يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

Praxis Precision Medicines (PRAX) Valuation After Analyst Upgrades And Key Breakthrough Therapy NDA Plans

Praxis Precision Medicines, Inc. PRAX | 335.28 | +1.11% |

Why Praxis Precision Medicines stock is back on investors’ radar

Praxis Precision Medicines (PRAX) has drawn fresh attention after multiple analysts expressed confidence in its lead drug candidates, alongside upcoming NDA submissions for ulixacaltamide and relutrigine, both with Breakthrough Therapy Designation.

The recent 2.98% 1 day share price return and 18.55% 30 day share price return, on top of a 1 year total shareholder return of around 3x, indicate that momentum has been building as investors react to upcoming NDA filings, fourth quarter results on 19 February 2026, and a packed investor conference schedule.

If you are watching biotech catalysts like Praxis, it could also be a time to look at other healthcare names powered by AI, using our screener of 24 healthcare AI stocks as a starting point.

After a very strong 1 year total return and a share price that still sits well below the average analyst target, the real question now is whether PRAX still trades at a discount or if the market is already pricing in future growth.

Most Popular Narrative: 25.9% Undervalued

Compared with the most followed fair value estimate of $449.13, Praxis Precision Medicines last closed at $332.92, so the narrative implies a meaningful valuation gap that hinges on how its late stage epilepsy portfolio plays out.

Multiple late stage epilepsy programs, including vormatrigine and relutrigine with breakthrough designation in severe genetic epilepsies, create a portfolio effect in a growing CNS innovation cycle. This increases the probability of multiple approvals and a step change in total company earnings over the back half of the decade.

Want to see what sits behind that earnings step change idea? The narrative leans heavily on sharp revenue expansion, margin improvement and a rich future earnings multiple. Curious which assumptions really drive that $449.13 figure and where expectations start to stretch?

Result: Fair Value of $449.13 (UNDERVALUED)

However, this hinges on pivotal epilepsy trials staying on track and on vormatrigine actually winning physician adoption, rather than remaining one more add on in complex regimens.

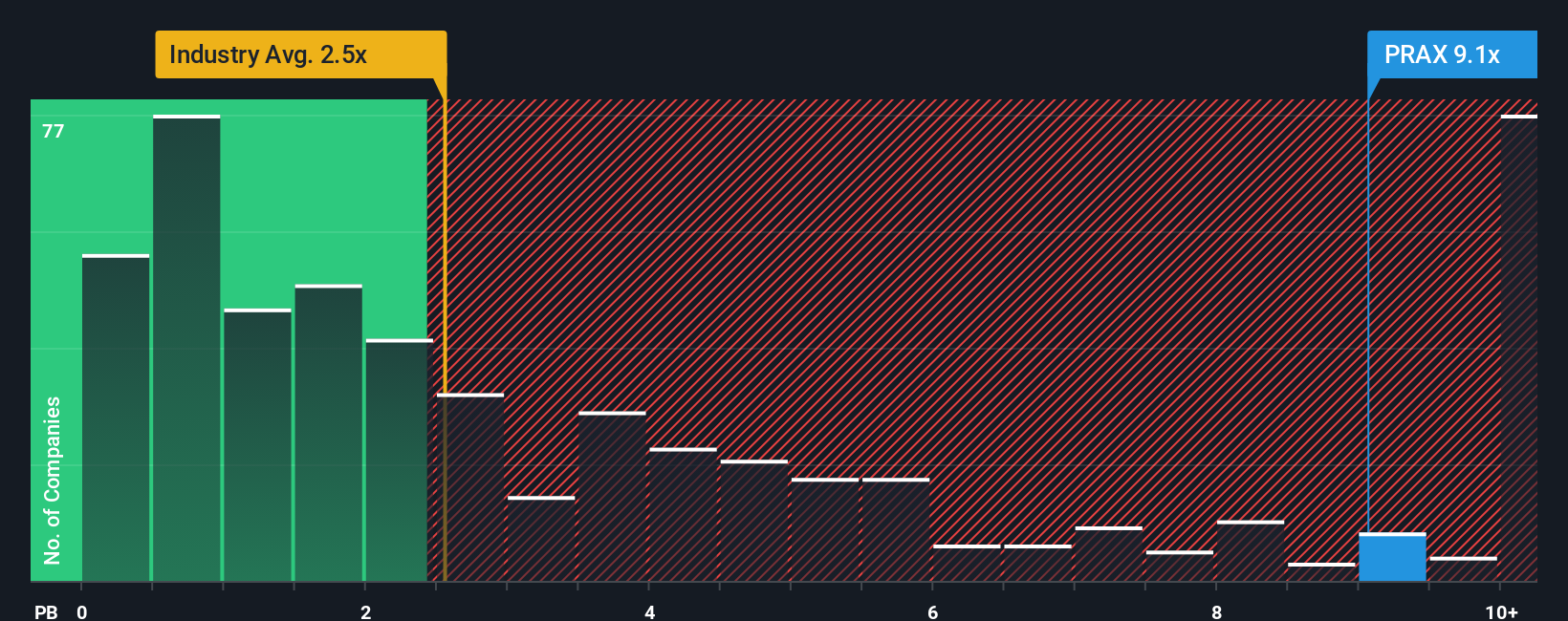

Another angle on valuation: what the multiples are saying

While our model-based fair value suggests Praxis Precision Medicines could be undervalued, the market is sending a different signal. PRAX trades on a P/B of 26.9x, far above the US Biotechs average of 2.7x and even above the peer average of 18.3x. This points to a lot of optimism already in the price. If earnings and cash flows do not develop as expected, how comfortable are you paying that kind of premium?

Build Your Own Praxis Precision Medicines Narrative

If this version of the story does not quite fit your view, or you would rather test the inputs yourself, you can build a fresh narrative in just a few minutes, starting with Do it your way.

A great starting point for your Praxis Precision Medicines research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If you are serious about levelling up your portfolio, do not stop at a single stock story. Use curated lists to spot opportunities others might overlook.

- Target potential mispricings by scanning 55 high quality undervalued stocks that pair quality fundamentals with prices that may not fully reflect them yet.

- Strengthen your income stream by reviewing 16 dividend fortresses that focus on higher yielding companies with the potential for more stable payouts.

- Reduce portfolio stress by considering 85 resilient stocks with low risk scores that our models flag as having more resilient profiles across key risk checks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.