يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

PBF Energy (PBF): Analyst Optimism and Strong Q3 Margins Put Valuation in Focus

PBF Energy, Inc. Class A PBF | 34.38 | +1.42% |

Several analysts have become more optimistic about PBF Energy (PBF) after the company reported stronger Q3 margins than expected. Many are now looking for solid Q4 results as market conditions continue to tighten.

PBF Energy’s share price has surged recently, racking up a 66% gain over the last 90 days as optimism grew alongside upbeat Q3 results and tightening market conditions. Despite a 30% total shareholder return in the past year, some insider selling and mixed analyst outlooks highlight ongoing risks. However, the company’s momentum is clearly building both in the short and long term.

If strong momentum and shifting market sentiment caught your attention, it might be the perfect time to broaden your investing horizons and discover fast growing stocks with high insider ownership

With analyst price targets rising and strong performance fueling recent gains, investors are left wondering if PBF Energy trades below its true value or if the recent surge already reflects expectations for future growth.

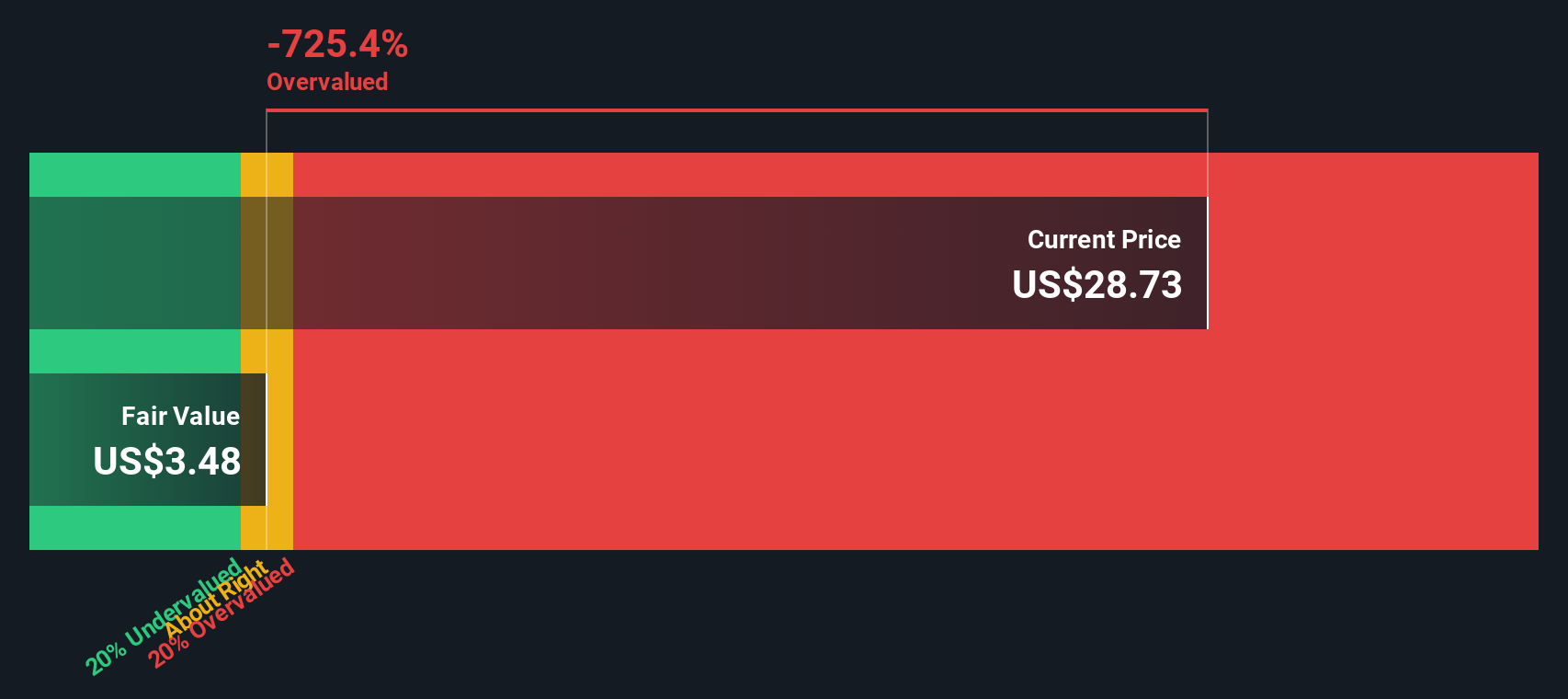

Most Popular Narrative: 30% Overvalued

According to the most widely followed narrative, the current fair value estimate sits well below the recent close, signaling that the market may be pricing in more optimism than analyst models support. This creates a tension between strong recent momentum and sober projections for future growth and profit margins.

Company-wide cost reduction and business improvement initiatives (RBI) are on track to deliver $230 million of annualized savings by end-2025 and $350 million by end-2026. These savings are expected to come mainly through lower OpEx and CapEx, and are projected to sustainably improve net margins and free cash flow over the next several years.

Curious what bold revenue and margin assumptions drive this high valuation call? The narrative hinges on ambitious fiscal turnaround plans and forecasts rivaling tech stock multiples. Find out what surprising financial leap analysts are projecting for PBF’s future. You may be shocked by what backs up this overvalued label.

Result: Fair Value of $30.08 (OVERVALUED)

However, persistent operational challenges at key refineries and ongoing regulatory risks could quickly undermine the assumptions behind the current fair value narrative.

Another View: SWS DCF Model Challenges the Market's Caution

While the fair value narrative suggests PBF Energy is overpriced based on future earnings multiples, our DCF model presents a different perspective. According to this cash flow-based approach, PBF shares are actually trading below what the future cash flows justify, highlighting a potential undervalued opportunity. Which outlook is giving the clearer signal?

Build Your Own PBF Energy Narrative

Want to weigh in with your own take? Delve into the data and shape your own narrative in just a few minutes: Do it your way

A great starting point for your PBF Energy research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let excitement over PBF distract you from other standout opportunities. Unearth powerful new investment possibilities with some of the market’s most promising trends on Simply Wall Street:

- Accelerate your growth strategy by evaluating these 26 AI penny stocks, which are shaping the world with cutting-edge artificial intelligence breakthroughs.

- Secure generous cash flow with these 16 dividend stocks with yields > 3%, offering consistent yields above 3% for income-focused investors.

- Capitalize on untapped market potential by searching for value in these 906 undervalued stocks based on cash flows, which may be flying under Wall Street’s radar.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.