يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

Orrstown Financial Services And 2 Other Top Dividend Stocks

Shore Bancshares, Inc. SHBI | 18.76 | +0.05% |

As the U.S. stock market experiences a surge with major indices like the S&P 500 and Nasdaq Composite reaching all-time highs, investors are increasingly optimistic about potential interest rate cuts by the Federal Reserve following stable inflation reports. In this buoyant environment, dividend stocks become particularly appealing for their ability to provide steady income streams amidst fluctuating market conditions.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (PEBO) | 5.74% | ★★★★★☆ |

| Huntington Bancshares (HBAN) | 3.87% | ★★★★★☆ |

| First Interstate BancSystem (FIBK) | 6.52% | ★★★★★★ |

| Ennis (EBF) | 5.56% | ★★★★★★ |

| Employers Holdings (EIG) | 3.10% | ★★★★★☆ |

| Douglas Dynamics (PLOW) | 3.82% | ★★★★★☆ |

| Dillard's (DDS) | 5.56% | ★★★★★★ |

| Columbia Banking System (COLB) | 5.93% | ★★★★★★ |

| Citizens & Northern (CZNC) | 5.97% | ★★★★★☆ |

| Banco Latinoamericano de Comercio Exterior S. A (BLX) | 5.56% | ★★★★★☆ |

Let's explore several standout options from the results in the screener.

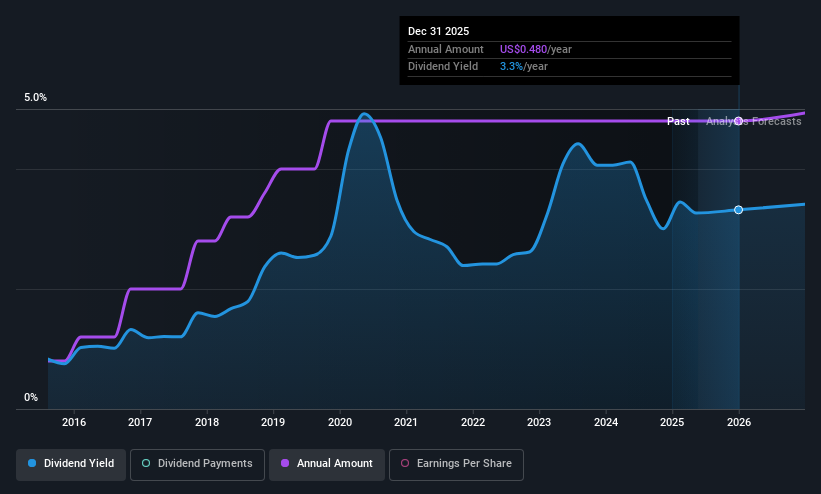

Orrstown Financial Services (ORRF)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Orrstown Financial Services, Inc., with a market cap of $623.72 million, operates as the financial holding company for Orrstown Bank, offering commercial banking and financial advisory services to retail, commercial, non-profit, and government clients in the United States.

Operations: Orrstown Financial Services, Inc. generates its revenue primarily through its Community Banking segment, which accounts for $233.72 million.

Dividend Yield: 3.4%

Orrstown Financial Services offers a stable dividend yield of 3.36%, supported by a low payout ratio of 43.4%, ensuring coverage by earnings. The company recently increased its quarterly dividend to $0.27 per share, marking a 35% rise since merging with Codorus Valley Bancorp, reflecting consistent growth over the past decade. Despite large one-off items affecting results, recent earnings and net interest income have shown significant improvement, enhancing its appeal to dividend investors seeking reliability and growth potential.

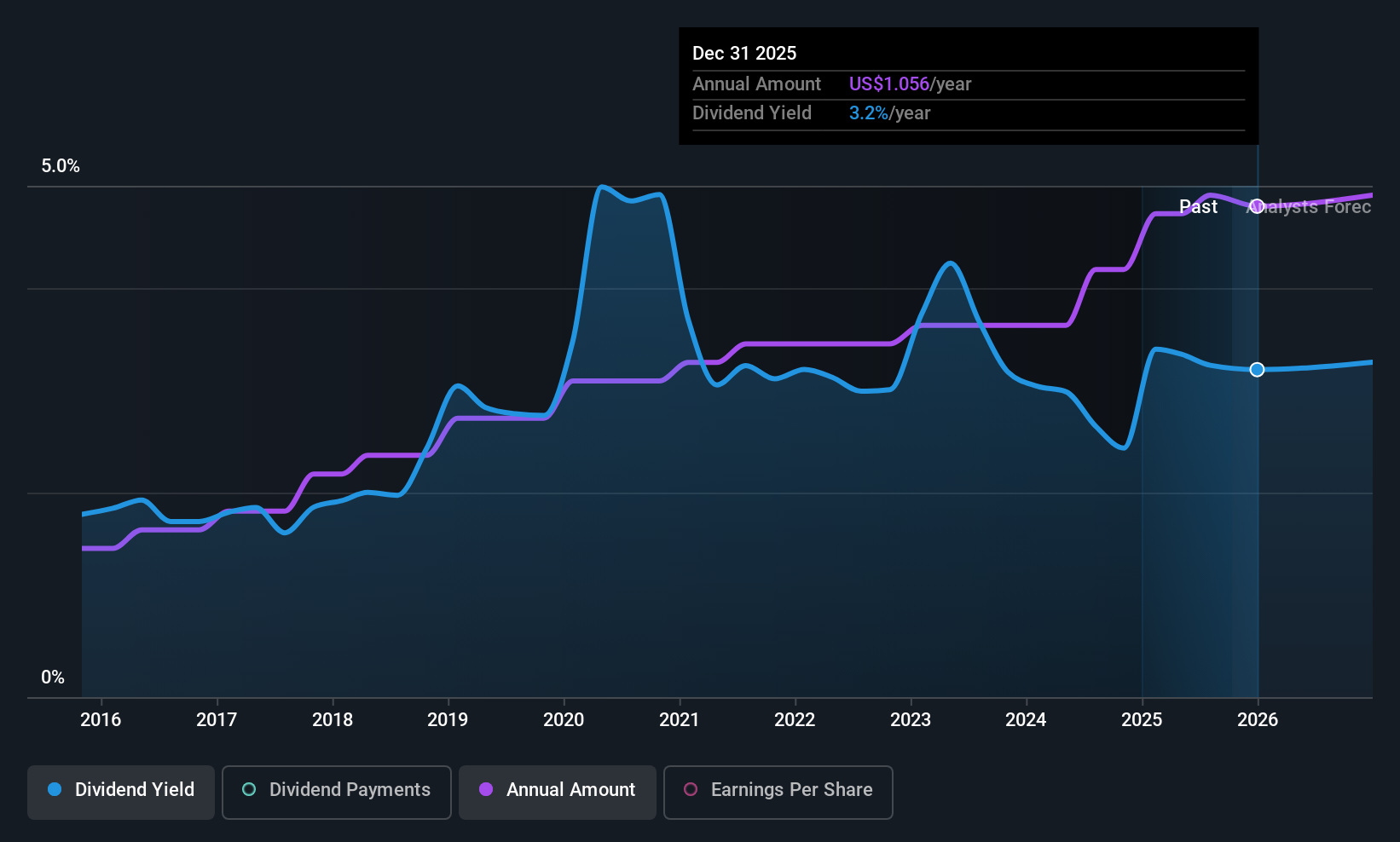

Shore Bancshares (SHBI)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Shore Bancshares, Inc. is a bank holding company for Shore United Bank, N.A., with a market cap of $513.63 million.

Operations: Shore Bancshares, Inc. generates its revenue primarily through its Community Banking segment, which accounted for $208.21 million.

Dividend Yield: 3.1%

Shore Bancshares maintains a stable dividend history, recently affirming a quarterly dividend of $0.12 per share. With a payout ratio of 29.8%, dividends are well-covered by earnings, supported by recent net income growth to US$15.51 million in Q2 2025 from US$11.23 million the previous year. Although its 3.14% yield is below top-tier payers, the company's consistent earnings and low price-to-earnings ratio offer value for investors prioritizing stability and reliability in dividends.

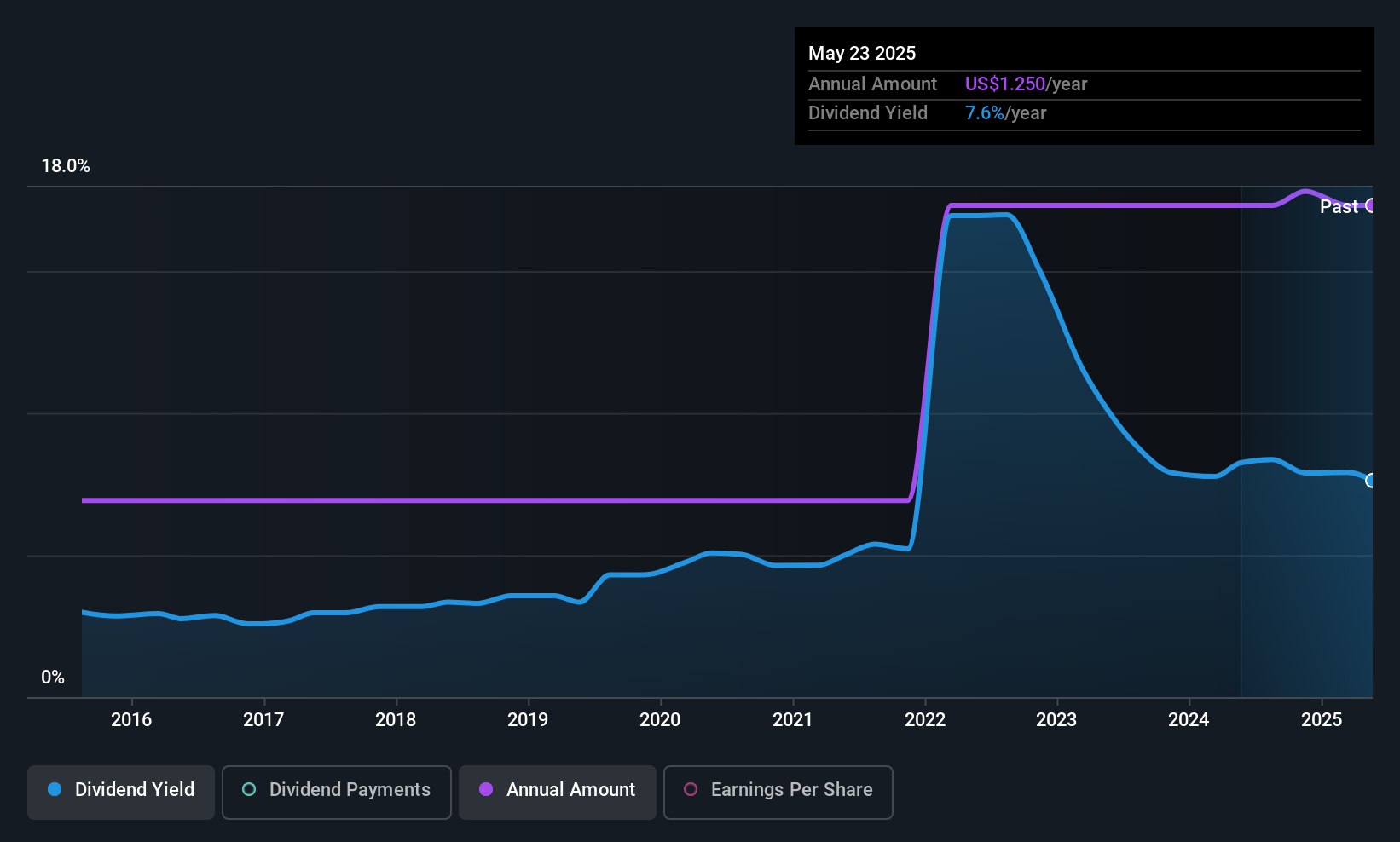

Spok Holdings (SPOK)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Spok Holdings, Inc., operating through its subsidiary Spok, Inc., offers healthcare communication solutions across various regions including the United States, Europe, Canada, Australia, Asia, and the Middle East with a market cap of $374.96 million.

Operations: Spok Holdings, Inc. generates revenue of $140.74 million from its Clinical Communication and Collaboration Business segment.

Dividend Yield: 6.8%

Spok Holdings' dividend yield of 6.78% ranks in the top 25% of US payers, but with a high payout ratio of 149.5%, dividends are not well covered by earnings or cash flows. Despite stable and reliable dividends over the past decade, recent insider selling raises concerns. The company has improved its earnings guidance for 2025 and reported increased Q2 revenue to US$35.69 million from US$33.98 million year-over-year, showcasing growth potential amidst coverage challenges.

Seize The Opportunity

- Investigate our full lineup of 142 Top US Dividend Stocks right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.