يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

MRC Global (NYSE:MRC): Assessing Valuation as Shares Gain Momentum

MRC Global Inc. MRC | 13.78 | Delist |

MRC Global (MRC) has caught the eye of investors recently, with its stock quietly advancing over the past month. There was no major news event to spark this move, but the uptick alone is enough to make some wonder if something is brewing beneath the surface or if the market is simply re-evaluating MRC Global’s valuation.

It’s not just this most recent month, either. The company’s shares have gained momentum over the course of the year, outperforming their pace in previous years and logging a double-digit increase. Over longer timeframes, returns have been solid as well, helped by steady growth in both revenue and net income. This gives reason to consider whether the market is reassessing MRC Global’s future potential.

The real question for investors, then, is whether these gains leave MRC Global undervalued, or if the market’s recent optimism has already priced in expectations for future growth.

Most Popular Narrative: 7% Undervalued

The most widely followed narrative currently views MRC Global as undervalued, suggesting there is room for the stock to rise based on future performance expectations and major corporate actions.

The sale of the Canada business and reinvestment of proceeds to reduce debt should improve profitability and margins. This would enhance the company's overall financial health and net earnings. A $125 million share buyback program reflects confidence in future performance and the strengthened balance sheet. As shares are repurchased and earnings are distributed across fewer shares, this could potentially increase EPS.

What is really boosting this valuation? Hints of accelerating earnings, margin expansion, and an aggressive buyback plan set the stage for outsized future gains. Wondering which ambitious projections and strategic moves are fueling this bullish outlook? The narrative hints at a financial inflection point that could surprise even seasoned market watchers.

Result: Fair Value of $15.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, risks remain, including internal control issues and a recent drop in sales. Both of these factors could challenge the bullish case if they persist.

Find out about the key risks to this MRC Global narrative.Another View: What Do Market Ratios Say?

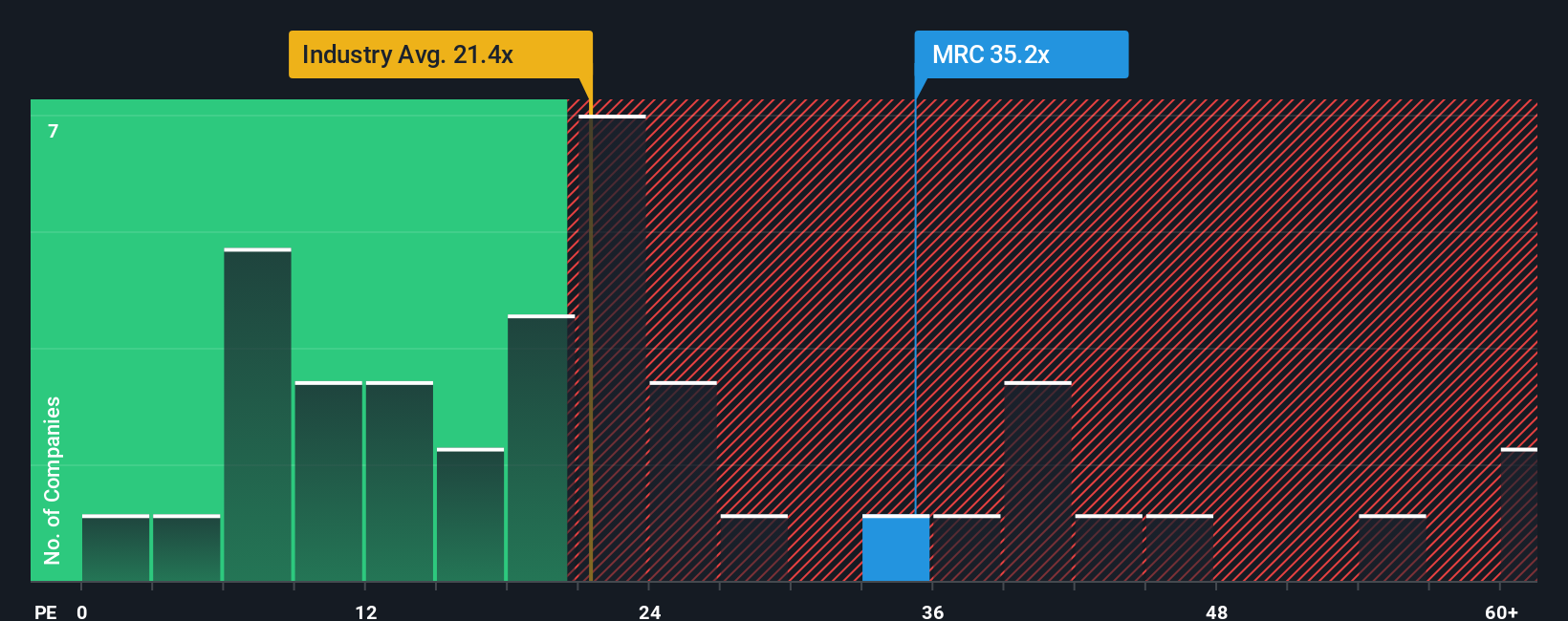

Taking a different approach, a look at market valuation ratios suggests MRC Global’s shares are actually expensive compared to others in its industry. This is in sharp contrast to the potential seen in future earnings. Which narrative will prove right?

Build Your Own MRC Global Narrative

If you see the data differently or would rather form your own perspective, it takes just a few minutes to craft a narrative yourself. Do it your way

A great starting point for your MRC Global research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Sharpen your investing edge by seeking out proven winners in fast-moving markets. Competitive ideas are waiting if you know where to look, so don’t let others get ahead of you.

- Boost your portfolio's potential and spot undervalued opportunities by tapping into undervalued stocks based on cash flows.

- Target future trends and gain early access to innovation by searching for tomorrow’s leaders among AI penny stocks.

- Capture resilient income streams even in unpredictable markets by finding companies with reliable yields through dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.