يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

Pacific Biosciences of California, Inc. (NASDAQ:PACB) Stocks Shoot Up 28% But Its P/S Still Looks Reasonable

Pacific Biosciences of California, Inc. PACB | 2.13 | -5.97% |

Pacific Biosciences of California, Inc. (NASDAQ:PACB) shareholders have had their patience rewarded with a 28% share price jump in the last month. The last 30 days bring the annual gain to a very sharp 39%.

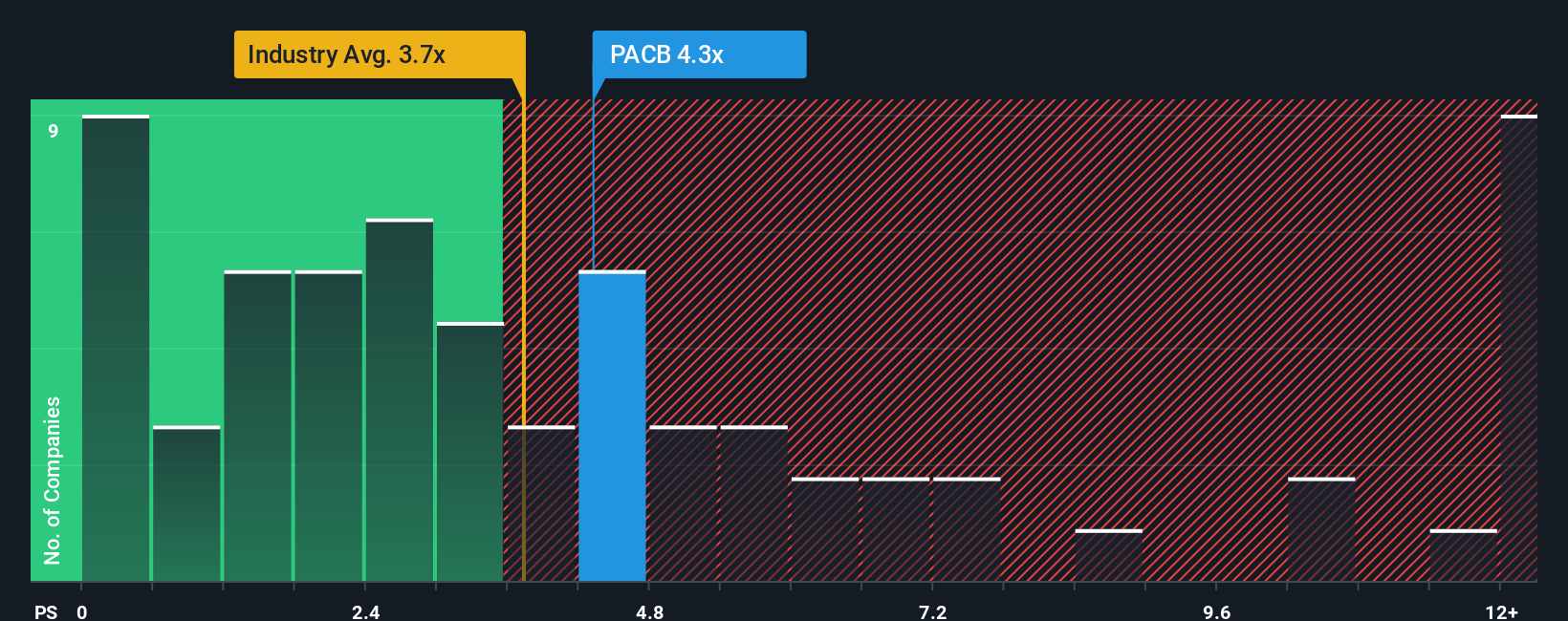

Following the firm bounce in price, you could be forgiven for thinking Pacific Biosciences of California is a stock not worth researching with a price-to-sales ratios (or "P/S") of 4.6x, considering almost half the companies in the United States' Life Sciences industry have P/S ratios below 3.6x. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

What Does Pacific Biosciences of California's Recent Performance Look Like?

Pacific Biosciences of California hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. Perhaps the market is expecting the poor revenue to reverse, justifying it's current high P/S.. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Keen to find out how analysts think Pacific Biosciences of California's future stacks up against the industry? In that case, our free report is a great place to start.How Is Pacific Biosciences of California's Revenue Growth Trending?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Pacific Biosciences of California's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 11% decrease to the company's top line. This has soured the latest three-year period, which nevertheless managed to deliver a decent 13% overall rise in revenue. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

Turning to the outlook, the next three years should generate growth of 14% per annum as estimated by the seven analysts watching the company. With the industry only predicted to deliver 6.5% per year, the company is positioned for a stronger revenue result.

With this in mind, it's not hard to understand why Pacific Biosciences of California's P/S is high relative to its industry peers. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Key Takeaway

Pacific Biosciences of California shares have taken a big step in a northerly direction, but its P/S is elevated as a result. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our look into Pacific Biosciences of California shows that its P/S ratio remains high on the merit of its strong future revenues. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless these conditions change, they will continue to provide strong support to the share price.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.