يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

Qualys (QLYS): Assessing Valuation After Strong Guidance, EPS Boost, and Recent Cybersecurity Wins

Qualys, Inc. QLYS | 104.91 | +0.11% |

Qualys (QLYS) is in the spotlight after delivering an upbeat revenue outlook for the next quarter, raising its full-year earnings guidance, and unveiling the TruRisk Eliminate and Qualys TotalAI platforms. These moves followed double recognition for the company’s Threat Research Unit at DEF CON, where Qualys uncovered major vulnerabilities in OpenSSH. This demonstrates technical depth that is hard for competitors to match. The positive news arrived just as Federal Reserve Chair Jerome Powell pointed to possible interest rate cuts, a signal that gave the entire tech sector, including Qualys, a clear lift.

This combination of company-specific achievements and wider market optimism has fueled short-term momentum in the stock. Shares climbed 3% in a day and gained 4% over the past week. However, it is worth noting the stock is only up 8% in the past year. Looking back over a longer period, gains stand at 26% in five years, while the past month saw a small pullback. Collectively, these moves suggest the market is gradually warming to the company’s evolving story, but long-term momentum has been less decisive compared to some cybersecurity peers.

After this burst of news and stock price reaction, investors may consider whether Qualys offers a true bargain based on its recent guidance and technology wins, or if the market has already factored in the next phase of growth.

Most Popular Narrative: 4.6% Undervalued

According to the community narrative, Qualys is considered undervalued by analysts who anticipate durable earnings growth, moderate margin pressure, and expanding market opportunities due to cloud-native innovation and strategic partnerships.

Adoption of Qualys' new cloud-native risk operations center (ROC) and Agentic AI platform positions the company as a leading pre-breach risk management provider. This offers unified orchestration, automation, and remediation across both Qualys and non-Qualys data, which creates incremental greenfield opportunities and may support higher ARPU and an expanded TAM. This could lead to durable revenue and earnings growth.

How much upside have analysts built into this fair value? There is a bold set of assumptions about revenue momentum, consistent profitability, and a powerful multiple shift in the years ahead. What is driving this verdict? Unpack the narrative’s financial blueprint and see why these projections could surprise even seasoned tech investors.

Result: Fair Value of $141.02 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, rapid advances in AI security and shifting customer preferences toward vendor consolidation could disrupt Qualys’ growth trajectory and challenge its competitive edge.

Find out about the key risks to this Qualys narrative.Another View: The SWS DCF Model Perspective

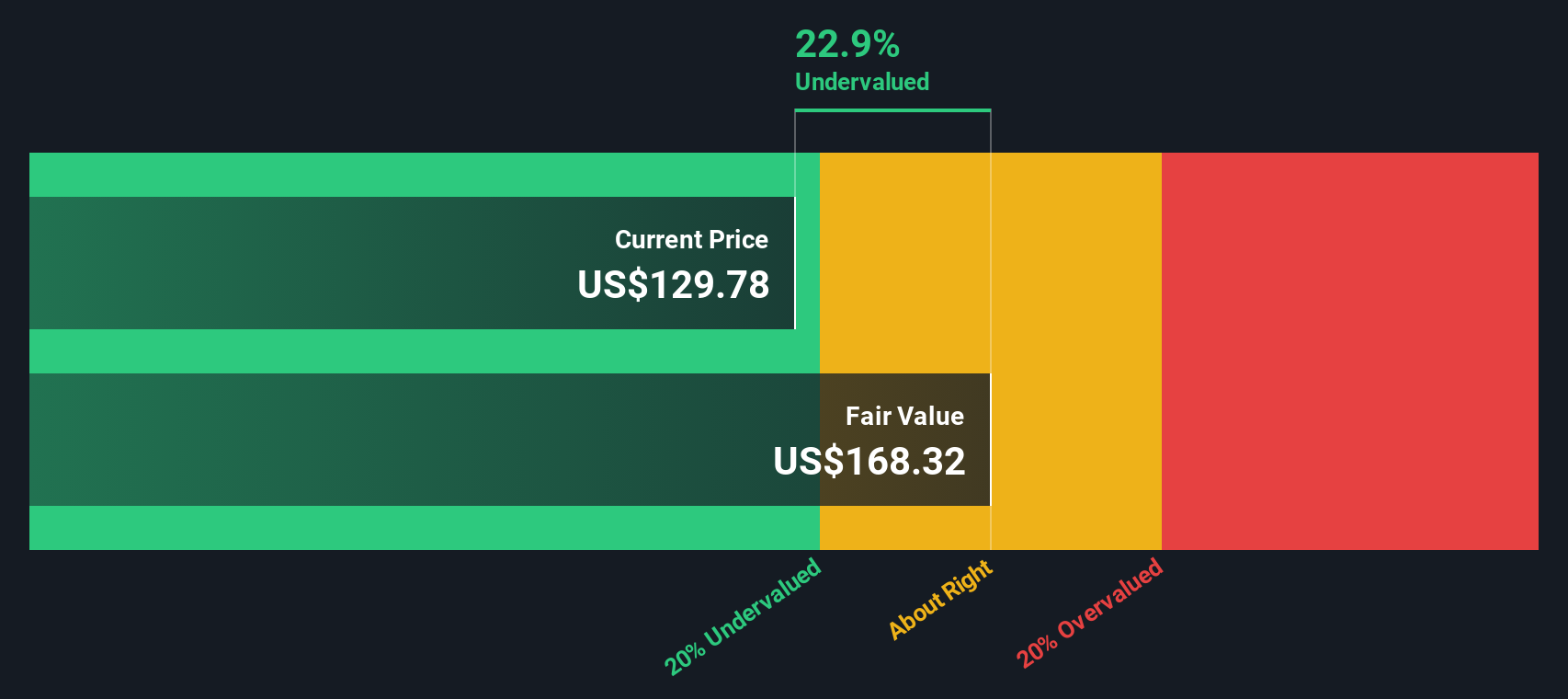

Looking beyond analyst targets, the SWS DCF model offers a fundamentals-based perspective and currently indicates that Qualys is undervalued as well. The question remains whether market sentiment will fully catch up to this valuation or if the price is reflecting hidden risks.

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Qualys Narrative

If you think there is more to the story or prefer drawing your own conclusions from the numbers, you can craft your own Qualys outlook and do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Qualys.

Looking for More Smart Investment Ideas?

Don’t limit your strategy to just one stock when the market is full of opportunities waiting to be seized. Use the Simply Wall Street Screener to spot companies fueling tomorrow’s growth and expand your approach with new investment ideas. Here are three popular ways to start:

- Boost your income potential by checking out dividend stocks with yields > 3%, where you can find companies offering steady yields above 3% for dependable returns.

- Capitalize on next-generation tech by browsing quantum computing stocks and discover which pioneering businesses are advancing the field of quantum computing today.

- Target exceptional value with undervalued stocks based on cash flows, a quick way to identify companies trading below their intrinsic worth based on strong cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.