يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

Kimco Realty Dividend Hike Meets Record Occupancy And Leasing Strength

Kimco Realty Corporation KIM | 23.17 | +2.66% |

- Kimco Realty (NYSE:KIM) has approved a 4% increase to its quarterly common dividend for 2025.

- The company reported record overall portfolio occupancy for 2025.

- Kimco also recorded its highest quarterly new leasing volume in more than 10 years.

Kimco Realty, a major owner of open air shopping centers, sits at the intersection of retail property and consumer spending trends. For investors following real estate income names, a 4% dividend increase from NYSE:KIM and record portfolio occupancy in 2025 highlight key corporate decisions and property-level results that shape the income profile and stability of the business.

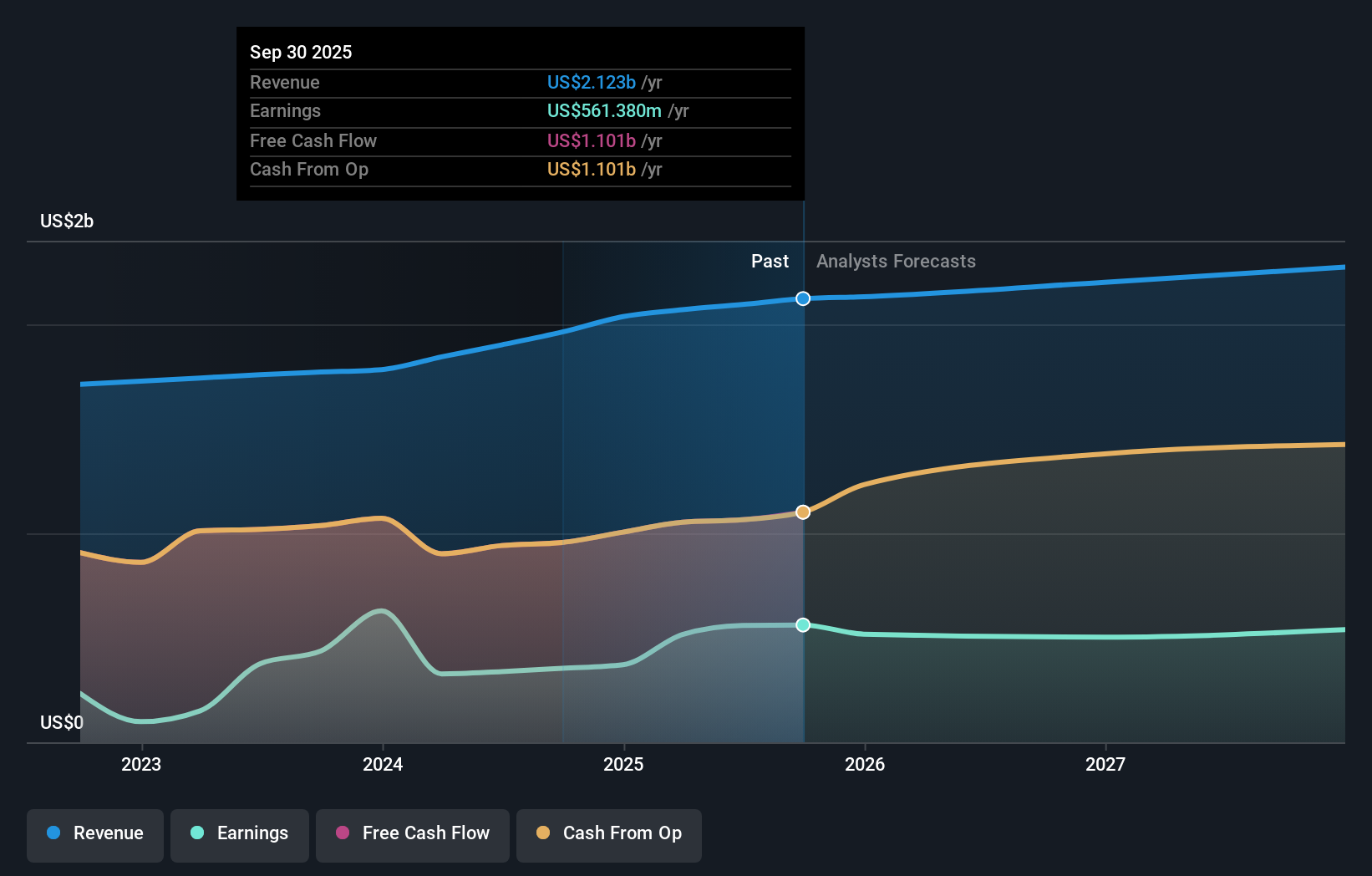

Record leasing activity and occupancy can influence how you think about Kimco’s tenant demand and potential cash flow durability over time. While outcomes are never guaranteed, this combination of a higher dividend and strong leasing metrics gives income-focused investors specific data points to watch as they compare NYSE:KIM with other real estate holdings in their portfolios.

Stay updated on the most important news stories for Kimco Realty by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on Kimco Realty.

Quick Assessment

- ⚖️ Price vs Analyst Target: At US$22.71, Kimco trades about 4% below the US$23.76 analyst target, which sits comfortably within the usual range of views.

- ✅ Simply Wall St Valuation: Simply Wall St estimates the shares are trading roughly 30.8% below fair value, flagging a potential value gap.

- ✅ Recent Momentum: The 30 day return of about 10% shows recent positive sentiment around the stock.

There is only one way to know the right time to buy, sell or hold Kimco Realty. Head to Simply Wall St's company report for the latest analysis of Kimco Realty's Fair Value.

Key Considerations

- 📊 A 4% dividend increase, record occupancy and strong leasing in 2025 give you clearer visibility on how management is using current property performance to support shareholder payouts.

- 📊 Keep an eye on the dividend yield at US$22.71, trends in occupancy and leasing spreads, and whether earnings continue to support higher distributions.

- ⚠️ The key watchpoint here is that interest payments are not well covered by earnings, which can limit flexibility if funding costs rise while dividends are higher.

Dig Deeper

For the full picture including more risks and rewards, check out the complete Kimco Realty analysis. Alternatively, you can visit the community page for Kimco Realty to see how other investors believe this latest news will impact the company's narrative.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.