يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

RenaissanceRe Extends Dividend Streak And Buybacks As Valuation Stays Low

RenaissanceRe Holdings Ltd. RNR | 299.00 | -0.33% |

- RenaissanceRe Holdings (NYSE:RNR) has announced its thirty-first consecutive annual dividend increase.

- The Board has also renewed and expanded the company’s authorized share repurchase program.

- These decisions come as the company’s share price stands at $310.9 following a 34.1% 1 year return.

For investors watching NYSE:RNR, the new dividend increase and larger buyback authorization arrive following recent share performance. The stock is at $310.9, with a 15.1% gain over the past 30 days and a 34.1% return over the past year. Over 3 and 5 years, the shares show returns of 50.6% and 103.2%, respectively.

The Board’s decision to keep raising dividends and expand repurchases reflects an ongoing focus on shareholder returns. For you, the key consideration is how this mix of cash dividends and buybacks fits your goals and risk tolerance, particularly if you are evaluating the balance between income and potential capital appreciation over time.

Stay updated on the most important news stories for RenaissanceRe Holdings by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on RenaissanceRe Holdings.

Quick Assessment

- ⚖️ Price vs Analyst Target: RNR trades at $310.9, almost in line with the $311.87 analyst target, which suggests expectations are largely priced in.

- ✅ Simply Wall St Valuation: Simply Wall St estimates the shares are trading at about 67.1% below fair value, pointing to a valuation discount.

- ✅ Recent Momentum: A 30 day return of roughly 15.1% shows the market has reacted positively in the near term.

There is only one way to know the right time to buy, sell or hold RenaissanceRe Holdings. Head to Simply Wall St's company report for the latest analysis of RenaissanceRe Holdings's Fair Value.

Key Considerations

- 📊 The thirty first consecutive dividend increase plus an expanded buyback program signal consistent capital returns alongside a share count that has already moved lower over the past year.

- 📊 Keep an eye on the low 5.2x P/E versus the Insurance industry average of about 12.3x, the pace of repurchases, and how earnings per share trend after this capital return decision.

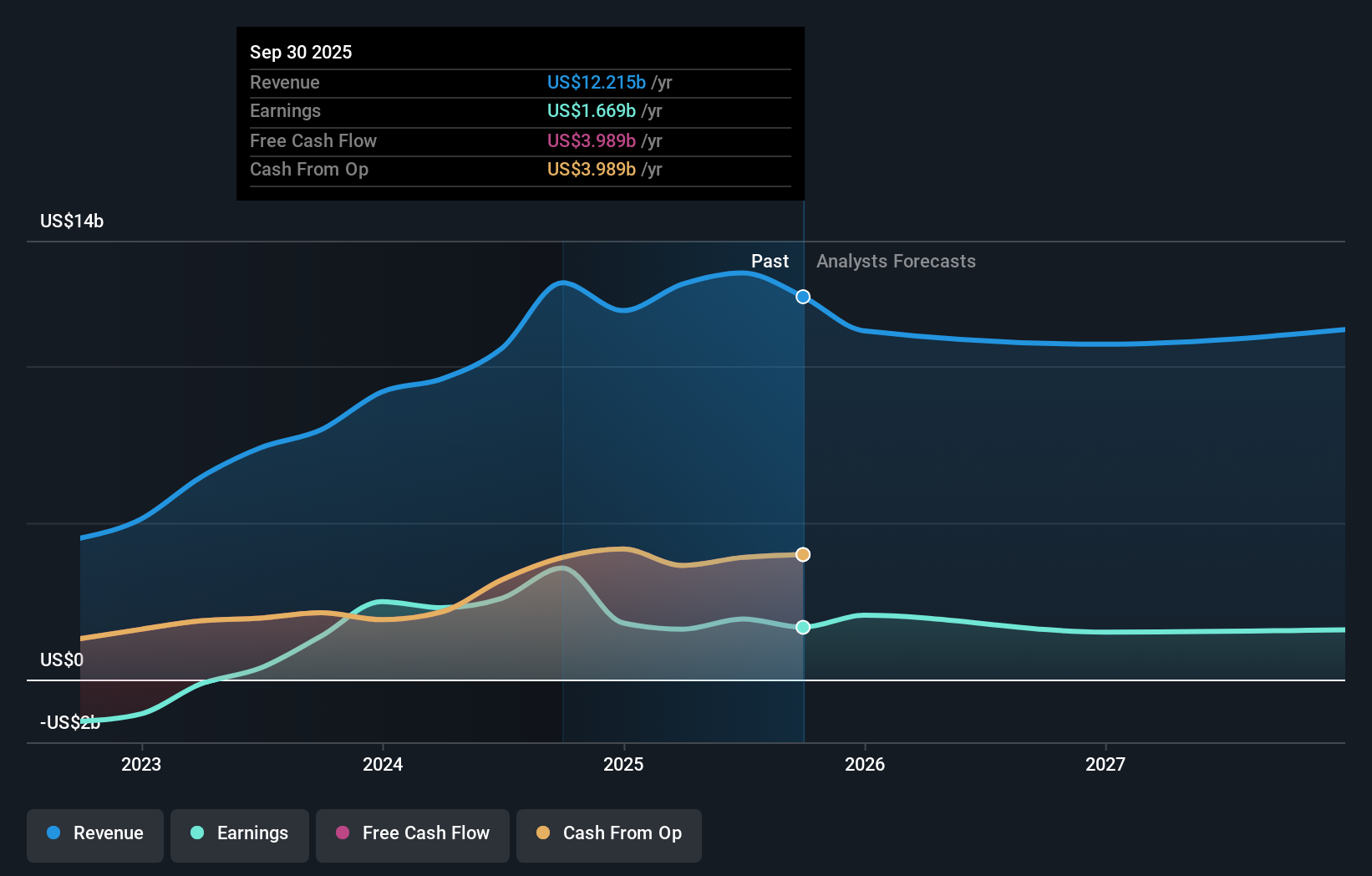

- ⚠️ Forecasts that earnings may decline by an average of 16.3% per year over the next 3 years and some recent insider selling are key risks to weigh against the current valuation and payout policy.

Dig Deeper

For the full picture, including more risks and rewards, check out the complete RenaissanceRe Holdings analysis. Alternatively, you can visit the community page for RenaissanceRe Holdings to see how other investors believe this latest news will impact the company's narrative.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.