يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

Semtech (SMTC) Valuation Check After Strong Q3 And AI Driven Re Rating

Semtech Corporation SMTC | 77.56 73.01 | 0.00% -5.87% Pre |

Semtech (SMTC) is back in focus after a strong Q3, with 12.8% year on year revenue growth and earnings ahead of analyst expectations, alongside sector tailwinds linked to AI driven semiconductor demand.

Sustained interest in AI related semiconductors has helped Semtech’s share price, which now trades at US$77.26 after a 4.15% 1 day share price return and a 13.99% 90 day share price return. Its 3 year total shareholder return of about 15x contrasts with a slightly negative 5 year total shareholder return, suggesting momentum has been rebuilding more recently.

If Semtech’s move has caught your eye, it could be a moment to see what else is gaining attention in chips and AI, starting with high growth tech and AI stocks.

With the shares up sharply and trading near the average analyst price target, the key question now is whether Semtech is still undervalued or if the recent rally already reflects the growth the market is expecting.

Most Popular Narrative: 5.8% Undervalued

Semtech's widely followed narrative pegs fair value at US$82, a touch above the latest close at US$77.26. This frames the current rally as still short of that reference point while keeping expectations anchored to detailed earnings and margin assumptions.

Strong balance sheet improvements and debt reduction are enabling greater capital allocation into innovation and selective M&A, while also lowering interest expense. These actions further support bottom-line growth and create optionality for accretive portfolio moves.

Curious what sits behind that US$82 figure? Revenue compounding, margin expansion and a premium future P/E are doing the heavy lifting. Want to see how tightly those moving parts are modeled, and how sensitive that value is to even small changes in earnings power and discount rate assumptions?

Result: Fair Value of $82 (UNDERVALUED)

However, there are still pressure points to watch, including mix driven margin risk and the possibility that LoRa or data center demand underperforms current expectations.

Another View: Multiples Point To A Richer Price

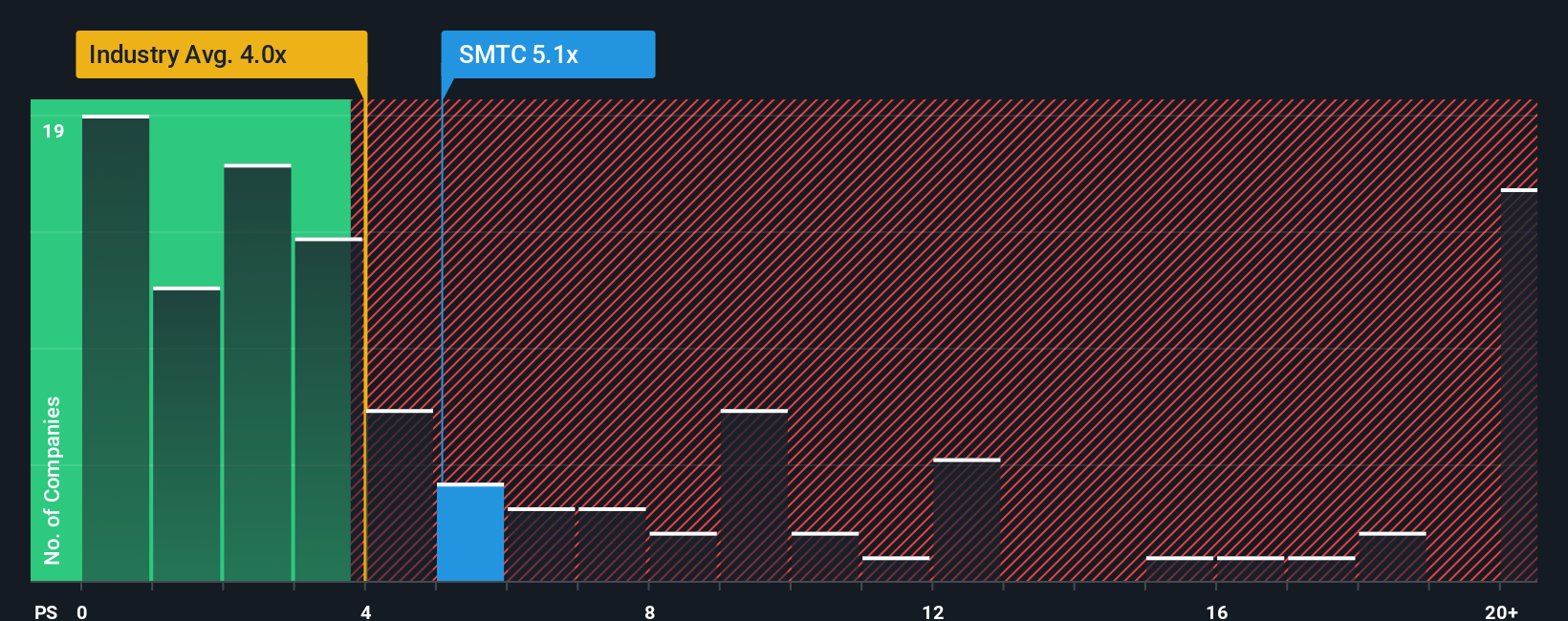

While the popular narrative calls Semtech about 5.8% undervalued at US$82, the current US$77.26 share price sits above our fair value estimate using a P/S based approach. At 7x P/S versus a fair ratio of 6.7x and a US Semiconductor average of 5.2x, the stock screens as expensive. Is the market already paying up for the story you are counting on?

Build Your Own Semtech Narrative

If you see the numbers differently or like to crunch the data yourself, you can build a fresh Semtech view in just a few minutes with Do it your way.

A great starting point for your Semtech research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Ready for more stock ideas?

If Semtech has sharpened your interest, do not stop here, some of the most interesting opportunities often sit just outside the names already on your radar.

- Spot potential value gaps by scanning these 868 undervalued stocks based on cash flows that currently price in more modest expectations than their cash flow profiles might imply.

- Zero in on next generation growth themes through these 24 AI penny stocks that stand to benefit from rising demand for AI related capabilities and infrastructure.

- Add income ideas to your watchlist with these 12 dividend stocks with yields > 3% that offer yields above 3% alongside stock market exposure.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.