يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

Lowered EBITDA Guidance and Project Delays Might Change the Case for Investing in Kinetik Holdings (KNTK)

Kinetik Holdings Inc. Class A KNTK | 45.56 | +1.90% |

- Kinetik Holdings Inc. recently reported its third-quarter 2025 results, highlighting revenue growth to US$463.97 million alongside a decline in net income and a downward revision of its adjusted EBITDA guidance due to operational and project-related challenges.

- The company also completed a major share buyback and discussed updates at the Bank of America Global Energy Conference in Houston, with the ongoing ramp-up and timing of its King's Landing project drawing particular investor attention.

- We'll explore how Kinetik's updated EBITDA guidance and operational hurdles could shape its investment narrative and long-term outlook.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Kinetik Holdings Investment Narrative Recap

To be a shareholder in Kinetik Holdings, you have to believe in the long-term growth of Permian midstream infrastructure and the company's ability to turn new projects like King's Landing into reliable earnings streams. The recent downward revision to adjusted EBITDA guidance and project delays could limit the impact of near-term catalysts, but for now, the main risk remains volume and margin sensitivity linked to upstream activity and commodity prices, both of which were highlighted in the latest results. There is no evidence yet that these headwinds will fundamentally alter the long-term investment case, but they do highlight short-term uncertainty around project ramp-up and earnings stability.

The recently completed share buyback, which retired over 7% of outstanding shares for US$181.81 million, stands out as one of the most relevant company responses in the face of these headwinds. While it does not directly address operational challenges, it may influence shareholder value considerations as investors pay closer attention to margin resilience and free cash flow, especially with large capital projects still ongoing. But with recent profit declines and earnings guidance cuts, investors should be mindful that...

Kinetik Holdings' narrative projects $2.8 billion revenue and $167.1 million earnings by 2028. This requires 19.0% yearly revenue growth and a $122.6 million earnings increase from $44.5 million today.

Uncover how Kinetik Holdings' forecasts yield a $49.92 fair value, a 45% upside to its current price.

Exploring Other Perspectives

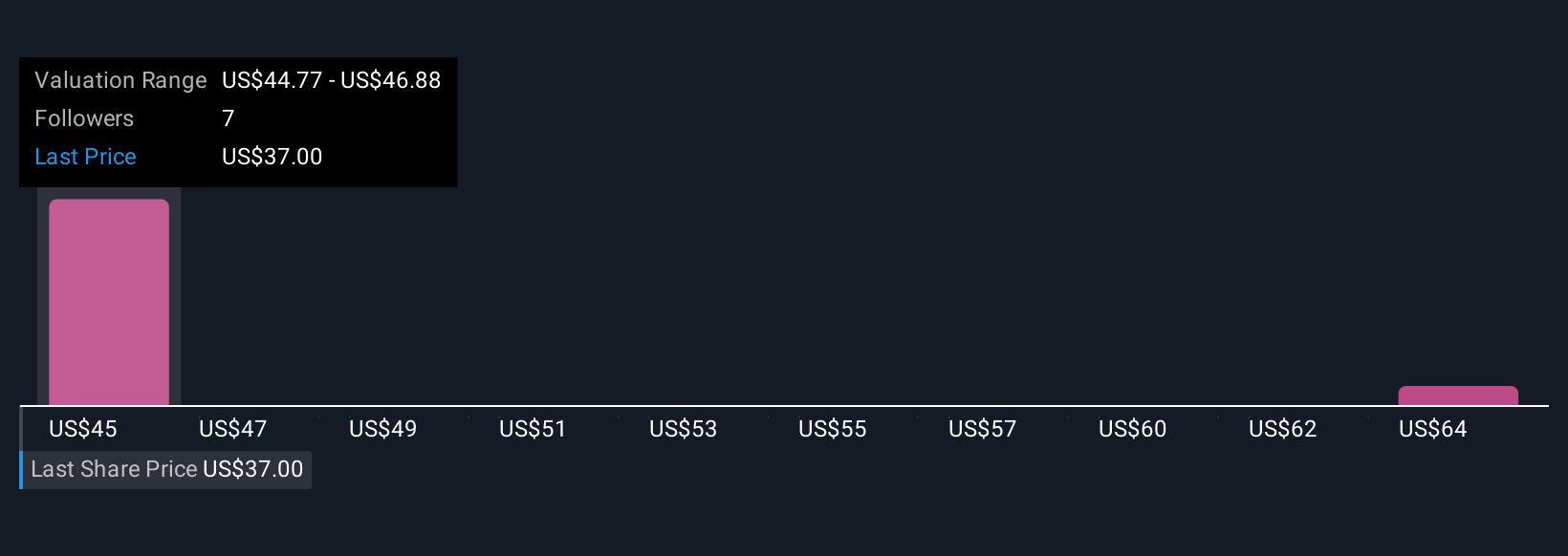

Fair value opinions from the Simply Wall St Community range from US$48.58 to US$65.85 across 3 contributors. With earnings guidance now lower, the company’s ability to convert new project ramp-ups into stable profits is central, see how others frame this debate.

Explore 3 other fair value estimates on Kinetik Holdings - why the stock might be worth as much as 91% more than the current price!

Build Your Own Kinetik Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Kinetik Holdings research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Kinetik Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Kinetik Holdings' overall financial health at a glance.

No Opportunity In Kinetik Holdings?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.