يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

NNN REIT Extends Dividend Streak As Record 2025 Acquisitions Test Balance Sheet

NNN REIT, Inc. NNN | 44.35 | +0.86% |

- NNN REIT (NYSE:NNN) reported a 36th consecutive year of dividend increases in 2025.

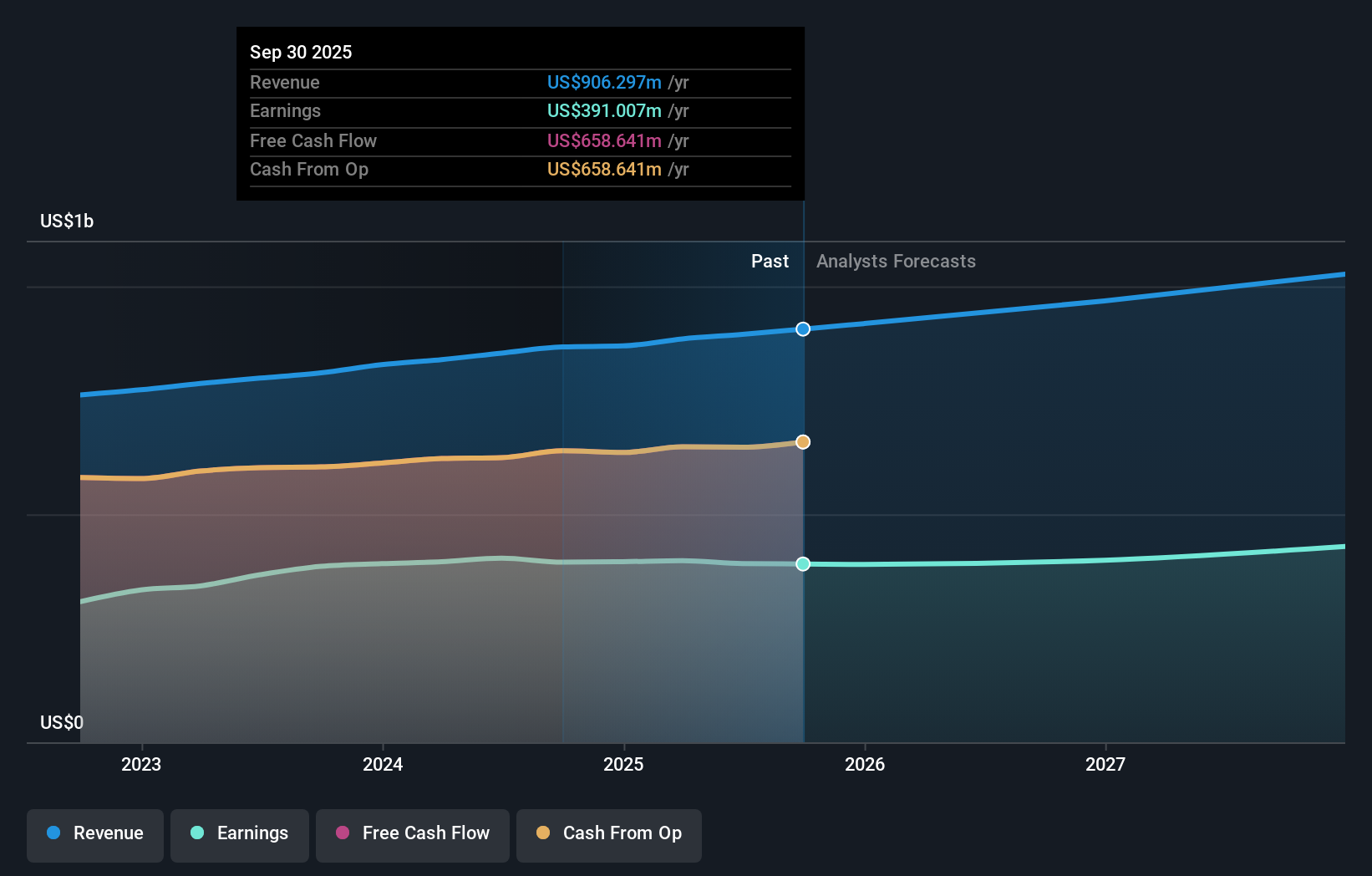

- The company recorded its highest ever annual acquisition volume, with more than $900m invested in new properties.

- NNN REIT highlighted a portfolio with high occupancy and long lease terms alongside this expansion.

NNN REIT enters 2026 with a long dividend growth streak that sets it apart from many other U.S. listed companies. Its shares recently traded at $44.34, with the stock up 3.3% over the past week, 4.0% over the past month, and 12.2% year to date, and a 5 year return of 36.4%. For investors who care about income consistency, that 36 year track record is likely to be a key part of the story.

The company’s record property acquisition activity in 2025, together with high occupancy and long leases, points to a focus on portfolio scale and tenant stability. As you think about NYSE:NNN, the mix of ongoing dividend growth and active portfolio investment may be useful context when comparing it with other income oriented real estate options.

Stay updated on the most important news stories for NNN REIT by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on NNN REIT.

For income focused investors, the headline here is that NNN REIT lifted its dividend for the 36th consecutive year while also recording record property acquisitions of more than US$900m in 2025. That kind of streak often points to management prioritising a predictable payout. The company supports this with a payout ratio below 70% of funds from operations and a portfolio that ended the year 98.3% occupied, which can help underpin rental cash flows.

How This Fits Into The NNN REIT Narrative

- The 36 year dividend growth run and 2.7% AFFO per share growth align with the narrative of steady, necessity based tenants and long net leases producing relatively stable cash flows.

- Higher interest costs and increased debt issuance to fund US$900m of acquisitions could pressure interest coverage, which ties into concerns about financing costs and the ability to keep earnings growth in step with portfolio expansion.

- The mix of large sale leaseback driven acquisitions and 2026 AFFO guidance built around free cash flow, dispositions and incremental debt adds detail that is not fully captured in the high level narrative about growth from acquisitions.

Knowing what a company is worth starts with understanding its story. Check out one of the top narratives in the Simply Wall St Community for NNN REIT to help decide what it is worth to you.

The Risks and Rewards Investors Should Consider

- ⚠️ Analysts have flagged that interest payments are not well covered by earnings, which can become more important if NNN REIT continues to use debt to fund acquisitions.

- ⚠️ Reliance on tenant sale leaseback deals and concentrated exposure to retail categories leaves the dividend dependent on tenant health and ongoing demand for single tenant properties.

- 🎁 Earnings are forecast to grow and the company reports growing FFO type metrics, giving some support to the idea that the dividend and acquisition program are backed by underlying cash flow.

- 🎁 A long history of dividend increases, a payout ratio below 70% of FFO and high occupancy together signal a focus on maintaining income for shareholders.

What To Watch Going Forward

From here, it is worth tracking whether NNN REIT can keep AFFO per share in line with its guidance range while continuing to fund acquisitions of several hundred million dollars a year without stretching its balance sheet. You may also want to watch how occupancy and rent collection hold up, since any sustained softness there could affect future dividend growth decisions.

To ensure you are always in the loop on how the latest news impacts the investment narrative for NNN REIT, head to the community page for NNN REIT to never miss an update on the top community narratives.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.