يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

Nicolet Bankshares (NIC) Analysts Lift EPS Outlook After Earnings Beat Is Confidence Now Outpacing Fundamentals?

Nicolet Bankshares, Inc. NIC | 161.37 | +1.70% |

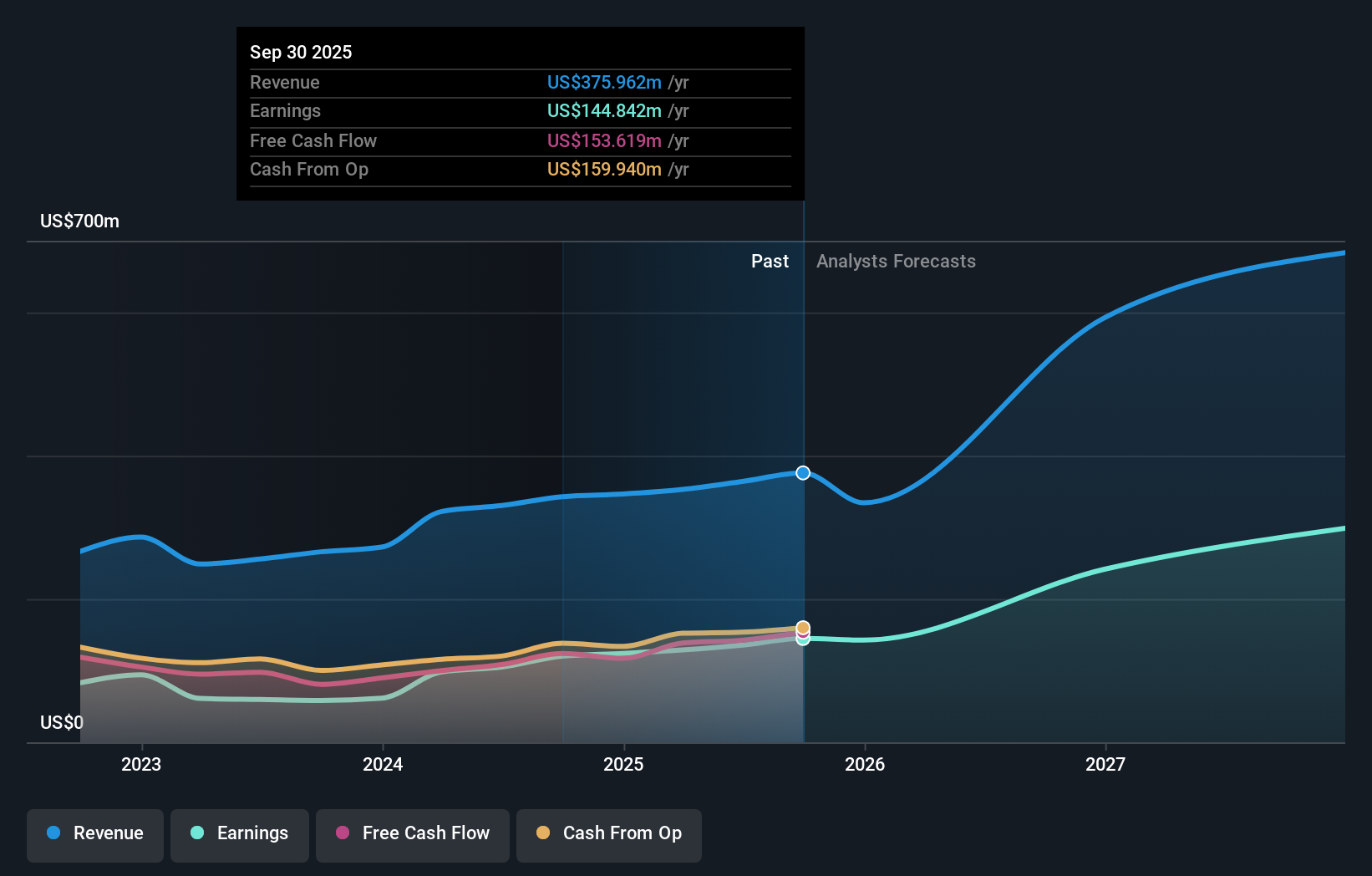

- Analysts have recently raised their consensus earnings-per-share estimates for Nicolet Bankshares’ December 2025 quarter, expecting higher revenue and year-over-year earnings growth following the company’s earlier quarterly earnings beat.

- This combination of upgraded expectations and a prior positive earnings surprise highlights growing confidence in Nicolet Bankshares’ ability to outperform near-term profit forecasts.

- With earnings expectations being revised higher, we’ll explore how this shift in analyst outlook shapes Nicolet Bankshares’ broader investment narrative.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

What Is Nicolet Bankshares' Investment Narrative?

To own Nicolet Bankshares, you need to be comfortable backing a regional bank that blends steady profitability, disciplined capital returns and what the market currently views as undervalued shares. The story has been about consistent revenue and earnings expansion, supported by rising net interest income, high quality earnings and ongoing buybacks that have already taken out a large slice of the share base, alongside a gradually growing dividend. The latest analyst upgrade for the December 2025 quarter, following a solid earnings beat, reinforces near term momentum and supports the existing catalysts of earnings growth and capital return rather than changing them outright. That said, a still-modest return on equity and a long-tenured board with limited recent refresh remain key risks if operating conditions or credit quality were to become less supportive.

However, there is a governance wrinkle here that investors should not ignore. Nicolet Bankshares' shares have been on the rise but are still potentially undervalued by 26%. Find out what it's worth.Exploring Other Perspectives

Explore 2 other fair value estimates on Nicolet Bankshares - why the stock might be worth as much as 36% more than the current price!

Build Your Own Nicolet Bankshares Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Nicolet Bankshares research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Nicolet Bankshares research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Nicolet Bankshares' overall financial health at a glance.

Looking For Alternative Opportunities?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 38 best rare earth metal stocks of the very few that mine this essential strategic resource.

- AI is about to change healthcare. These 109 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- This technology could replace computers: discover 23 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.