يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

Revisiting AppFolio (APPF) Valuation After Its Recent Share Price Rebound

AppFolio Inc Class A APPF | 232.65 | -1.26% |

Why AppFolio Stock Is Back on Investors’ Radar

AppFolio (APPF) has quietly outperformed over the past week, adding about 5% and trimming some of its slide from the past 3 months, even as the 1-year return remains slightly negative.

With the share price now around $236.21, AppFolio’s recent 7 day share price return of just over 5% is a welcome shift after a weaker 90 day patch. Its three year total shareholder return above 120% shows the longer term momentum story is still very much intact.

If AppFolio’s rebound has you reassessing the space, it could be worth scanning other software and platform names through our screen of fast growing stocks with high insider ownership to spot where strong growth lines up with aligned insiders.

With revenue still growing at a double-digit pace and Wall Street targets sitting well above today’s price, investors now face a key question: is AppFolio quietly undervalued, or is the market already baking in years of future growth?

Most Popular Narrative Narrative: 25.5% Undervalued

Compared with AppFolio’s last close at $236.21, the most followed narrative pegs fair value materially higher, implying meaningful upside if its assumptions hold.

Sustained investment in high-margin, value-added services, such as advanced screening, payment processing, and insurance, alongside continued operational efficiency is expected to further increase net margins and support profitable revenue growth.

Curious how steady revenue expansion, shifting margins, and a punchy future earnings multiple combine to justify that higher fair value? Unpack the full playbook behind this narrative.

Result: Fair Value of $317.20 (UNDERVALUED)

However, heavy spend on AI innovation and rising regulatory scrutiny around data and fintech partnerships could squeeze margins and blunt AppFolio’s high growth narrative.

Another Lens on Valuation

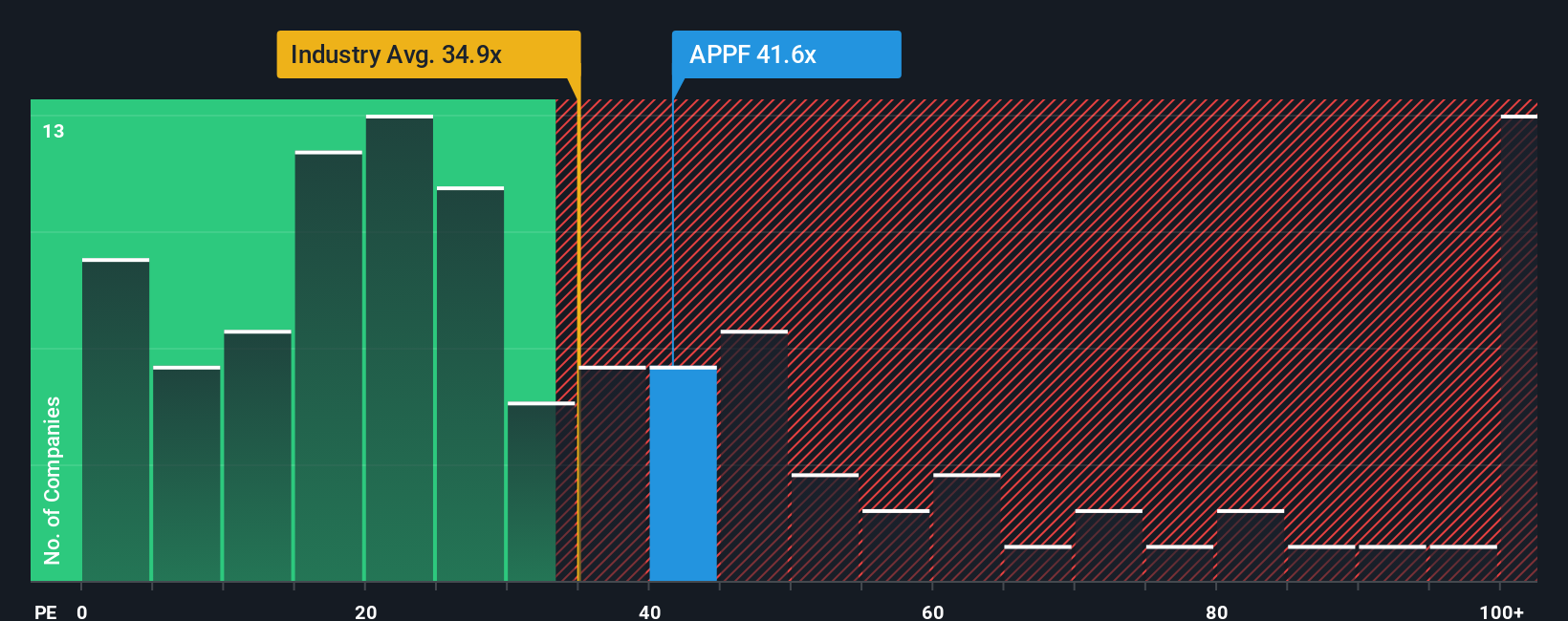

While narrative driven fair value implies upside, the current price already looks demanding versus earnings. AppFolio trades on 41.6 times earnings, well above the US Software industry at 32.4 times and a fair ratio of 27.2 times, which points to meaningful valuation risk if growth cools.

Build Your Own AppFolio Narrative

If you see the story differently or would rather dig into the numbers yourself, you can build a complete view in minutes: Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding AppFolio.

Looking for more investment ideas?

Do not stop at AppFolio. Put your watchlist to work by tapping into fresh stock ideas powered by Simply Wall Street’s data driven screeners right now.

- Capture potential multibaggers early by targeting these 3630 penny stocks with strong financials that already show solid balance sheets and improving fundamentals.

- Position ahead of the next tech wave by focusing on these 24 AI penny stocks harnessing artificial intelligence to reshape entire industries.

- Explore income opportunities with these 10 dividend stocks with yields > 3% offering yields above 3 percent from established businesses.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.