يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

Onshape AI Enhancements Could Be a Game Changer for PTC (PTC)

PTC Inc. PTC | 176.00 | -1.12% |

- PTC recently announced new AI-powered advancements for its cloud-native Onshape CAD platform, launching the Onshape AI Advisor to provide real-time design guidance and productivity enhancements, with further agent-driven AI features on the product roadmap.

- This development signals PTC’s commitment to not only expanding its AI capabilities in product development but also strengthening its position against traditional, file-based CAD competitors by leveraging cloud scalability and open APIs for customer-driven innovation.

- We’ll assess how real-time AI integration within the Onshape platform could impact PTC’s investment narrative and growth outlook.

Find companies with promising cash flow potential yet trading below their fair value.

PTC Investment Narrative Recap

At its core, the PTC story is about betting on AI-driven design and lifecycle tools becoming essential for next-generation product development across industries. The newly announced Onshape AI Advisor broadens PTC’s capabilities in real-time design insights and highlights cloud-native strengths, but it does not materially change the near-term focus on accelerating ARR growth, nor does it ease the major risk of sector competition and deal delays tied to ongoing policy and trade uncertainties.

Among recent news, Enlil Inc.’s integration with PTC Onshape showcases the value of open APIs and real-time data flow in high-compliance fields like medical device development. This supports one of PTC’s main short-term catalysts: driving broader platform adoption and cross-sell opportunities by embedding its SaaS design solutions at the core of customers’ digital ecosystems.

However, investors should also weigh the impact from unresolved trade uncertainties, as inconsistent global policy could still threaten quarterly revenue visibility and...

PTC's outlook suggests $3.3 billion in revenue and $814.8 million in earnings by 2028. This hinges on revenue growing by 9.6% annually and earnings increasing by $302.1 million from the current $512.7 million.

Uncover how PTC's forecasts yield a $224.68 fair value, a 11% upside to its current price.

Exploring Other Perspectives

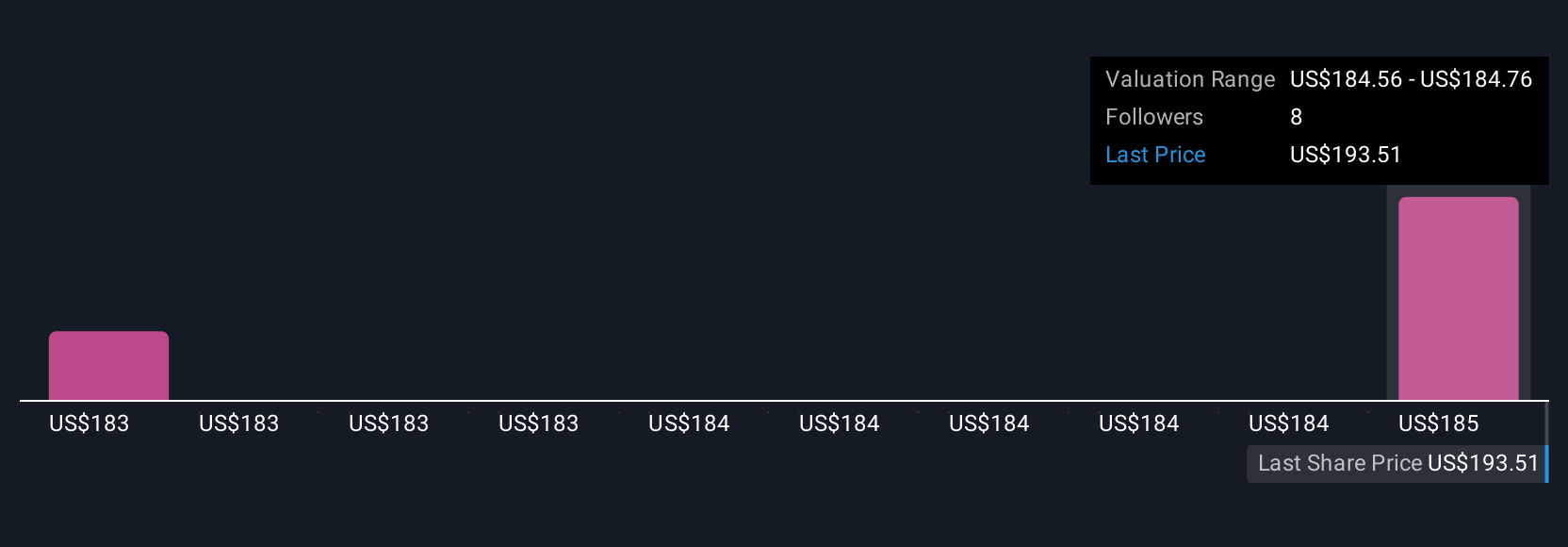

Simply Wall St Community members submitted four fair value estimates for PTC, from as low as US$160 to as high as US$230,747.64. With AI adoption accelerating but sector competition still intense, explore these contrasting views for insights into the company’s future direction.

Explore 4 other fair value estimates on PTC - why the stock might be a potential multi-bagger!

Build Your Own PTC Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your PTC research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free PTC research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate PTC's overall financial health at a glance.

No Opportunity In PTC?

Our top stock finds are flying under the radar-for now. Get in early:

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.