يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

Prime D.C. Retail Acquisition Might Change the Case for Investing in Cohen & Steers (CNS)

Cohen & Steers, Inc. CNS | 62.84 | +0.48% |

- On September 18, 2025, funds managed by the Private Real Estate Group of Cohen & Steers and Lincoln Property Company announced a joint venture to acquire Cityline at Tenley, a retail center in the affluent Tenleytown area of northwest Washington D.C., featuring direct metro access and anchored by a high-performing Target store.

- This acquisition is based in a top 1% zip code for retail attractiveness, reflecting a move into prime real estate with strong demographic fundamentals and limited nearby retail development.

- We'll now examine how acquiring a premier retail property in Washington D.C. may influence Cohen & Steers' investment outlook and diversification strategy.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Cohen & Steers Investment Narrative Recap

To be a shareholder of Cohen & Steers, you need to believe in the ongoing relevance and growth potential of active real estate management, especially as the firm moves further into high-quality property investments like Cityline at Tenley. While this new acquisition could help diversify assets and signal appetite for prime opportunities, the most immediate catalyst, potential net inflows from improved real estate sentiment, may not be materially affected by a single transaction. The key risk remains structural outflows due to shifting asset allocation trends away from active strategies.

Of the past announcements, the May 2025 launch of a blended listed and private real estate strategy stands out as most connected to this acquisition. This type of strategy reflects how Cohen & Steers seeks to broaden client appeal and stabilize asset growth, helping to address the same sector concentration concerns that underpin both their recent acquisition efforts and the quest for steady inflows.

But while expanding into top-tier retail properties can help address portfolio concentration, investors should stay attuned to the risk of...

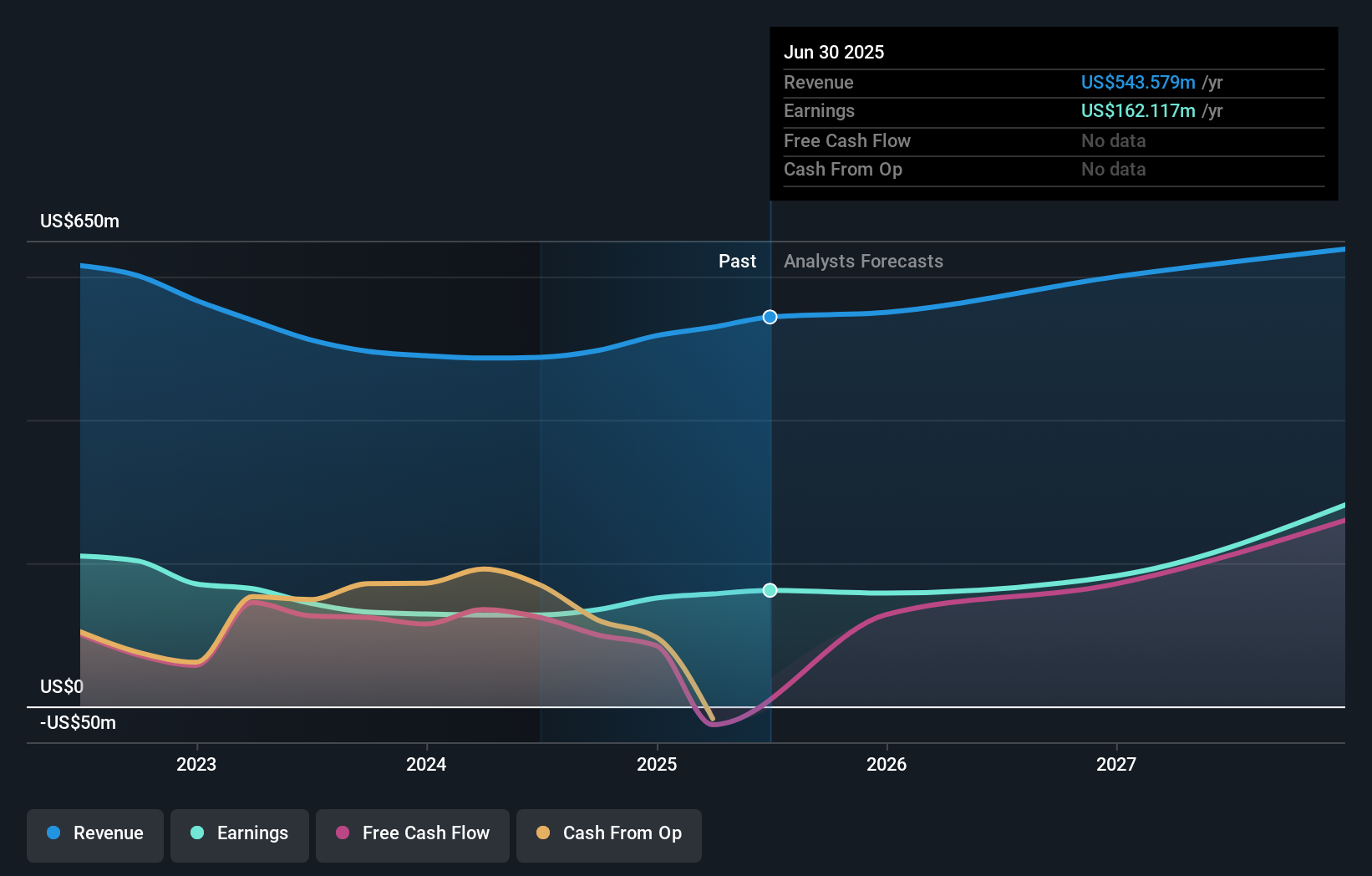

Cohen & Steers' outlook anticipates $704.3 million in revenue and $318.2 million in earnings by 2028. This projection is based on a 9.0% annual revenue growth rate and a $156.1 million increase in earnings from the current $162.1 million.

Uncover how Cohen & Steers' forecasts yield a $74.33 fair value, a 14% upside to its current price.

Exploring Other Perspectives

One member of the Simply Wall St Community valued Cohen & Steers at US$74.33 per share. When compared with persistent net institutional outflows, this single-point fair value highlights how investor opinions can differ widely, see more diverse perspectives within the Community.

Explore another fair value estimate on Cohen & Steers - why the stock might be worth as much as 14% more than the current price!

Build Your Own Cohen & Steers Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cohen & Steers research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Cohen & Steers research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cohen & Steers' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.