يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

Sempra Hydrogen Petition Seeks Faster Clarity On Future Gas Investments

Sempra SRE | 93.55 | +0.62% |

- Sempra subsidiaries Southern California Gas Co. and San Diego Gas & Electric have petitioned California regulators to drop a 5% hydrogen blending demonstration requirement.

- The filing argues that existing research and operational data are sufficient to assess low level hydrogen blending safety without new pilot projects.

- The request targets rules that would have required utilities to complete demonstration projects before regulators consider a systemwide hydrogen blending standard.

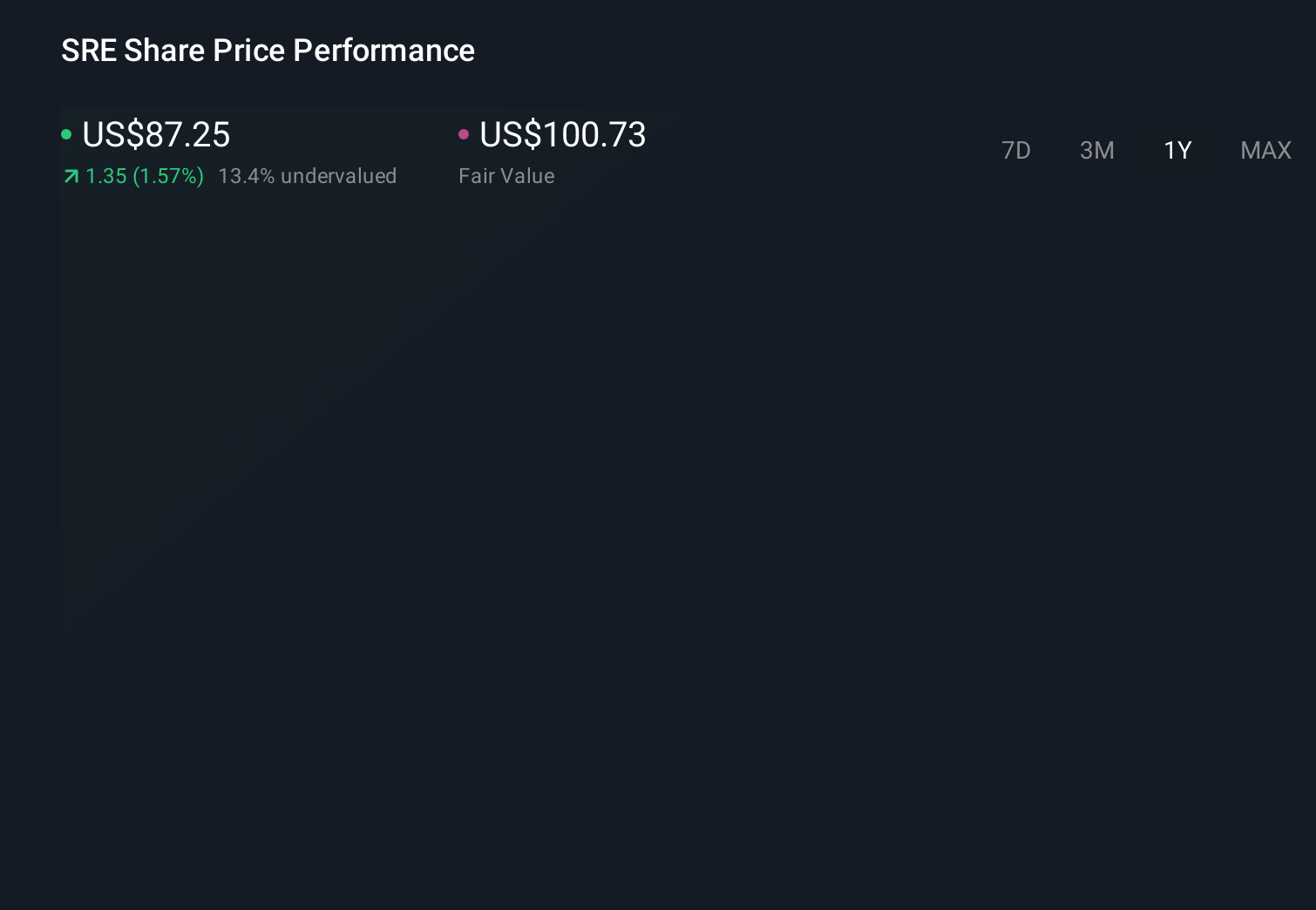

Sempra, traded as NYSE:SRE, is drawing attention as it links its gas utilities more closely with California's clean energy transition. The company’s shares recently closed at $86.66, with a 1 year return of 9.0% and a 5 year return of 61.6%. That longer track record may be relevant for investors monitoring how policy decisions around hydrogen infrastructure intersect with Sempra’s regulated utility footprint.

For investors, the petition is described as less about immediate financial impact and more about how Sempra positions its gas network for a lower carbon future. If regulators accept the request, it could shorten the timeline for setting hydrogen blending rules, which may influence future capital plans and regulatory discussions for NYSE:SRE.

Stay updated on the most important news stories for Sempra by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on Sempra.

The petition from SoCalGas and SDG&E looks less like a short term earnings swing for Sempra and more like an attempt to shape the rulebook for how its gas networks can participate in California's lower carbon plans. If regulators agree that existing research is enough to set a 5% blending standard without new pilot projects, Sempra could avoid extra project specific costs and gain earlier clarity on what hydrogen related investments will be allowed into its regulated rate base compared with peers such as PG&E and Southern Company.

How This Fits Into the Sempra Narrative

This regulatory move lines up with Sempra's broader story of using regulated infrastructure to support decarbonization while still running a traditional utility model. For investors who follow the long term narrative around grid modernization, LNG projects, and earnings growth, the hydrogen filing sits in the bucket of policy decisions that may affect which parts of Sempra's gas system remain investable over time and how those assets complement its electric and LNG businesses.

Risks and Rewards To Keep in Mind

- Regulatory risk if the CPUC rejects the petition or adds stricter conditions, which could lead to extra pilot costs or tighter rules on hydrogen use.

- Policy risk if future California decarbonization measures reduce the role of gas networks, putting pressure on long lived gas infrastructure returns.

- Potential upside if a quicker path to a 5% blending standard supports smoother long term planning for Sempra's gas utilities and could simplify future capital allocation.

- Possible reputational benefit as Sempra positions its utilities as supportive of lower carbon fuels while still emphasizing customer safety and system reliability.

What To Watch Next

Looking ahead, the key items to watch are how the CPUC responds to the petition, whether any new conditions are attached, and how Sempra reflects hydrogen related assumptions in future capital plans and regulatory filings. If you want a broader view of how this kind of regulatory news fits into the long term story for Sempra, take a look at community narratives for NYSE:SRE that connect policy decisions, earnings expectations, and valuation views.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.