يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

Minerals Technologies Balances Record Safety, Growth Investments And Talc Litigation Costs

Minerals Technologies Inc. MTX | 72.11 | -0.26% |

- Minerals Technologies reported a record company safety performance in 2025, setting a new benchmark for its operations.

- The company increased investment in growth platforms across pet litter, edible oil purification, and paper and packaging in key global markets.

- Engineered Solutions delivered record profitability in a challenging market, while Minerals Technologies continued to incur talc related litigation costs.

For investors tracking NYSE:MTX, the recent news adds important context to a share price of $65.76 and mixed return trends. The stock is up 7.5% over the past month and year to date, but shows a 13.6% decline over the past year and a 1.4% gain over five years, pointing to a more muted long term profile.

The latest safety record and segment level performance provide additional angles to assess alongside regular earnings updates. As Minerals Technologies continues to invest in its growth platforms and manage legal exposures, the balance between operational progress and litigation costs is likely to remain a key factor for investor attention.

Stay updated on the most important news stories for Minerals Technologies by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on Minerals Technologies.

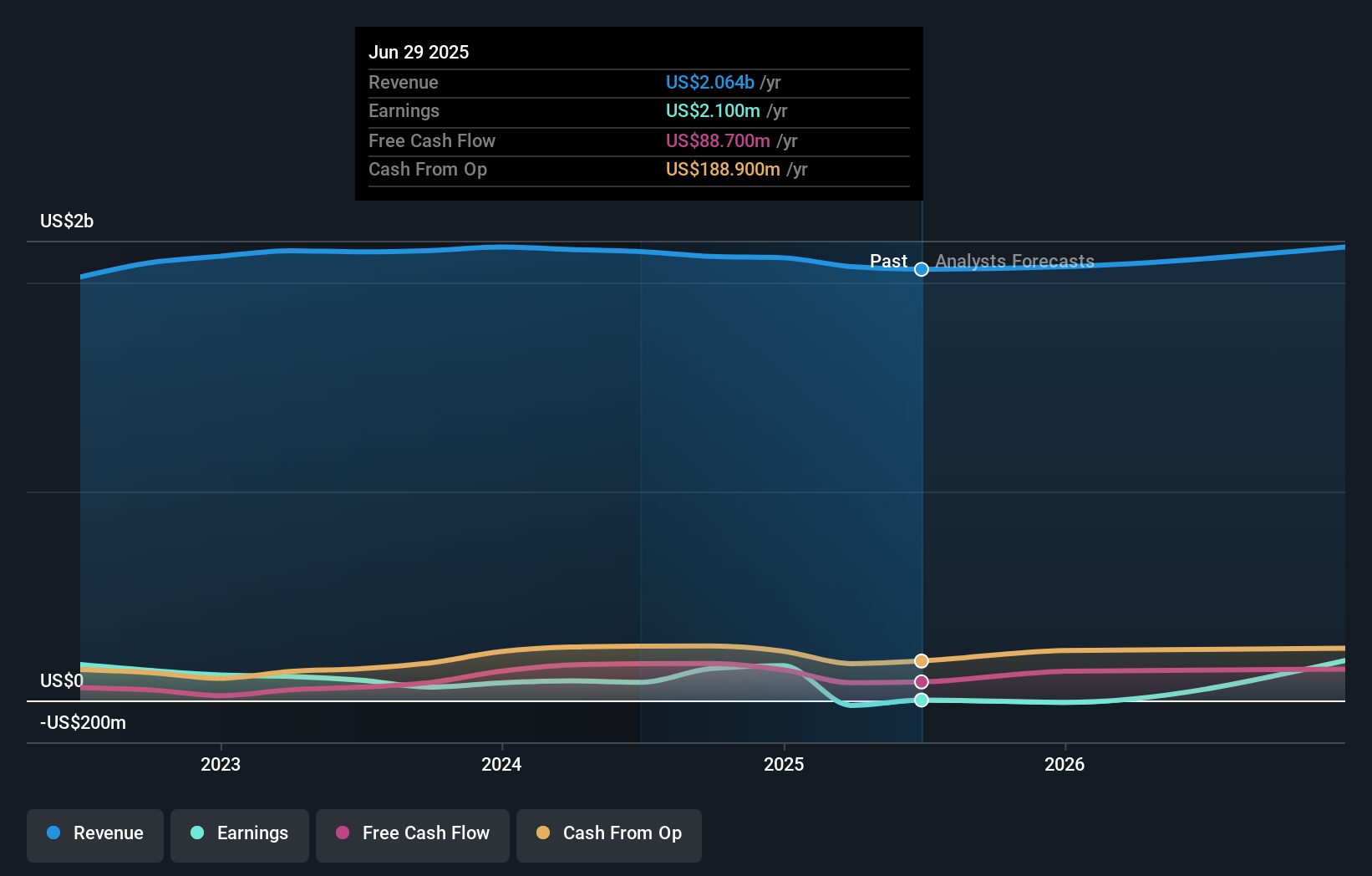

Minerals Technologies is pairing its best ever safety record with a clear push into higher growth platforms such as pet litter, edible oil purification, and paper and packaging, while still dealing with talc related legal costs and a full year net loss of $18.4 million on sales of $2.07b. The contrast between record profitability in Engineered Solutions and weaker performance elsewhere, alongside a slight earnings miss in Q4 (adjusted EPS of $1.27 versus the $1.28 consensus), suggests execution is working in some parts of the portfolio but not yet across the whole business.

How This Fits The Minerals Technologies Narrative

The focus on sustainable products and eco-friendly packaging, plus capacity expansions in areas like oil purification and pet care, lines up closely with the longer term narrative of shifting the mix toward higher margin, sustainability linked segments. At the same time, continued exposure to slower paper markets and talc litigation keeps the story balanced between growth efforts and legacy headwinds that investors may want to weigh against each other.

Risks and Rewards To Keep In Mind

- Record operating income in Engineered Solutions and Q4 net income of $37.1 million indicate that certain businesses can support earnings even when conditions are mixed.

- Ongoing investments in cat litter, natural oil purification, and packaging satellites support the push toward higher value applications that may compare with peers such as Imerys and Clariant.

- The shift from prior year net income of $167.1 million to a loss of $18.4 million, including a $215 million talc reserve, underlines that legal and earnings volatility remain central issues.

- Three negative EPS revisions in the last 90 days show that analyst expectations have been moving down, which can affect sentiment even when quarterly revenues are slightly ahead of forecasts.

What To Watch Next

From here, it is worth watching how quickly the new growth projects in pet litter, edible oil purification, and Asian paper and packaging translate into revenue and margin progress, and whether legal cash outflows stay manageable relative to the company’s balance sheet and dividend plans. If you want to see how other investors are connecting these developments to the longer term story, take a look at the community narratives for Minerals Technologies by visiting the company’s narrative page and checking what the community is saying.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.