يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

Lennox International (LII) Margin Improvement Reinforces Quality Narratives Despite Slower Growth Forecasts

Lennox International Inc. LII | 561.01 | +1.94% |

Lennox International (LII) has put another solid quarter on the board for FY 2025, with Q3 revenue of US$1.4 billion, basic EPS of US$7.00 and net income of US$245.8 million setting the tone for this earnings season update. The company has seen quarterly revenue move from US$1.5 billion in Q2 2025 to US$1.4 billion in Q3, while EPS has shifted from US$7.86 to US$7.00 over the same stretch. This gives investors a clean read on how the top and bottom line are tracking through the year. With margins running alongside these headline figures, the focus now is on how sustainable this profitability profile looks as new results roll through.

See our full analysis for Lennox International.With the numbers on the table, the next step is to line them up against the prevailing narratives around Lennox to see which views the latest margins and earnings support and which ones they start to challenge.

Margins Hold Up In The Mid‑Teens

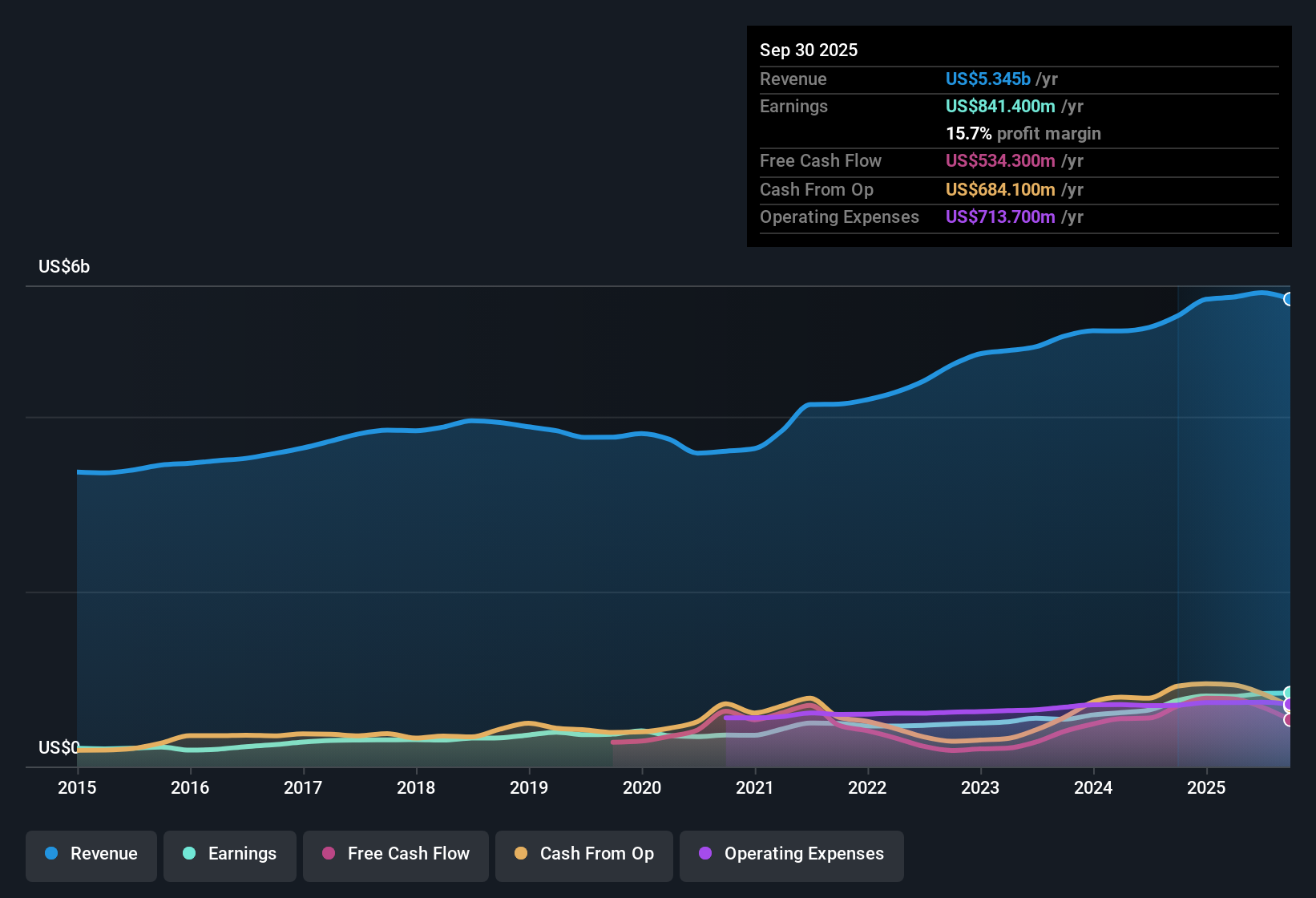

- On a trailing twelve month basis, Lennox converted US$5.3b of revenue into US$841.4 million of net income, which comes out to a 15.7% net profit margin compared with 14.6% a year earlier.

- What really supports the bullish angle on quality is that net income over the last year, at US$841.4 million, grew 11.6% while revenue growth sat at about 4.6%. This aligns with a view that the business has been leaning more on efficiency than on chasing rapid sales growth.

- Bulls often like to see this kind of profile. A 15.7% margin and US$23.79 of trailing EPS show that profit per dollar of sales and per share has moved ahead of the top line.

- The shift from a 14.6% margin to 15.7% also gives them concrete evidence to point to when they argue that recent profitability is not just a single quarter story but visible across the last 12 months.

Investors who focus on quality of earnings rather than sheer size tend to pay attention when net margin edges higher while revenue growth stays modest.

Growth Pace Trails Market Averages

- Over the last 12 months, earnings grew 11.6% and revenue about 4.6%, while forecasts cited point to 6.3% annual earnings growth and 4.6% annual revenue growth, both below the US market benchmarks of 16.1% for earnings and 10.6% for revenue.

- Critics who take a more bearish stance point out that, even with US$23.79 of trailing EPS and US$5.3b of sales, the growth profile implied by those 4.6% and 6.3% figures looks slower than the broader market. They see this as a constraint on how much investors may be willing to pay for that earnings stream.

- Bears highlight that while historical growth ran at 11.6% for earnings, the step down to a 6.3% forecast suggests expectations are more muted than the 16.1% market earnings growth figure.

- They also flag that revenue growth at 4.6% sits well under the 10.6% US market forecast. In their view, this limits the case for paying up for further expansion without a clear acceleration.

For you as an investor, that gap versus market growth expectations is a key piece of context when you think about how ambitious future assumptions should be.

P/E, DCF And Debt Send Mixed Signals

- Lennox currently trades on a 20.3x P/E, slightly below the Building industry and peer averages around 20.7x to 20.8x. The cited DCF fair value of US$441.46 sits under the current share price of US$487.49, and the company is flagged as carrying a high level of debt.

- What stands out for investors trying to balance bullish and bearish arguments is that the modest P/E discount to peers points to some relative value. However, the gap between the US$487.49 share price and the US$441.46 DCF fair value, together with the presence of higher debt, are the main reasons skeptics say the risk side of the ledger cannot be ignored.

- Supporters of the stock tend to focus on the slightly cheaper 20.3x P/E compared with industry and peers, alongside improving margins and 11.6% earnings growth, as evidence that the current price is backed by recent performance.

- Skeptics instead lean on the DCF fair value being below the market price and the high debt level to argue that, even with US$841.4 million of trailing net income, the balance of growth and leverage needs a closer look.

Putting those pieces together helps you see why some investors see a fairly priced quality business, while others focus more on slower forecast growth and leverage when weighing up the trade off.

To see how other investors are pulling these threads together, including how they weigh growth, debt and valuation, Curious how numbers become stories that shape markets? Explore Community Narratives

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Lennox International's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Lennox pairs healthy margins with slower forecast growth than the broader US market and carries a high level of debt alongside its current earnings base.

If that mix of slower growth and higher leverage feels uncomfortable, use our solid balance sheet and fundamentals stocks screener (386 results) to zero in on companies with sturdier finances and more room to move.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.