يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

Pitney Bowes (PBI): Assessing Value After Leadership Changes and Earnings Momentum

Pitney Bowes Inc. PBI | 10.78 | +1.89% |

Change is in the air for Pitney Bowes (PBI) as the company announced a major reshuffle in its executive ranks, with Todd Everett stepping in to lead its Sending Technology Solutions business and Wayne Walker joining the Board of Directors. Investors have been closely watching these moves, given Everett’s previous track record in driving profitable growth and the emphasis on tightening corporate governance through Walker’s deep experience. The leadership change is signaling a push for sharper operational execution and hints that management is intent on extracting more value from its core business lines.

The shakeup has landed at a time when Pitney Bowes is already enjoying impressive momentum. Over the past year, the stock has climbed 73%, and gains of 14% have been recorded in just the past three months. While the price ticked slightly lower in the last month, recent favorable earnings trends and strong investor interest have more than offset short-term dips. In the bigger picture, the stock’s multi-year performance has been on a steady upward slope, keeping sentiment positive and the outlook lively.

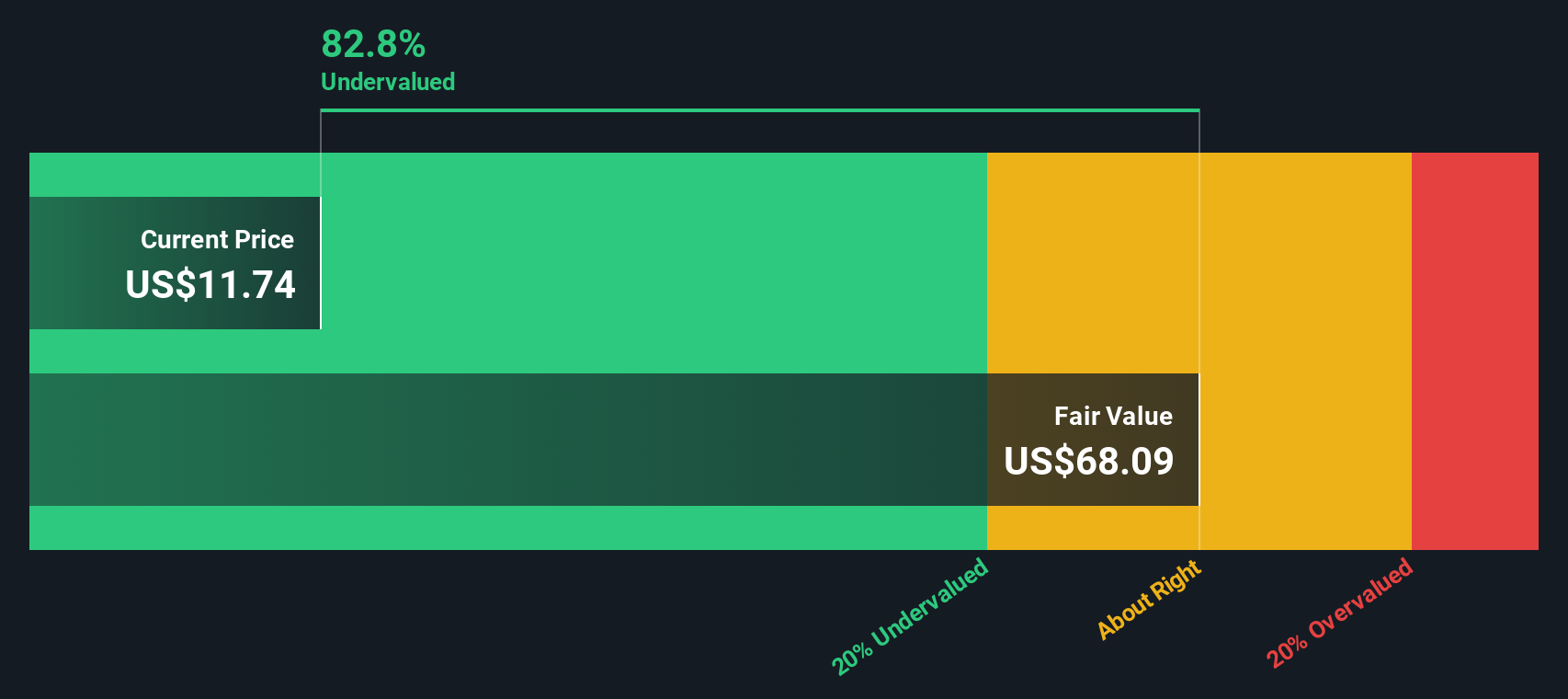

After so much change and renewed momentum, the big question is whether Pitney Bowes is now an undervalued opportunity, or if the market has already factored in the next wave of growth.

Most Popular Narrative: 30.6% Undervalued

According to the most widely followed valuation narrative, Pitney Bowes appears substantially undervalued compared to its projected fair value, based on future earnings growth and margin expansion expectations.

Ongoing investments in digital transformation, operational efficiencies, and automation, supported by a leadership team focused on efficiency, are expected to yield further improvements in net margins and free cash flow through cost reductions and modernization. This is anticipated to enhance long-term earnings power.

Curious how analysts came to such an optimistic fair value? Their bold projections go beyond steady profit gains, hinging on margin breakthroughs and future financial multiples that could surprise most investors. Which performance levers did they spotlight, and just how aggressive are their underlying earnings models?

Result: Fair Value of $17.00 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing digitization of mail and fierce industry competition could erode Pitney Bowes’ revenue and temper the optimism around future earnings growth.

Find out about the key risks to this Pitney Bowes narrative.Another View: What Does the SWS DCF Model Say?

To challenge the rosy picture painted by earnings and margin multiples, our SWS DCF model takes a closer look at Pitney Bowes’ future cash flows. This method also points to the stock being undervalued. However, is any model truly bulletproof?

Build Your Own Pitney Bowes Narrative

If you see things differently or want to dive into the numbers your own way, you can craft your personal narrative in just a few minutes. Do it your way

A great starting point for your Pitney Bowes research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Every savvy investor keeps an eye out for standout opportunities. If you want to get ahead and spot tomorrow’s winners, don’t miss these powerful stock ideas powered by Simply Wall Street’s screeners:

- Find established companies rewarding shareholders with solid income streams when you access our list of dividend stocks with yields > 3%.

- Capitalize on the future of medicine by uncovering innovators at the forefront of artificial intelligence in healthcare with healthcare AI stocks.

- Catch undervalued stocks poised for growth and see which names the market has overlooked by checking out undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.