يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

Lacklustre Performance Is Driving Heron Therapeutics, Inc.'s (NASDAQ:HRTX) 26% Price Drop

Heron Therapeutics Inc HRTX | 1.38 | -1.43% |

The Heron Therapeutics, Inc. (NASDAQ:HRTX) share price has softened a substantial 26% over the previous 30 days, handing back much of the gains the stock has made lately. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 32% share price drop.

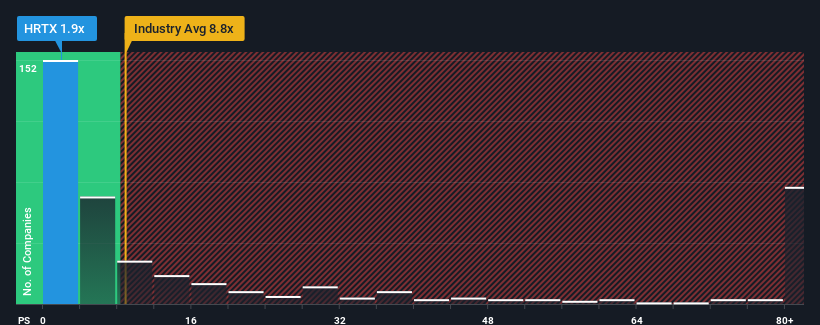

Following the heavy fall in price, Heron Therapeutics may be sending very bullish signals at the moment with its price-to-sales (or "P/S") ratio of 1.9x, since almost half of all companies in the Biotechs industry in the United States have P/S ratios greater than 8.8x and even P/S higher than 51x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

Our free stock report includes 2 warning signs investors should be aware of before investing in Heron Therapeutics. Read for free now.

What Does Heron Therapeutics' Recent Performance Look Like?

With revenue growth that's inferior to most other companies of late, Heron Therapeutics has been relatively sluggish. Perhaps the market is expecting the current trend of poor revenue growth to continue, which has kept the P/S suppressed. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Heron Therapeutics will help you uncover what's on the horizon.Is There Any Revenue Growth Forecasted For Heron Therapeutics?

The only time you'd be truly comfortable seeing a P/S as depressed as Heron Therapeutics' is when the company's growth is on track to lag the industry decidedly.

If we review the last year of revenue growth, the company posted a worthy increase of 14%. This was backed up an excellent period prior to see revenue up by 67% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Shifting to the future, estimates from the three analysts covering the company suggest revenue should grow by 13% per annum over the next three years. Meanwhile, the rest of the industry is forecast to expand by 173% per year, which is noticeably more attractive.

With this in consideration, its clear as to why Heron Therapeutics' P/S is falling short industry peers. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Bottom Line On Heron Therapeutics' P/S

Heron Therapeutics' P/S looks about as weak as its stock price lately. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As expected, our analysis of Heron Therapeutics' analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. The company will need a change of fortune to justify the P/S rising higher in the future.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Heron Therapeutics (at least 1 which can't be ignored), and understanding these should be part of your investment process.

If these risks are making you reconsider your opinion on Heron Therapeutics, explore our interactive list of high quality stocks to get an idea of what else is out there.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.