يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

PC Connection (CNXN) Margin Slippage To 2.9% Tests Bullish Earnings Narratives

PC Connection, Inc. CNXN | 62.11 | +0.57% |

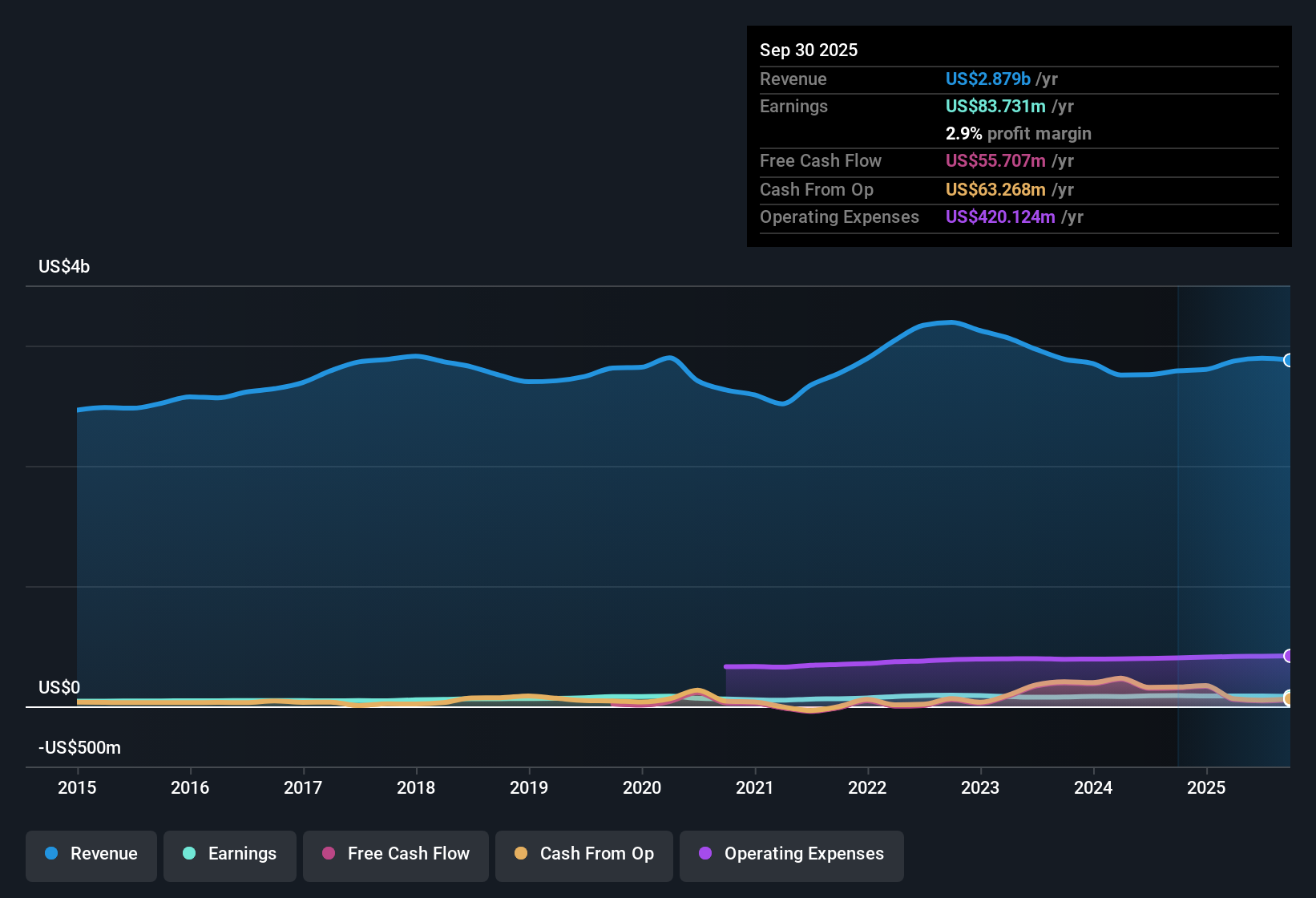

PC Connection (CNXN) just wrapped up FY 2025 with Q4 revenue of US$702.9 million and basic EPS of US$0.82, alongside net income of US$20.7 million. On a trailing twelve month basis, revenue sat at US$2.9 billion with EPS of US$3.28 and net income of US$83.7 million. The company has seen quarterly revenue range from US$701.0 million to US$759.7 million across 2025, with EPS moving between US$0.52 and US$0.98. This provides a clearer view of how the top and bottom lines have been tracking into the latest results and sets up a reporting season focused on how sustainably the business is converting sales into profit. Margins are firmly in focus here as investors weigh how consistently those earnings can be supported by the revenue base.

See our full analysis for PC Connection.With the latest numbers on the table, the next step is to see how this earnings profile lines up with the widely followed narratives around PC Connection’s growth, risks, and profitability, and where those stories might need a reset.

Trailing margins settle around 2.9%

- On a trailing 12 month basis, PC Connection generated US$2.9b of revenue and US$83.7 million of net income, which works out to a 2.9% net margin compared with 3.1% a year earlier.

- What stands out for a bullish view is that five year earnings growth of 6.8% a year and trailing 12 month revenue growth of 4.6% a year sit alongside this 2.9% margin, which:

- Supports the idea of a business that has been able to grow earnings over several years while keeping margins relatively close to the prior 3.1% level.

- Also shows that the recent year, where earnings growth turned negative and the margin slipped, is a key data point bulls need to weigh against that longer track record.

Investors who want to see how different views join these margin trends to longer term growth stories can check the broader community angle in the Curious how numbers become stories that shape markets? Explore Community Narratives.

📊 Read the full PC Connection Consensus Narrative.Quarterly EPS swings across FY 2025

- Across FY 2025, basic EPS moved from US$0.52 in Q1 to US$0.98 in Q2 and Q3, then to US$0.82 in Q4, while quarterly revenue ranged from US$701.0 million to US$759.7 million over the same stretch.

- Critics who focus on earnings volatility may point to the drop from US$0.98 EPS in Q2 and Q3 to US$0.82 in Q4 alongside the modest revenue spread as a risk factor, which:

- Lines up with the comment that earnings growth was negative over the most recent year even though the trailing 12 month EPS is US$3.28.

- Connects to the trailing net margin easing from 3.1% to 2.9%, giving bears concrete quarterly and annual numbers to reference when they worry about profit resilience.

DCF gap vs 19.8x P/E

- With the share price at US$65.65, PC Connection is about 20.3% below the stated DCF fair value of roughly US$82.39, yet it trades on a 19.8x P/E compared with a 17.5x peer average and a 27.1x US Electronic industry average.

- Supporters of a more optimistic stance point out that forecasts call for roughly 11.5% yearly earnings growth while the stock sits below the DCF fair value, but bears highlight the higher than peer P/E and recent margin dip, which together:

- Give bulls a valuation anchor in the DCF gap and a growth anchor in the 11.5% earnings outlook, set against a history of 6.8% annual earnings growth.

- Give bears concrete reasons to question paying a premium to peers when trailing 12 month revenue growth is 4.6% and the most recent year showed negative earnings growth.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on PC Connection's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

PC Connection’s recent negative earnings growth, softer net margin and premium 19.8x P/E against peers all raise questions about paying up for this earnings profile.

If that mix of weaker earnings momentum and a richer valuation worries you, use our 55 high quality undervalued stocks to quickly zero in on ideas with pricing that looks more forgiving.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.