يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

Northrop Grumman (NOC): Evaluating Hidden Value as Defense Giant's Shares Consolidate After Strong YTD Gains

Northrop Grumman Corp. NOC | 709.11 | +1.81% |

Northrop Grumman (NOC) shares have traded in a fairly tight range recently, even as the company’s long-term total return remains impressive. With consistent revenue and income growth, investors may be considering current valuations in relation to potential future upside.

Northrop Grumman’s share price has stepped back from its highs this month but is still up over 21% year-to-date, reflecting solid momentum and positive sentiment in the defense sector. The company’s 1-year total shareholder return of 18.6% and impressive 5-year return of 104% highlight a track record of delivering for long-term investors, even as the market weighs near-term catalysts against lofty valuations.

If Northrop’s recent performance has you watching the sector, now is the perfect moment to explore the full landscape of aerospace and defense leaders with our curated list: See the full list for free.

With steady gains and robust fundamentals, the key question now is whether Northrop Grumman offers hidden value at current levels or if Wall Street has already factored in all of its expected growth prospects.

Most Popular Narrative: 14.7% Undervalued

Northrop Grumman’s most widely followed narrative sees the shares trading at a meaningful discount to its fair value estimate, with the last close at $569.42 and a consensus fair value of $667.21. This gap reflects optimism around core defense programs and highlights diverging analyst views on long-term earnings power.

Accelerating U.S. and allied defense spending, supported by substantial increases in procurement and RDT&E budgets (for example, a 22% increase in U.S. spending for FY26) and significant new funding for key Northrop Grumman programs (B-21, Sentinel, and E-2D), is expected to drive sustained revenue growth and provide multi-year order visibility.

Curious what revenue benchmarks and margin shifts are fueling this bullish thesis? The analysts’ narrative hinges on bold future projections and a valuation multiple that sets Northrop apart from its industry peers. Uncover exactly which assumptions could propel the price even higher. Click through to get the full picture behind the fair value target.

Result: Fair Value of $667.21 (UNDERVALUED)

However, persistent execution risks and potential changes in U.S. defense budgets could challenge Northrop Grumman’s long-term growth outlook and current valuation assumptions.

Another View: The SWS DCF Model

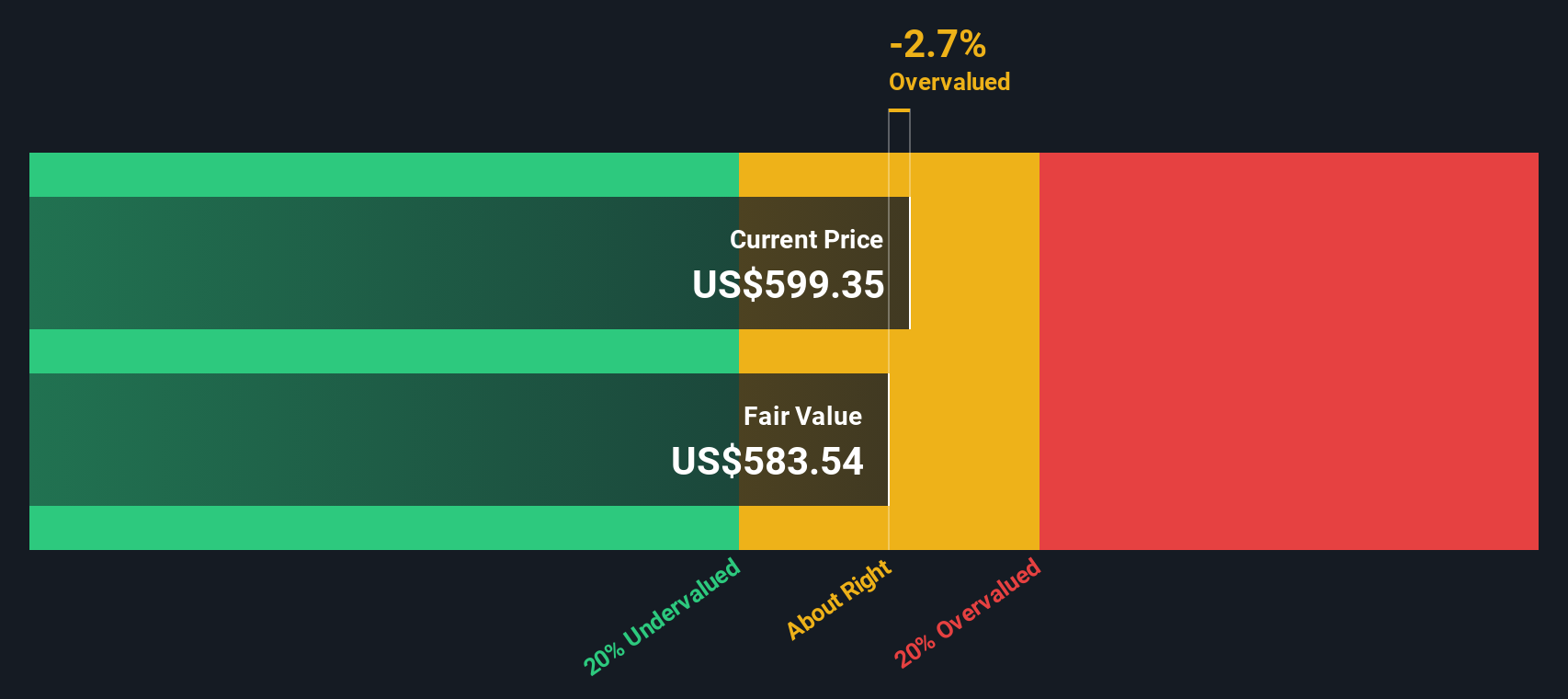

While analysts’ price targets suggest Northrop Grumman is undervalued, our DCF model arrives at a different conclusion. Currently, shares trade above our estimate of fair value ($569.42 vs. $534.81), which points to a modest premium. Could this mean future growth is already reflected in today’s price?

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Northrop Grumman for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 925 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Northrop Grumman Narrative

If you have your own perspective or want to test your own assumptions, you can quickly build a personalized thesis based on the numbers in just a few minutes. Do it your way

A great starting point for your Northrop Grumman research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Now is the perfect time to broaden your horizons and tap into a world of fresh investing opportunities other savvy investors are already capitalizing on.

- Get ahead of the market and target investments with steady cash flows by reviewing these 925 undervalued stocks based on cash flows based on real fundamentals.

- Earn while you invest by seeking out companies offering reliable income streams through these 14 dividend stocks with yields > 3% with yields above 3%.

- Explore the potential of artificial intelligence by considering these 26 AI penny stocks that are reshaping entire industries with smart technology.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.