يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

Miracle-Gro Expands Indoor And Organic Range As Valuation Near Fair Value

Scotts Miracle-Gro Company Class A SMG | 69.96 | +1.17% |

- Miracle-Gro, a brand under Scotts Miracle-Gro (NYSE:SMG), has launched a refreshed lineup of indoor soils and plant foods.

- The company has introduced new plant care solutions and its first organic plant food, tailored to indoor gardeners.

- The products are positioned to support easier indoor gardening and promote wellness during the winter months.

For Scotts Miracle-Gro, best known for lawn and garden products, expanding its indoor range fits with growing interest in home based hobbies and wellness focused routines. Indoor plants have become a year round fixture in many homes, and consumers often look for simpler, more clearly labeled products, especially when trying gardening for the first time.

The addition of organic options and targeted pest solutions could make the Miracle-Gro aisle more relevant to renters, apartment dwellers and health conscious buyers. If interest in indoor gardening remains steady through colder months, this refreshed lineup may help the brand stay front of mind with consumers who are looking for small, everyday ways to improve their living spaces and mood.

Stay updated on the most important news stories for Scotts Miracle-Gro by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on Scotts Miracle-Gro.

Quick Assessment

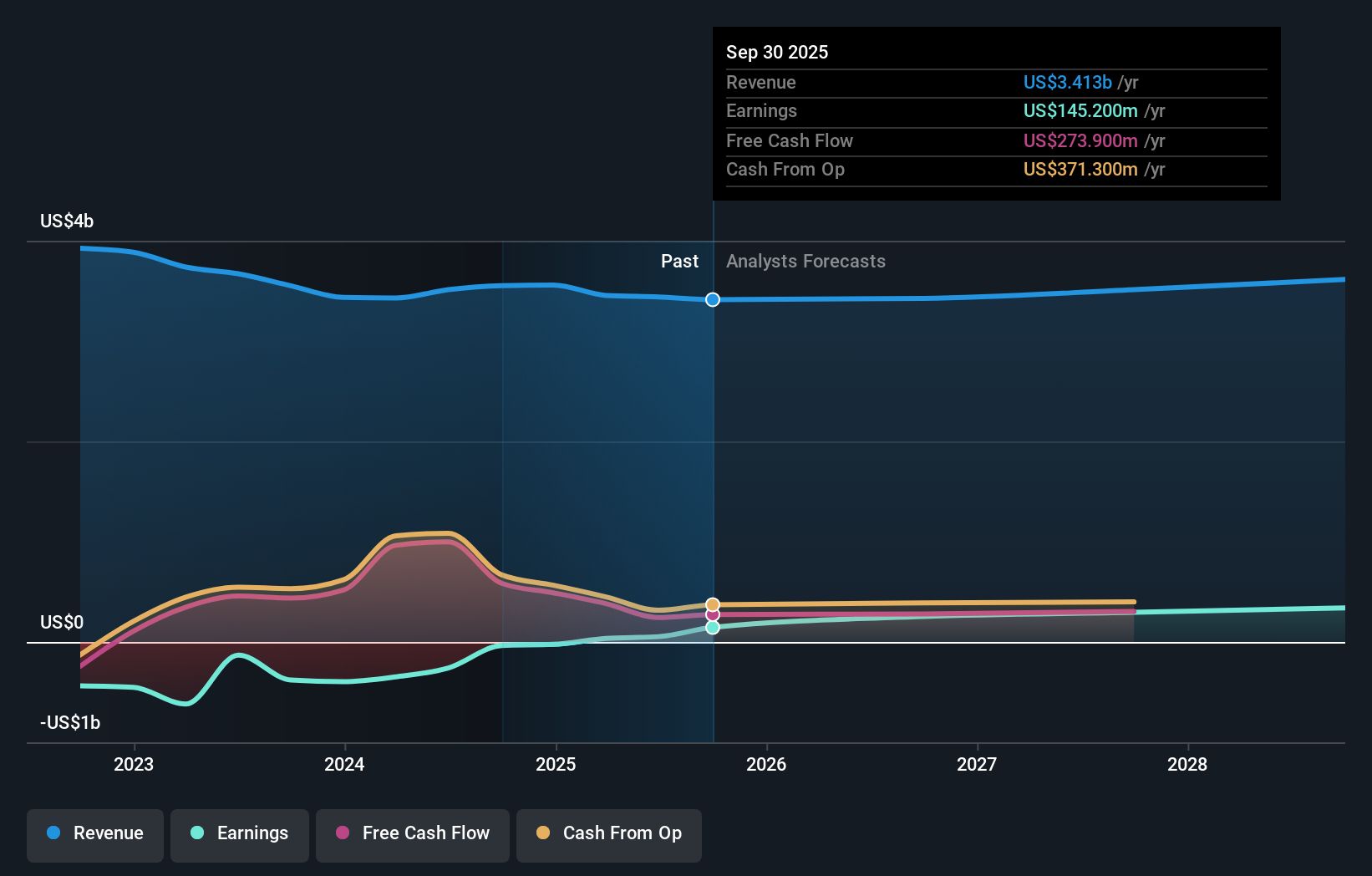

- ⚖️ Price vs Analyst Target: At US$67.02, the share price is about 6% below the US$71.50 analyst target, which sits comfortably inside the analyst range of US$67 to US$80.

- ⚖️ Simply Wall St Valuation: The stock is described as trading close to estimated fair value, so the refreshed product lineup may matter more for the story than for any immediate valuation gap.

- ✅ Recent Momentum: A 30 day return of roughly 8.5% suggests buyers have been slightly more active recently.

There is only one way to know the right time to buy, sell or hold Scotts Miracle-Gro. Head to Simply Wall St's company report for the latest analysis of Scotts Miracle-Gro's Fair Value.

Key Considerations

- 📊 The push into indoor and organic plant care ties the brand more closely to year round indoor gardening and wellness habits, which may help diversify demand beyond the traditional lawn season.

- 📊 Keep an eye on how indoor product sales trend versus overall revenue of US$3.4b, as well as whether the current P/E of about 23.8 stays close to or diverges from the chemicals industry average of about 26.6.

- ⚠️ With debt not well covered by operating cash flow and a dividend that is not fully covered by earnings, investors may want to watch cash generation if the new products require sustained marketing and inventory investment.

Dig Deeper

For the full picture including more risks and rewards, check out the complete Scotts Miracle-Gro analysis. Alternatively, you can visit the community page for Scotts Miracle-Gro to see how other investors believe this latest news will impact the company's narrative.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.