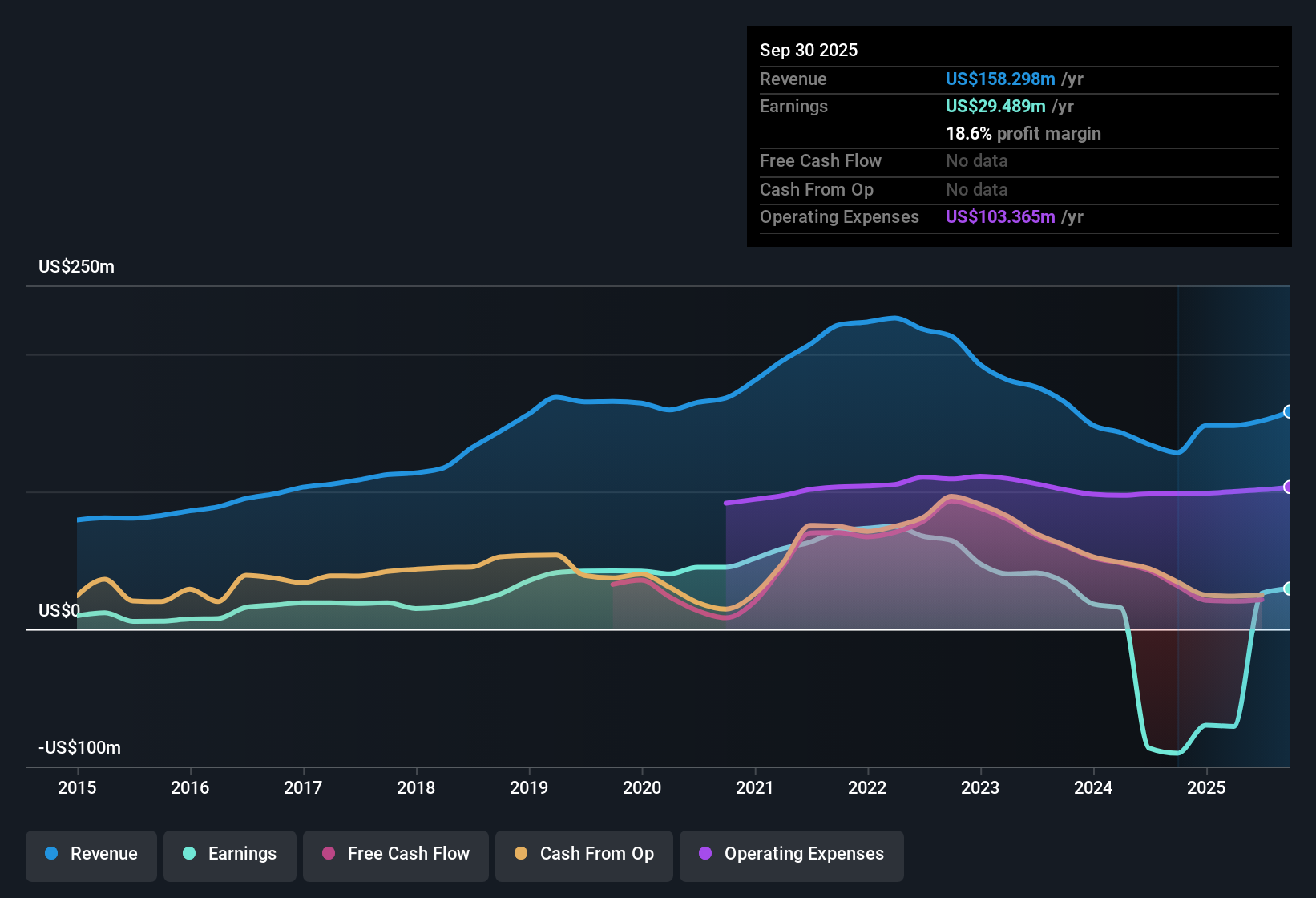

Kearny Financial (KRNY) just reported Q2 2026 results with total revenue of about US$43.0 million and EPS of roughly US$0.15, putting fresh numbers on the table for investors tracking its recovery story. The company has seen quarterly revenue move from US$37.4 million in Q2 2025 to US$42.97 million in Q2 2026. EPS over the same quarters has shifted from around US$0.11 to about US$0.15, and the trailing twelve month figures now show revenue of US$163.9 million and EPS of US$0.52. Overall, the latest print points to a business where margins and earnings power are central to how investors are likely to read this update.

See our full analysis for Kearny Financial.With the numbers on the board, the next step is to see how this earnings profile lines up with the widely followed growth and risk narratives around KRNY, and where those stories might need a rethink.

TTM profit of US$32.4 million after prior losses

- On a trailing twelve month basis, KRNY shows net income of US$32.4 million and Basic EPS of US$0.52, a shift from earlier twelve month periods that were in loss territory with EPS figures such as a US$1.45 loss and a US$1.13 loss.

- For investors with a bullish view, what stands out is that this return to profit now sits alongside quarterly EPS around US$0.15 and net income near US$9.5 million, which supports the idea of a more stable earnings run rate even though earlier trailing periods reported large losses of over US$70 million.

- Supporters of the bullish angle can point to the move from a trailing twelve month loss of about US$90.4 million to a profit of US$32.4 million as evidence that recent quarters differ from the loss making stretch embedded in older TTM figures.

- At the same time, the step up in quarterly net income from around US$6.1 million in early 2025 to roughly US$9.5 million in early 2026 indicates that, within the last six quarters, profit has been recorded consistently rather than being a one off swing.

Net interest margin holds around 2.1%

- KRNY reports a net interest margin of 2.1% in Q1 2026 versus 1.9% in Q3 2025 and 1.82% in Q2 2025, with total revenue in those quarters moving from US$37.4 million and US$38.2 million to US$43.6 million alongside this margin profile.

- Supporters of a bullish stance argue that a margin level near 2.1% helps underpin the TTM revenue of US$163.9 million and EPS of US$0.52, and the data here gives some backing to that view while also showing how sensitive profits could be if margins were to slip again.

- The sequence from a 1.8% to 2.1% net interest margin sits next to the move in quarterly net income from about US$6.1 million to roughly US$9.5 million, which some investors see as evidence that even modest margin changes can matter significantly for the earnings line.

- However, because total loans are roughly flat in a narrow range around US$5.8 billion across these periods, any future change in that 2.1% margin would directly affect interest income on a fairly steady loan base, which is the kind of sensitivity both bullish and cautious investors are likely to watch.

Mixed valuation versus DCF fair value

- The stock trades at US$8.10 with a trailing P/E of 15.7x, compared with a DCF fair value of about US$0.37, while also sitting below the broader US market P/E of 19.5x and peer P/E of 32.8x but above the US Banks industry average of 12.1x.

- Skeptics highlight that a DCF fair value of US$0.37 against a share price of US$8.10, along with a reported 70% allowance for bad loans and an unstable dividend history, provides material for a bearish case that the current price embeds expectations that are much richer than what this DCF and risk profile imply.

- On one side, the P/E discount to the broader US market and to the 32.8x peer level could be read as valuation support, yet the premium to the 12.1x US Banks average and the large gap to the DCF fair value pull in the opposite direction.

- On the risk side, the 70% allowance for bad loans and the unstable dividends mean that if credit costs rise or payouts shift again, the combination of a higher than industry P/E and a low DCF estimate may weigh more heavily on how bearish investors frame KRNY.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Kearny Financial's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

Explore Alternatives

KRNY’s current P/E premium to the US Banks average, its large gap to DCF fair value, and its unstable dividend record point to meaningful valuation and income weaknesses.

If those gaps make you uneasy, use our these 878 undervalued stocks based on cash flows to quickly focus on companies where prices look more reasonable relative to fundamentals and potential rewards.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.