يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

Sentiment Still Eluding Johnson Outdoors Inc. (NASDAQ:JOUT)

Johnson Outdoors Inc. Class A JOUT | 50.50 | +3.80% |

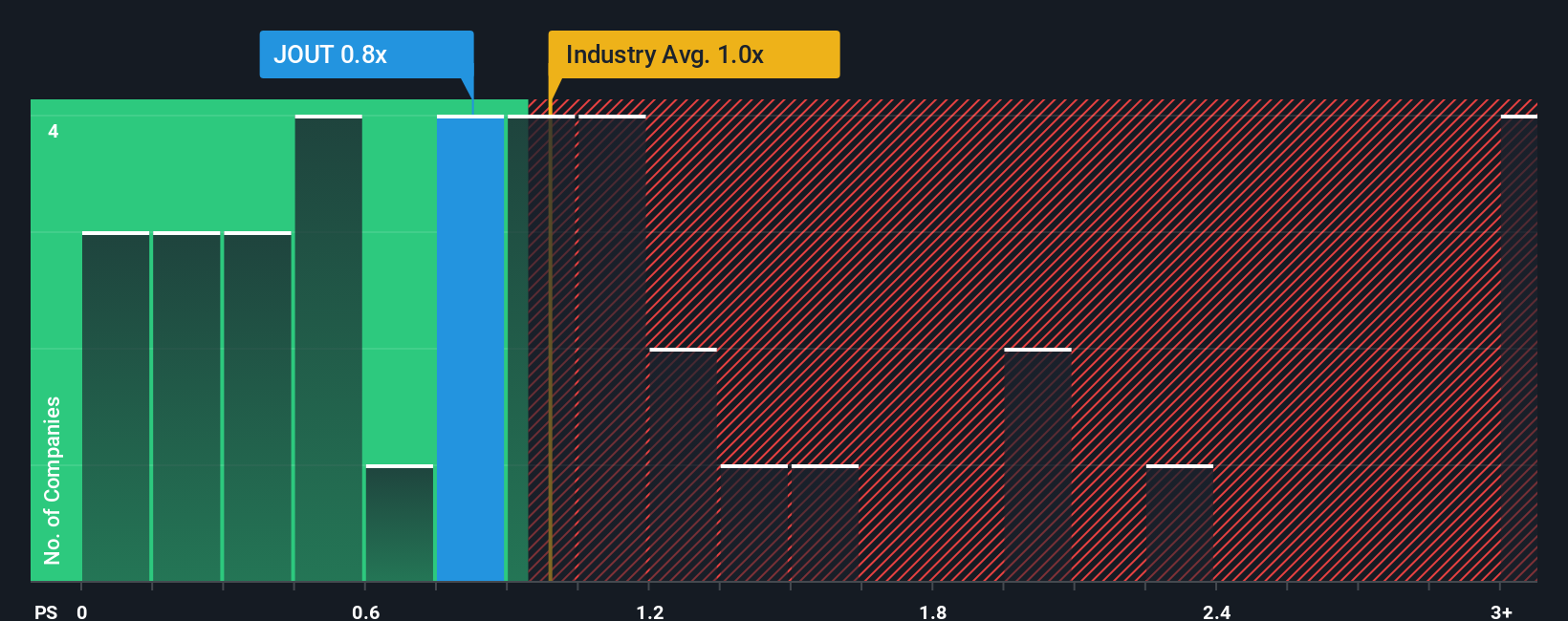

There wouldn't be many who think Johnson Outdoors Inc.'s (NASDAQ:JOUT) price-to-sales (or "P/S") ratio of 0.9x is worth a mention when the median P/S for the Leisure industry in the United States is similar at about 1x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

How Johnson Outdoors Has Been Performing

Recent revenue growth for Johnson Outdoors has been in line with the industry. It seems that many are expecting the mediocre revenue performance to persist, which has held the P/S ratio back. If you like the company, you'd be hoping this can at least be maintained so that you could pick up some stock while it's not quite in favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Johnson Outdoors.How Is Johnson Outdoors' Revenue Growth Trending?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Johnson Outdoors' to be considered reasonable.

Taking a look back first, we see that there was hardly any revenue growth to speak of for the company over the past year. The lack of growth did nothing to help the company's aggregate three-year performance, which is an unsavory 20% drop in revenue. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Turning to the outlook, the next year should generate growth of 6.6% as estimated by the lone analyst watching the company. That's shaping up to be materially higher than the 2.7% growth forecast for the broader industry.

With this in consideration, we find it intriguing that Johnson Outdoors' P/S is closely matching its industry peers. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Final Word

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Johnson Outdoors currently trades on a lower than expected P/S since its forecasted revenue growth is higher than the wider industry. When we see a strong revenue outlook, with growth outpacing the industry, we can only assume potential uncertainty around these figures are what might be placing slight pressure on the P/S ratio. This uncertainty seems to be reflected in the share price which, while stable, could be higher given the revenue forecasts.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Johnson Outdoors, and understanding these should be part of your investment process.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.