يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

Progressive (PGR): Evaluating the Insurance Giant’s Valuation After Recent Market Movement

Progressive Corporation PGR | 212.12 | -0.93% |

Progressive’s stock may have gained a bit today, but over the past year it’s been a tougher ride, with a 1-year total shareholder return of -11.6%. Price momentum has faded since earlier highs, which puts a spotlight on how investors are weighing valuation against long-term performance. Over the last five years, though, total shareholder returns of 161% illustrate the company’s ability to deliver for patient holders.

If you’re exploring what’s working in the market beyond insurers, now is a great chance to broaden your search and discover fast growing stocks with high insider ownership

That leaves investors with a crucial question: Is Progressive’s current price an appealing entry for value seekers, or has the market already factored in all the growth ahead?

Most Popular Narrative: 13.9% Undervalued

Progressive's widely followed narrative puts its fair value estimate well above the last close, hinting at a sizable upside if market expectations hold. But what is really powering this view? The answer lies in the narrative's belief in Progressive's core strengths and their future impact.

Persistent growth in U.S. vehicle ownership, population, and rising vehicle complexity expand the addressable market and increase future demand for auto insurance, which should underpin sustained top-line revenue growth for Progressive. The accelerating shift toward digital consumer preference for price transparency and coverage customization gives Progressive an edge due to its flexible, usage-based (e.g., Snapshot) offerings and advanced segmentation, supporting both premium growth and higher customer retention.

Curious how Progressive’s digital strategy is being valued so highly? The narrative's entire forecast relies on bold assumptions about future customer growth, profitability, and competitive advantages. Find out what financial leaps are driving this standout fair value.

Result: Fair Value of $259.13 (UNDERVALUED)

However, sustained competition or a rapid shift in mobility trends could quickly challenge Progressive's projected growth and put pressure on future earnings.Another View: Are Market Comparisons Sending Mixed Signals?

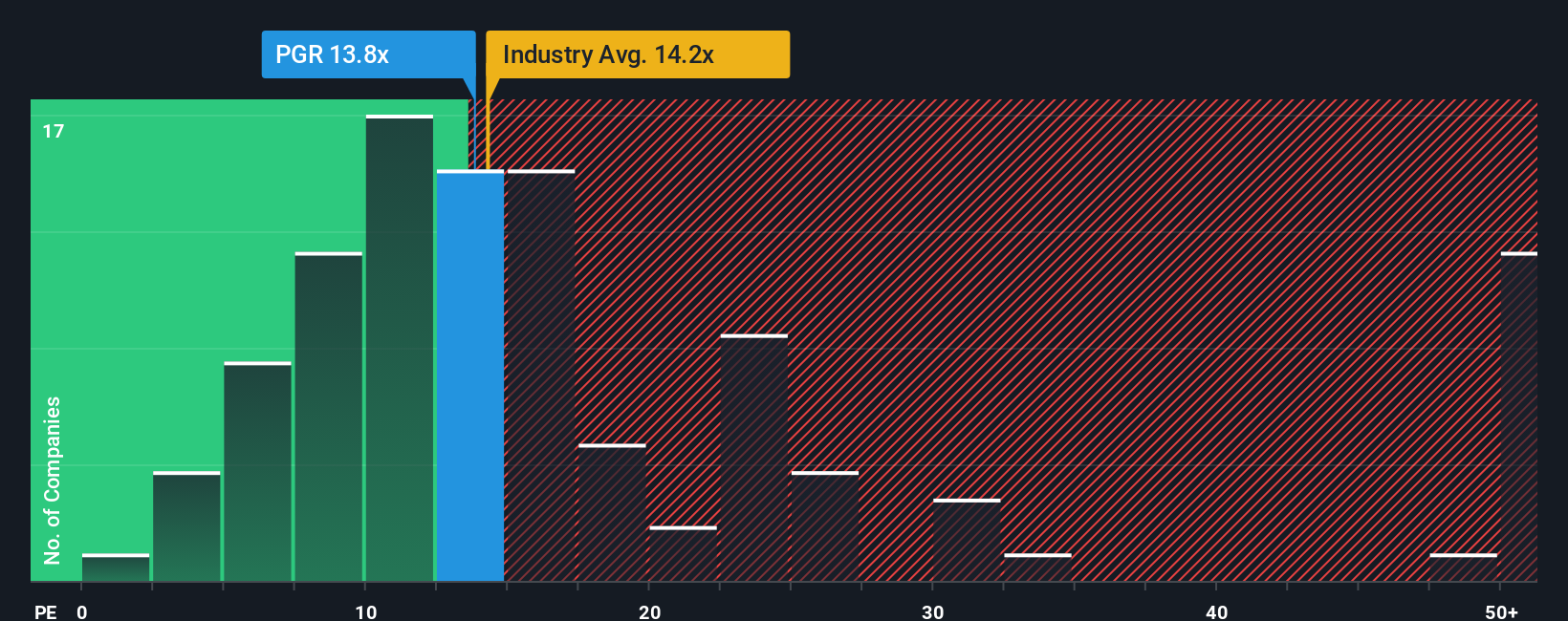

Looking at Progressive’s price-to-earnings ratio offers a different story. The company trades at 12.2 times earnings, above its peer average of 9.5 and higher than the fair ratio of 10.8. This premium suggests investors expect more than the sector norm, but it also points to greater risk if growth falters. Is the optimism justified, or could market sentiment shift?

Build Your Own Progressive Narrative

If you see things differently or want to explore Progressive from your own angle, you can shape your own view in just a few minutes: Do it your way

A great starting point for your Progressive research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Seize the opportunity to level up your portfolio. Smart investors constantly stay alert for tomorrow’s winners and track fresh trends before the crowd does.

- Unlock potential gains by tapping into these 876 undervalued stocks based on cash flows that are priced below their intrinsic worth but still show strong business fundamentals.

- Accelerate your search for high-yield opportunities by checking out these 15 dividend stocks with yields > 3% boasting 3%+ yields and solid sector performance.

- Fuel your curiosity with these 26 AI penny stocks, where artificial intelligence is transforming entire industries and sparking innovative business models.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.