يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

Roku Bets On Shoppable TV And AI As Valuation Signals Upside Potential

Roku, Inc. Class A ROKU | 107.00 | +0.72% |

- Roku and Pinterest have launched a new shoppable TV series on Roku, letting viewers buy products directly from what they see on screen.

- The rollout ties into Roku’s expansion of The Roku Channel and new AI powered tools such as conversational weather updates and real time content suggestions.

- These features are gaining traction with younger audiences and aim to deepen engagement on Roku’s platform.

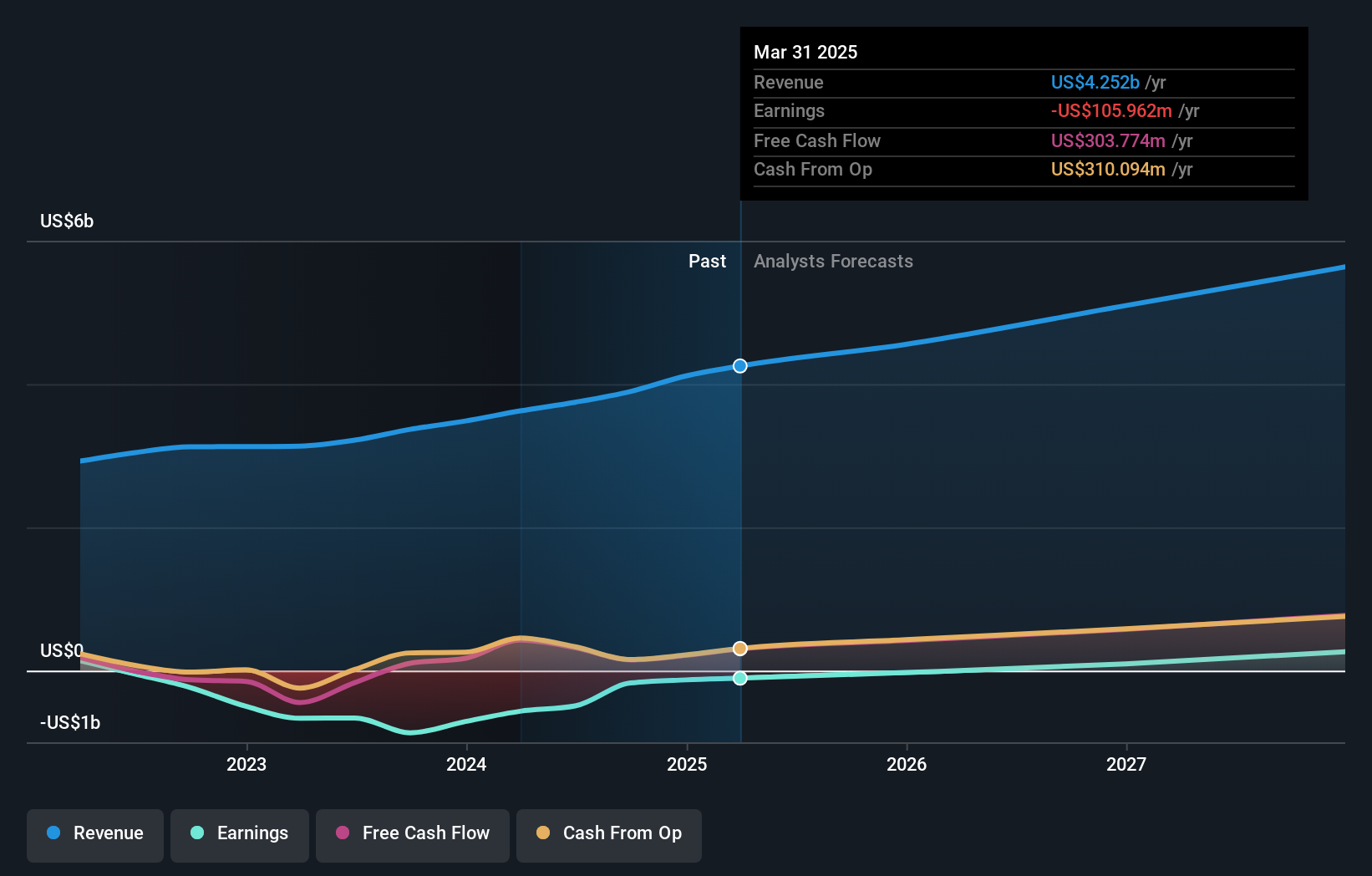

Roku, traded as NasdaqGS:ROKU, is leaning into interactive streaming at a time when its shares trade around $102.75. Over the past year, the stock has returned 28.9%, while the 5 year figure shows a 74.5% decline, underlining how volatile the journey has been for long term holders.

For you as an investor, the key consideration is how much this mix of shoppable TV and AI driven personalization can influence time spent on the platform and ultimately monetization. As Roku works to position itself as a bridge between traditional TV and digital first viewing, the depth and durability of user engagement will remain an important factor to watch.

Stay updated on the most important news stories for Roku by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on Roku.

Quick Assessment

- ✅ Price vs Analyst Target: At US$102.75, the price sits about 17% below the US$123.46 analyst consensus target.

- ✅ Simply Wall St Valuation: Simply Wall St flags Roku as undervalued, trading 42.9% below its estimated fair value.

- ❌ Recent Momentum: The 30 day return is about 5.6% lower, showing recent weakness despite the product news.

Check out Simply Wall St's in-depth valuation analysis for Roku.

Key Considerations

- 📊 Shoppable TV with Pinterest plus AI powered personalization aims to increase viewer engagement and advertising relevance on Roku’s platform.

- 📊 Watch how ad revenue, The Roku Channel performance and user growth, especially among younger viewers, respond to these features over coming quarters.

- ⚠️ A forward P/E of around 98.6 leaves little room if engagement or monetization from shoppable TV and AI tools does not meet expectations.

Dig Deeper

For the full picture including more risks and rewards, check out the complete Roku analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.