يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

Rigetti Computing (NasdaqCM:RGTI) Joins DARPA Quantum Benchmarking Initiative

Rigetti Computing, Inc. RGTI | 19.85 | -9.81% |

Rigetti Computing (NasdaqCM:RGTI) has seen a notable 12% increase in its share price over the past week, a period marked by the company's announcement of its participation in DARPA's Quantum Benchmarking Initiative. This participation, aimed at advancing utility-scale quantum computing, emphasizes Rigetti's partnership with Riverlane and their technological innovations using superconducting qubits. This news aligns with a general market rise of 4.1% over the same timeframe, which was buoyed by a streak of three strong trading days. While tech sector excitement was generally broad-based, Rigetti's specific advancements likely contributed positively to investor sentiment.

Over the last year, Rigetti Computing has experienced a very large total return of 694.87%, contrasting with its performance relative to the broader market over the same timeframe, wherein it exceeded both the US Semiconductor industry and the US Market, which returned 9.9% and 7.9%, respectively. While the short-term 12% surge in share price following its DARPA initiative may be eye-catching, it is essential to consider such moves within the larger context of Rigetti's overall market trajectory.

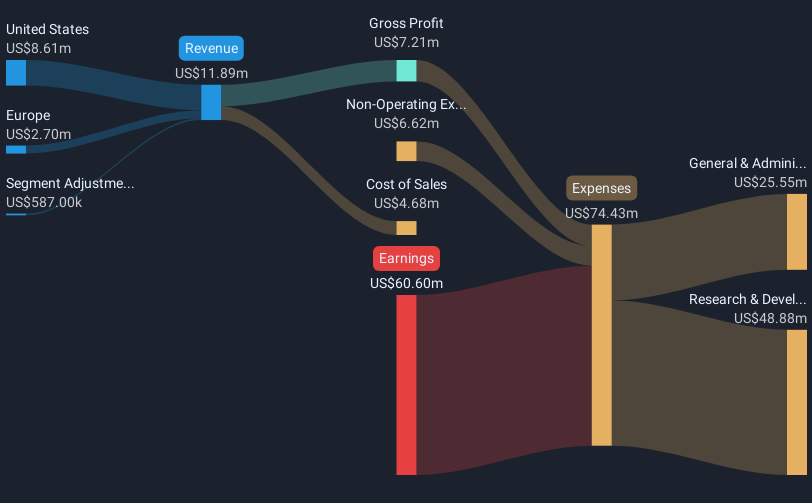

The recent price movement aligns with Rigetti's participation in high-profile projects, which could positively influence its revenue forecasts. Despite financial challenges, as evidenced by significant losses and a revenue decrease to US$10.79 million in 2024, anticipated revenue growth of 39.2% per year signals potential recovery. The current share price is substantially below the consensus analyst price target of US$15.00, suggesting potential upside according to analysts. Such underlying investor sentiment could reflect expectations for improved operational performance as Rigetti pursues its advanced quantum computing initiatives.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.