يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

Orion Group Holdings, Inc.'s (NYSE:ORN) Shares Bounce 29% But Its Business Still Trails The Industry

Orion Group Holdings, Inc. ORN | 14.13 | +3.14% |

Orion Group Holdings, Inc. (NYSE:ORN) shareholders would be excited to see that the share price has had a great month, posting a 29% gain and recovering from prior weakness. The last 30 days bring the annual gain to a very sharp 66%.

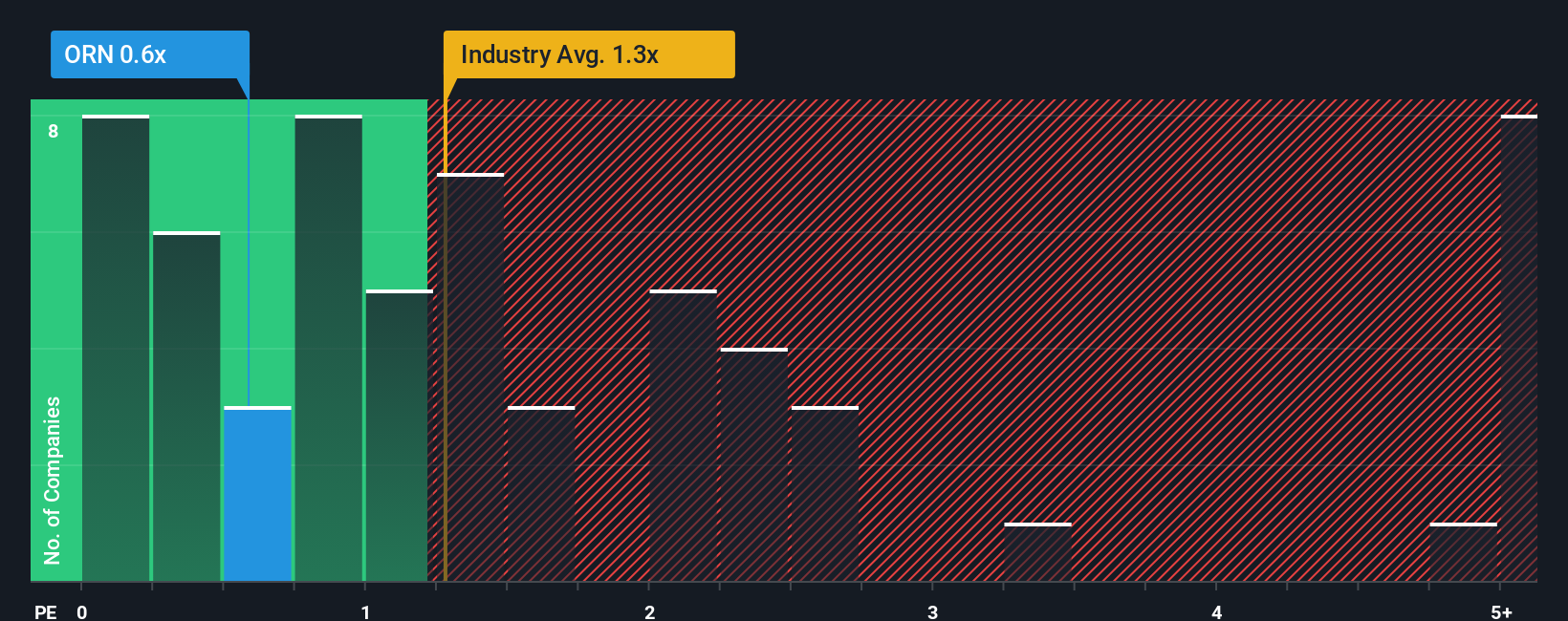

Although its price has surged higher, given about half the companies operating in the United States' Construction industry have price-to-sales ratios (or "P/S") above 1.3x, you may still consider Orion Group Holdings as an attractive investment with its 0.6x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

What Does Orion Group Holdings' P/S Mean For Shareholders?

With revenue growth that's inferior to most other companies of late, Orion Group Holdings has been relatively sluggish. The P/S ratio is probably low because investors think this lacklustre revenue performance isn't going to get any better. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

Keen to find out how analysts think Orion Group Holdings' future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The Low P/S Ratio?

In order to justify its P/S ratio, Orion Group Holdings would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered a decent 7.0% gain to the company's revenues. The solid recent performance means it was also able to grow revenue by 17% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Looking ahead now, revenue is anticipated to climb by 4.0% during the coming year according to the four analysts following the company. With the industry predicted to deliver 12% growth, the company is positioned for a weaker revenue result.

With this in consideration, its clear as to why Orion Group Holdings' P/S is falling short industry peers. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Key Takeaway

Orion Group Holdings' stock price has surged recently, but its but its P/S still remains modest. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As we suspected, our examination of Orion Group Holdings' analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Orion Group Holdings, and understanding should be part of your investment process.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.