يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

Meritage Homes (MTH) Margin Compression To 7.7% Challenges Bullish Earnings Narratives

Meritage Homes Corporation MTH | 77.83 | +0.03% |

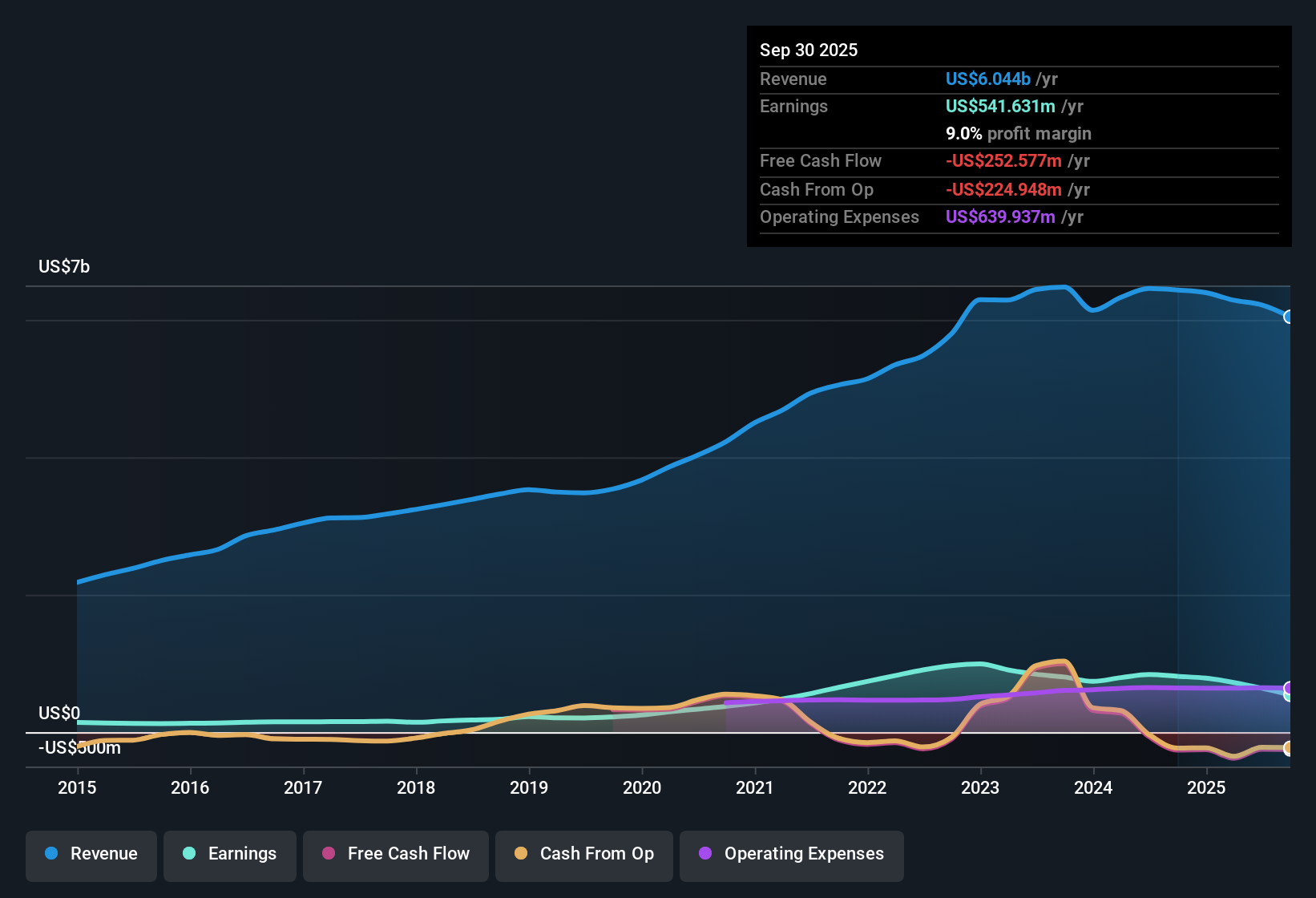

Meritage Homes (MTH) just closed out FY 2025 with fourth quarter revenue of US$1.4b and basic EPS of US$1.21, while trailing twelve month revenue came in at US$5.9b with basic EPS of US$6.40. Over recent quarters the company has seen revenue move from US$1.6b and EPS of US$2.39 in Q4 2024 to US$1.6b and EPS of US$2.06 in Q2 2025, before landing at the latest Q4 2025 levels. With net profit margins easing from 12.3% to 7.7% over the last year, this set of results gives investors plenty to weigh up around the balance between growth ambitions and profitability pressure.

See our full analysis for Meritage Homes.With the numbers on the table, the next step is to see how this earnings profile lines up against the prevailing narratives around Meritage Homes, and where those stories might need a rethink.

Margins Under Pressure At 7.7%

- On a trailing twelve month view, Meritage earned US$453.0 million of net income on US$5.9b of revenue, which works out to a 7.7% net margin compared with 12.3% a year earlier.

- Critics highlight this margin compression as a bearish signal, and the figures give that concern some grounding:

- Quarterly net income went from US$172.6 million in Q4 2024 to US$84.0 million in Q4 2025, even though quarterly revenue stayed in roughly the US$1.4b to US$1.6b range.

- Over the same FY 2025 run rate, EPS moved from US$2.39 in Q4 2024 to US$1.21 in Q4 2025, which is consistent with profit being squeezed even while the top line held around similar levels.

P/E Of 10.9x Versus Peers

- The shares trade on a 10.9x P/E, which is a discount to the US Consumer Durables industry at 11.2x and to the cited peer average of 15.4x, while the current share price of US$69.96 also sits well below the US$201.84 DCF fair value and the US$85.00 analyst target used in the analysis.

- Supporters of a bullish stance point to this valuation gap, and the numbers give that view some weight but also some tension:

- On one hand, trading below both the industry and peer P/E multiples, and below a DCF fair value of US$201.84, lines up with the idea that the market is pricing Meritage conservatively relative to those benchmarks.

- On the other hand, the same data set shows trailing net margin slipping from 12.3% to 7.7%, which gives bears a concrete reason why the shares might be cheaper than the DCF and price target of US$85.00 suggest.

Dividend Yield 2.46% With Tight Coverage

- The stock offers a 2.46% dividend yield, but the analysis flags that dividend payments over the last 12 months have not been fully covered by free cash flow.

- For income focused investors, that creates a practical trade off that both bullish and bearish views have to grapple with:

- Bulls may lean on forecast earnings growth of about 10.1% per year and revenue growth of about 7.0% per year, arguing that improving profitability could help support the payout over time.

- Bears can point back to the trailing picture, where net income over the last 12 months was US$453.0 million and margins fell to 7.7%, to argue that relying on future growth to support a dividend that recent free cash flow did not fully cover adds risk to the income story.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Meritage Homes's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

Explore Alternatives

Meritage Homes is working through thinner 7.7% net margins, softer EPS and a dividend that recent free cash flow has not fully covered.

If stretched payout coverage and profit pressure leave you cautious, check out these 1814 dividend stocks with yields > 3% to focus on income ideas where recent cash generation supports the yield more comfortably.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.