يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

MSA Safety (MSA) Unveils New Safety Innovations at National Safety Congress & Expo

MSA Safety, Inc. MSA | 159.27 | -0.67% |

MSA Safety (MSA) recently launched the V-Gard H2 Full Brim Safety Helmet and ALTAIR io 6 Multigas Detector, aimed at enhancing workplace safety across various industries. The company's stock saw a price move of 3% over the past quarter, a change that aligns closely with broader market trends, as the market itself experienced an 18% rise over the last year, with significant gains recently. While product innovations potentially bolstered investor interest, the company's return appeared consistent with general market momentum, alongside broader economic developments such as anticipated Federal Reserve actions and tech sector advances.

The recent launch of MSA Safety's V-Gard H2 Full Brim Safety Helmet and ALTAIR io 6 Multigas Detector has the potential to strengthen its narrative of leveraging innovation to drive market reach and earnings growth. The introduction of these advanced safety technologies aligns with MSA's strategy in connected safety solutions, which are anticipated to fuel revenue expansion and support margin improvements due to their premium pricing potential. This innovation is in line with the company's ongoing efforts to expand its product portfolio, possibly mitigating some risks associated with currency impacts and core product demand weaknesses.

Considering MSA Safety's total shareholder return of 47.54% over the past three years, shareholders might view the recent developments as reinforcing a generally positive longer-term performance trajectory. Despite the company's stock underperforming the broader US market, which returned 18.7% over the past year, the three-year performance context offers a broader perspective. Over the same year, the company's return showed a disconnect with the 2.2% return of the US Commercial Services industry, illustrating some industry-specific challenges.

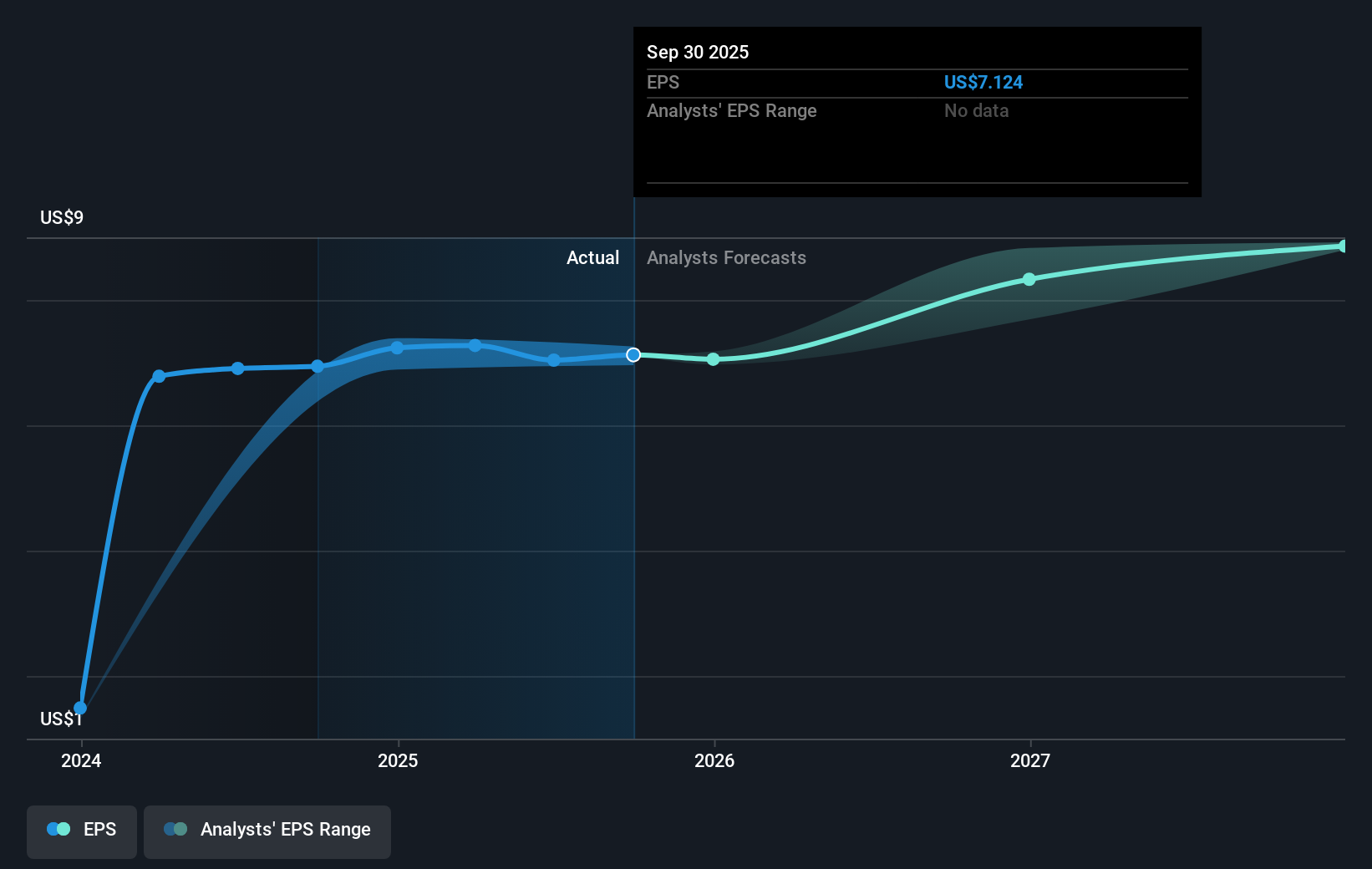

In terms of financial forecasts, the new product launches may positively influence MSA's future revenue and earnings projections. Analysts envisage annual revenue growth of 5.2% over the next three years, supported by ongoing innovation and strategic acquisitions. With a current share price of $169.26, there remains a 12.03% upside potential relative to the consensus analyst price target of $191.80. As the company continues to execute its vision, the stock's alignment towards that target could be bolstered by the anticipated economic impacts of these new launches.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.