يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

Live Oak Bancshares (LOB): Evaluating Valuation Following the Federal Reserve’s Interest Rate Cut and New Outlook

Live Oak Bancshares, Inc. LOB | 35.51 | +0.57% |

Most Popular Narrative: 2.3% Undervalued

The most widely followed narrative suggests that Live Oak Bancshares is trading just below its estimated fair value, offering a slight undervaluation based on the current analyst consensus.

"Continued investment in AI, digital banking technology and process automation is enabling greater operating efficiency, improved customer and employee experiences, and potential for lower credit costs. This supports operating leverage and the potential for higher net margins over time."

Curious what makes analysts bullish on Live Oak’s future? There is a strategic blend of digital innovation, efficiency gains, and ambitious profit projections—numbers that might surprise you. If you want the full story behind this fair value, the narrative holds the secrets shaping its outlook, from rapid growth assumptions to the metrics Wall Street is watching now.

Result: Fair Value of $38.00 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent regulatory changes or rising fintech competition could quickly challenge Live Oak’s growth story and test assumptions behind today’s optimism.

Find out about the key risks to this Live Oak Bancshares narrative.Another View: Looking Through a Different Lens

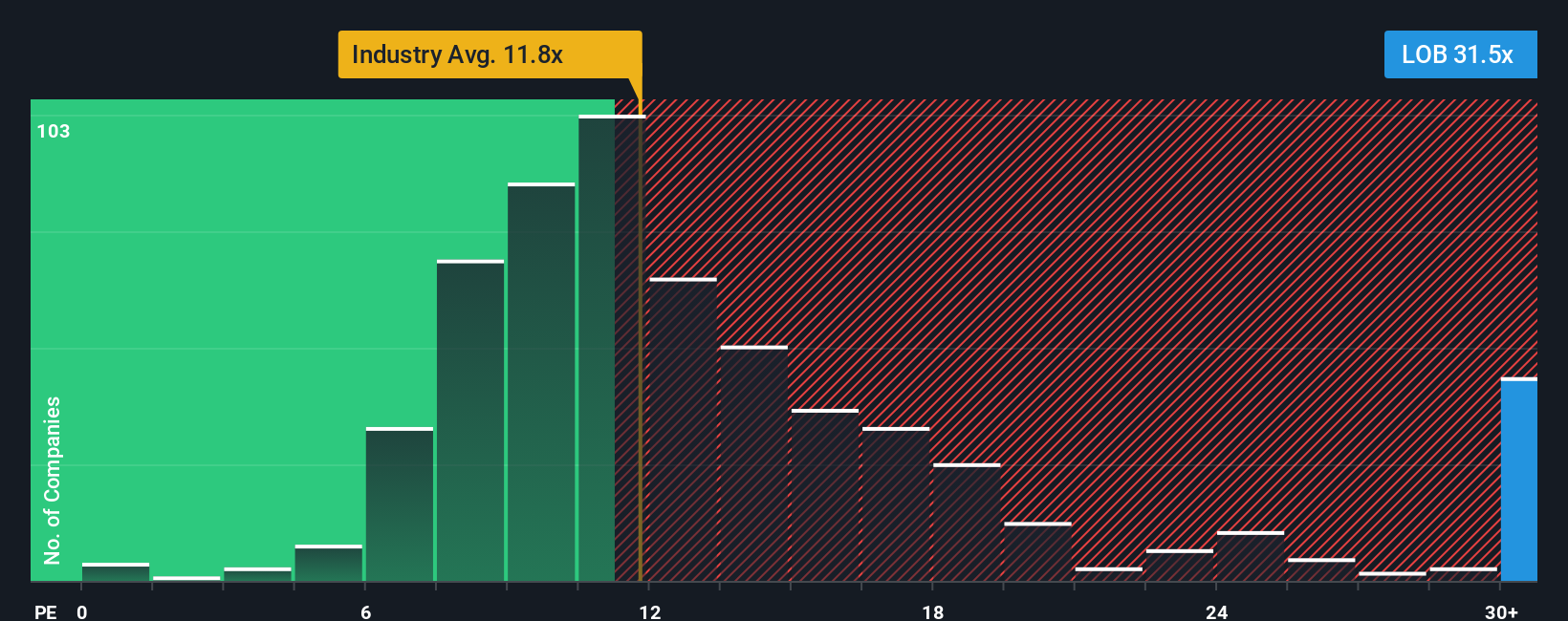

Switching focus to a different approach, the market-based valuation tells a more cautious story than the first. Using this method, Live Oak Bancshares does not look as cheap as some might expect. Could the market be seeing risks the first method missed?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Live Oak Bancshares Narrative

If you want to take a different perspective or dive into the numbers on your own terms, shaping your own vision for Live Oak Bancshares is just a few minutes away. Do it your way.

A great starting point for your Live Oak Bancshares research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Seize the chance to broaden your portfolio with unique opportunities beyond Live Oak Bancshares. These handpicked themes are sparking attention among investors right now. Don’t sit on the sidelines while others move ahead.

- Uncover hidden gems among fast-growing up-and-comers by checking out penny stocks with strong financials and spot tomorrow’s leaders before the crowd catches on.

- Tap into unstoppable trends in artificial intelligence by exploring AI penny stocks, where innovative companies are reshaping the modern world.

- Capture strong yields and stable returns with dividend stocks with yields > 3%, a gateway to companies rewarding shareholders with consistent dividend payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.